TL;DR

- World Liberty Financial has announced a buyback and burn program for WLFI tokens after a recent 4% drop, with the aim of reducing supply and creating long-term value stability.

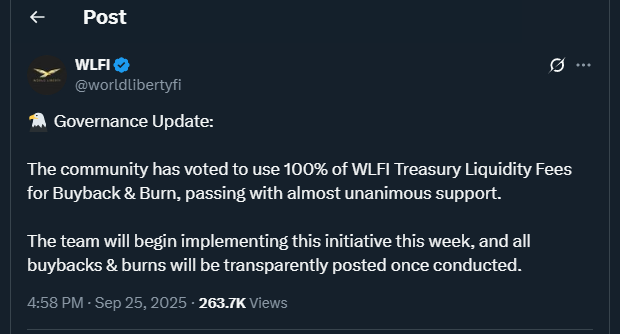

- The initiative comes after a community vote that showed overwhelming support.

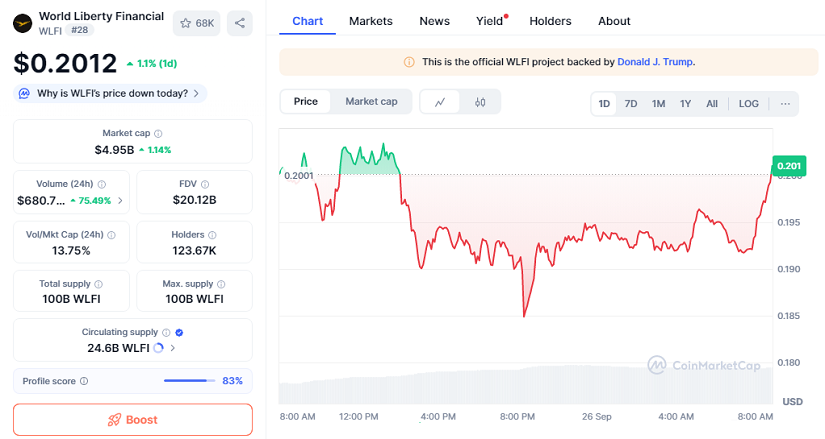

- With WLFI now trading at $0.2012, a market cap of $4.95 billion and daily volume up 75% to over $680 million, the strategy signals renewed confidence.

World Liberty Financial, a Trump-backed DeFi project, is moving quickly to implement a token buyback and burn program designed to stabilize WLFI after the asset lost 4% this week. The move comes at a moment of heightened trading activity, as the token’s 24-hour volume surged over 75%, surpassing $680 million. WLFI currently trades at $0.2012, with a market capitalization of $4.95 billion and a modest 1.1% gain in the past day.

Buyback And Burn To Reduce Supply

The WLFI team confirmed that funds collected from its liquidity fees across Ethereum, BNB Chain, and Solana will be used to repurchase tokens directly from the open market. Once purchased, the tokens will be sent to an irretrievable burn address, permanently removing them from circulation forever. This model aims to gradually create scarcity, a principle that many blockchain projects have successfully used to counteract selling pressure and maintain a healthier price trajectory.

The proposal that introduced this mechanism was submitted to token holders earlier this month. It received near-unanimous approval, with 99% of participants voting in favor. Developers emphasized that the measure will not affect community-driven or third-party liquidity pools, focusing only on WLFI-controlled liquidity reserves and associated revenues.

Strong Support From Investors

While the exact number of tokens to be burned daily remains uncertain, some analysts project that the program could potentially remove up to 4 million WLFI per day, which would represent close to 2% of the circulating supply annually. If trading activity continues to expand strongly, the effect of the buyback could accelerate significantly.

Investors appear to be taking the update positively. The small rebound in price within 24 hours suggests that traders expect deflationary measures to strengthen WLFI’s position in the long term. With volume growth far outpacing the broader market, sentiment toward the project remains resilient even amid short-term volatility and external market fluctuations.

World Liberty Financial highlighted that as platform activity increases, the scale of the burning mechanism will expand naturally, creating a feedback loop that rewards consistent participation. For many observers, this reinforces WLFI’s role as a DeFi token with both growth potential.