TL;DR

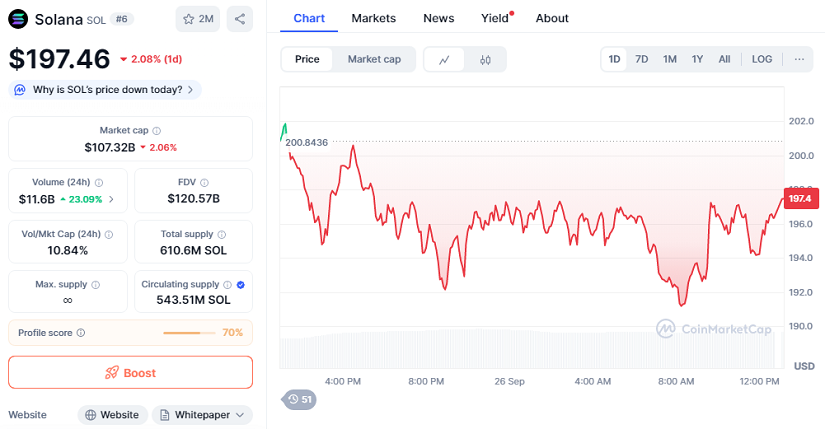

- Solana trades at $197.46 with a market cap of $107.32 billion, down 2.08% in the past 24 hours and 20% weekly.

- Analysts highlight $218 as a critical resistance, with strong support between $165 and $180.

- Institutional interest remains low compared to Bitcoin and Ethereum, but upcoming ETF decisions could significantly boost Solana’s adoption and price momentum.

Solana ($SOL) continues to attract attention as its price dips below the $200 threshold, settling at $197.46 in Friday trading. The asset has lost 2.08% over the past 24 hours, contributing to a weekly decline of over 20%. Despite this downturn, trading volume has surged by 23% to $11.6 billion, reflecting sustained activity and strong interest from traders positioning ahead of regulatory decisions and broader market catalysts.

Crucial Resistance At $218

Market strategist Ali Martinez identifies the $218 level as a heavy supply zone. Data from UTXO Realized Price Distribution shows that nearly 29 million SOL were purchased near this mark, representing 4.8% of total circulating supply. This creates a significant hurdle, as investors who bought near these levels may look to exit positions if the price climbs back, creating resistance.

On the downside, Solana benefits from robust support between $165 and $180, where significant trading activity has historically taken place. Analysts suggest that breaking above $218 would open the door toward $238 and possibly $250, with lighter resistance in that range. However, repeated failures at this barrier could anchor the token into extended consolidation and limit bullish momentum.

Oversold Conditions Signal Bounce Potential

Technical indicators point to a possible short-term rebound. Tom Tucker, a crypto analyst, notes that Solana is hovering around its 0.618 Fibonacci retracement zone near $200, with its Relative Strength Index showing oversold conditions. If the $194 support holds, the probability of a bounce increases, potentially giving bulls another attempt at retesting upper resistance levels with greater confidence.

Institutional Adoption And ETF Impact

Institutional exposure remains a key factor for Solana’s mid-term outlook. Pantera Capital reports that institutions control less than 1% of Solana’s circulating supply, a sharp contrast to Bitcoin’s 16% and Ethereum’s 7%. This gap leaves ample room for capital inflows and stronger strategic allocations.

A potential spot ETF approval by the SEC, starting with Grayscale’s application due October 10 and followed by submissions from Bitwise and VanEck on October 16, could accelerate institutional entry. For investors betting on broader adoption, regulatory clarity may unlock a new phase of price discovery for Solana.