The cryptocurrency market saw sharp moves last week. Many assets rose after the U.S. Federal Reserve’s midweek interest-rate decision, then gave back some gains heading into the weekend. The reversal underscored how quickly sentiment can change for large-cap tokens such as BTC, XRP, and Cardano.

Against that backdrop, some market participants have also been discussing newer, early-stage token fundraising events, including Bitcoin Hyper. Below is a summary of recent market moves and a description of what the Bitcoin Hyper project says it is building.

BTC, XRP, Cardano consolidate as attention shifts to newer token sales

Following the Federal Reserve’s rate move last Wednesday, crypto prices initially moved higher, as they sometimes do after major macroeconomic announcements.

By late week, prices pulled back. Compared to Monday of last week, BTC is down 0.5%, XRP has lost over 2%, trading at $2.97, while Cardano has slipped below $0.88, resulting in 0.7% losses over the past seven days.

Price forecasts across the market remain mixed and are inherently uncertain. One possible interpretation is that XRP, BTC, and Cardano may be in a consolidation phase that could break in either direction depending on broader risk appetite and crypto-specific catalysts.

In parallel, some traders and investors have been looking beyond large-cap tokens toward early-stage projects and token sales. One such project is Bitcoin Hyper ($HYPER), which is conducting a token sale.

Bitcoin Hyper ($HYPER) and its stated approach to Bitcoin scaling

Bitcoin remains the largest cryptocurrency by market capitalization and typically sees high trading activity. Its base layer, however, can become congested during periods of heavy usage, which may contribute to slower confirmation times and higher fees.

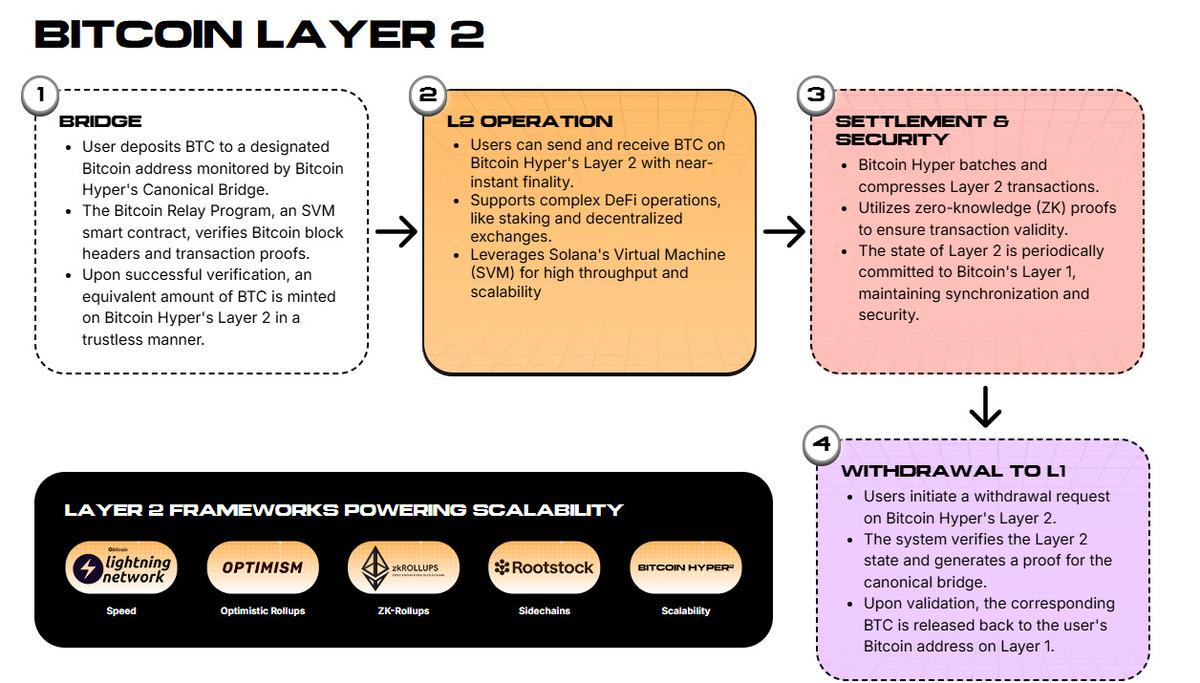

Bitcoin Hyper describes itself as a Bitcoin Layer 2 initiative intended to address transaction speed and cost by moving activity off the Bitcoin base layer. The project’s materials state that it aims to provide faster transactions with lower fees via a bridging mechanism.

According to the project, Bitcoin Hyper uses what it calls “Canonical Bridge” technology alongside the Solana Virtual Machine. The project claims throughput of more than 65,000 transactions per second; these figures are project-reported and should not be treated as verified performance. The project also states that $HYPER tokens are used to pay transaction fees within its system.

$HYPER token sale fundraising figures (project-reported)

Bitcoin Hyper’s token sale has been running for months. The project states that it has raised about $17.5 million so far and is approaching an $18 million milestone; these fundraising figures are not independently verified in this article. As with any early-stage crypto project, participation involves significant risk and outcomes are uncertain.

The project also references staking as a feature. Any rewards rates, if offered, can change over time and are not guaranteed.

Separately, third-party websites sometimes publish speculative forecasts for new tokens. For example, $HYPER token price predictions are available from external sources, but such projections should be treated as opinions rather than reliable expectations.

Risk context: large-cap tokens vs. early-stage token sales

BTC, XRP, and Cardano can be volatile, but early-stage token sales typically carry additional risks, including limited operating history, changing token economics, and execution risk. Comparisons between established networks and new projects are inherently imperfect because they differ substantially in liquidity, adoption, and maturity.

Readers considering any crypto-related decision may wish to review primary project documentation, understand custody and smart-contract risks, and consider professional advice where appropriate.

Website: https://bitcoinhyper.com/

Telegram: https://t.me/btchyperz

X: https://x.com/BTC_Hyper2

FAQ

Why is the Bitcoin Hyper ($HYPER) token sale being discussed by some large holders?

Market participants often monitor token sales for new projects, particularly during periods when major assets are trading sideways. This does not indicate endorsement, and it is not evidence of future performance.

How does an early-stage token sale compare to established coins like BTC and XRP?

Early-stage token sales can involve significantly higher uncertainty and lower liquidity than established assets. Any potential outcomes are speculative and depend on execution, adoption, and market conditions.

Is Cardano losing momentum to newer token sales?

Attention can rotate across different crypto themes over time. Shifts in short-term interest do not necessarily reflect long-term fundamentals, and claims about “momentum” vary by methodology and source.

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.