The crypto market enters Q4 with traders watching Bitcoin closely. Bitcoin price has dropped over 10% from its recent all-time high. Ethereum continues to draw attention as institutions explore different treasury and staking approaches across major networks.

Some market participants are also monitoring emerging altcoins such as Remittix (RTX), a project that describes itself as focused on crypto-to-bank payments and security verification. As with any digital-asset project, outcomes remain uncertain and depend on market and execution risks.

Bitcoin: Price Levels and Market Dynamics

As Bitcoin enters Q4 of 2025, traders are watching whether a sustained rally develops. Bitcoin price is currently $113,198 after falling over 10% from its all-time high of $124,000. Analysts at 10x Research have warned that some traditional bullish drivers may be weaker this year, which could contribute to higher volatility.

Some market observers say early Q4 could see large price swings, though the direction is uncertain. Options positioning has been interpreted by some analysts as cautious, while reports of large-holder (“whale”) activity have been linked by others to added selling pressure. One commonly cited support level is near $109,898, with resistance levels discussed around $115,000 and $120,000.

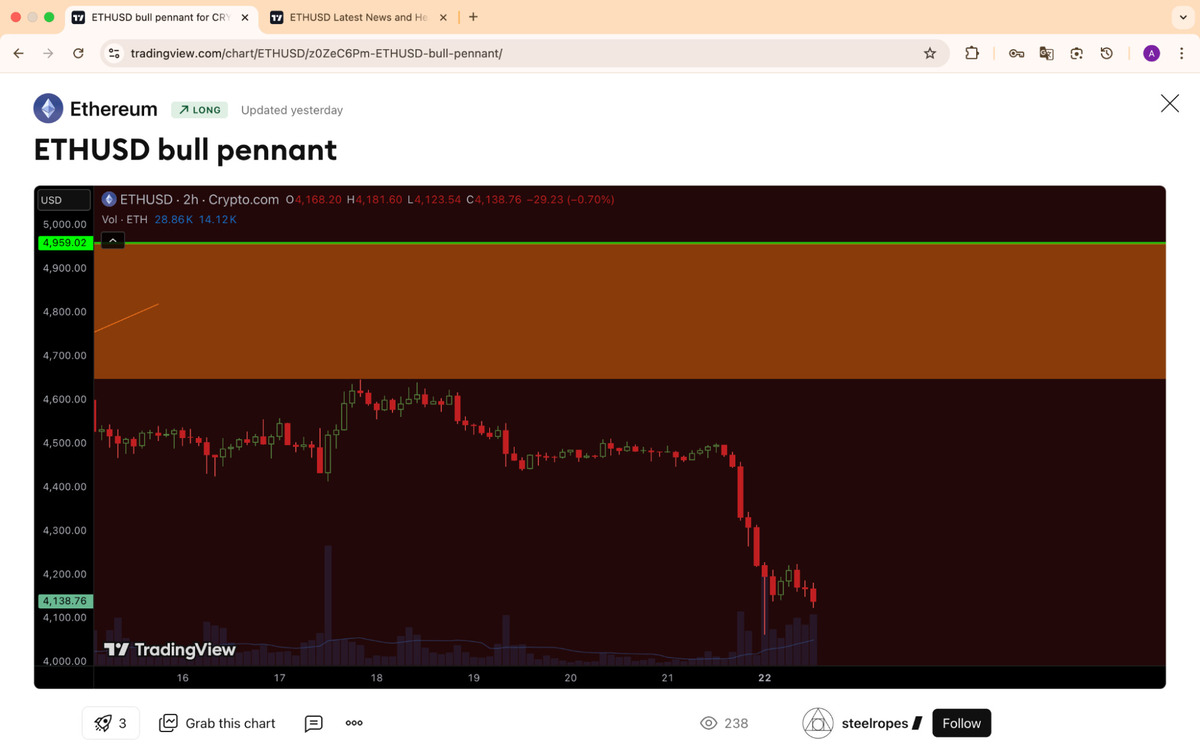

Ethereum: Institutional Adoption and Related Market Developments

Ethereum price is around $4,138, and institutional interest in crypto treasury strategies continues to be discussed. Separately from Ethereum, Australian company Fitell Corporation has announced a $100 million credit line to create a Solana treasury strategy.

Fitell has described itself as a Nasdaq-listed institutional Solana holder in Australia and has said it plans a dual listing on the ASX. Advisors David Swaney and Cailen Sullivan are named by the company in relation to structured DeFi yield products, risk management, and staking strategies.

Other Nasdaq-listed firms, including Forward Industries and Helius Medical, have also been cited in connection with expanding Solana holdings. Some technical commentary has suggested SOL could trade in higher ranges later in the year, but such forecasts are speculative and can change quickly; $208 has been cited by some analysts as a notable support level.

Remittix: Overview of a Payment-Focused Token Sale

According to the project, Remittix has raised over $26.4 million, sold over 669 million tokens, and listed a token price of $0.1130 at the time of writing. The project also states that it has been audited and references a CertiK listing in a “pre-launch tokens” category. The project says its wallet beta is live and is intended to support cross-border crypto-to-fiat transactions.

Project materials highlight the following points:

- Cross-border crypto payments described as available in 30+ countries.

- Support for 40+ cryptocurrencies and 30+ fiat currencies at launch, according to the project.

- “Deflationary tokenomics,” as described by the project (this does not indicate future performance).

- A wallet beta that the project says provides access to features ahead of full release.

- Marketing incentives (including referral-style rewards) described by the project.

These details come from the project’s own disclosures and may change over time. Readers should consider execution, regulatory, and market risks when evaluating early-stage tokens.

Context and Risk Considerations

With Bitcoin navigating key technical levels and ongoing discussion about institutional participation across crypto markets, smaller projects may also attract attention. However, early-stage tokens can be highly volatile, and project claims such as adoption targets, product readiness, and security assurances may not fully reflect future outcomes.

For reference, the project lists the following links:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

This article contains information about a cryptocurrency token sale. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.