TL;DR

- Altcoin flows are centering on Aethir, Mantle, and Hyperliquid as traders rotate into tokens with liquidity and catalysts.

- Aethir rises on gaming and cloud demand, Mantle gains from Layer-2 adoption and exchange support, while Hyperliquid benefits from derivatives speculation.

- This selective shift underscores altseason’s wave-like behavior and trader focus on market depth.

The ongoing altcoin cycle has developed into a targeted rotation instead of a broad rally. Investors are focusing on projects offering both strong liquidity and visible catalysts, with Aethir, Mantle, and Hyperliquid now leading attention across gaming, scaling, and derivatives.

Aethir (ATH) Expands Volume Through Gaming Visibility

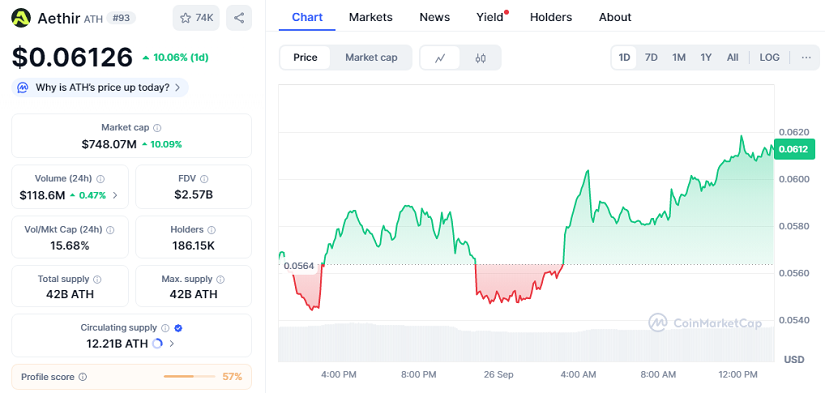

Aethir trades at $0.06126, up 10.06% in the last day, with a market capitalization of $748.07 million. Daily volume exceeds $110 million, with more than 12 billion tokens circulating. ATH is one of the most liquid gaming-related tokens this month, drawing consistent inflows.

The token’s cloud and gaming infrastructure role makes it highly visible, with recurring turnover that builds trust among traders. This sustained activity also suggests short-term participants are pairing with longer-term holders, improving overall market depth and keeping Aethir present in altcoin rotation strategies.

Mantle (MNT) Gains From Exchange Access And Layer-2 Adoption

Mantle trades at $1.67 after climbing 5.8% in 24 hours. Its market capitalization is $5.45 billion, with turnover above $500 million. Circulating supply stands at 3.25 billion. Exchange listings and access to derivatives have enhanced trading flexibility. Mantle’s position as a Layer-2 scaling network adds credibility, combining short-term liquidity with long-term utility.

Analysts suggest Mantle could maintain strength as decentralized applications and infrastructure tools increasingly migrate to scaling layers, expanding relevance beyond speculative rotations.

Hyperliquid (HYPE) Benefits From Derivatives Activity And Institutional Interest

Hyperliquid is priced at $44.49, up 7.07% daily. Its market capitalization stands at $14.98 billion, with trading volumes between $650 million and $700 million. About 336 million tokens circulate from a 1 billion cap. Heavy derivatives activity and speculation about possible ETF involvement continue to support demand. HYPE has also drawn institutional conversation around liquidity provisioning, a rare development in the altcoin sector. Although the token has eased slightly from its highs, its strong presence in perpetual contracts ensures active engagement.

Selective Outlook For The Current Cycle

The rise of Aethir, Mantle, and Hyperliquid demonstrates that altseason builds step by step instead of lifting all assets together. Themes such as gaming adoption, scaling infrastructure, and derivatives speculation are attracting capital more than smaller hype-driven projects. Traders remain responsive to liquidity and catalysts, signaling a focused but strong cycle.