A Crisis That Shook Investors’ Confidence

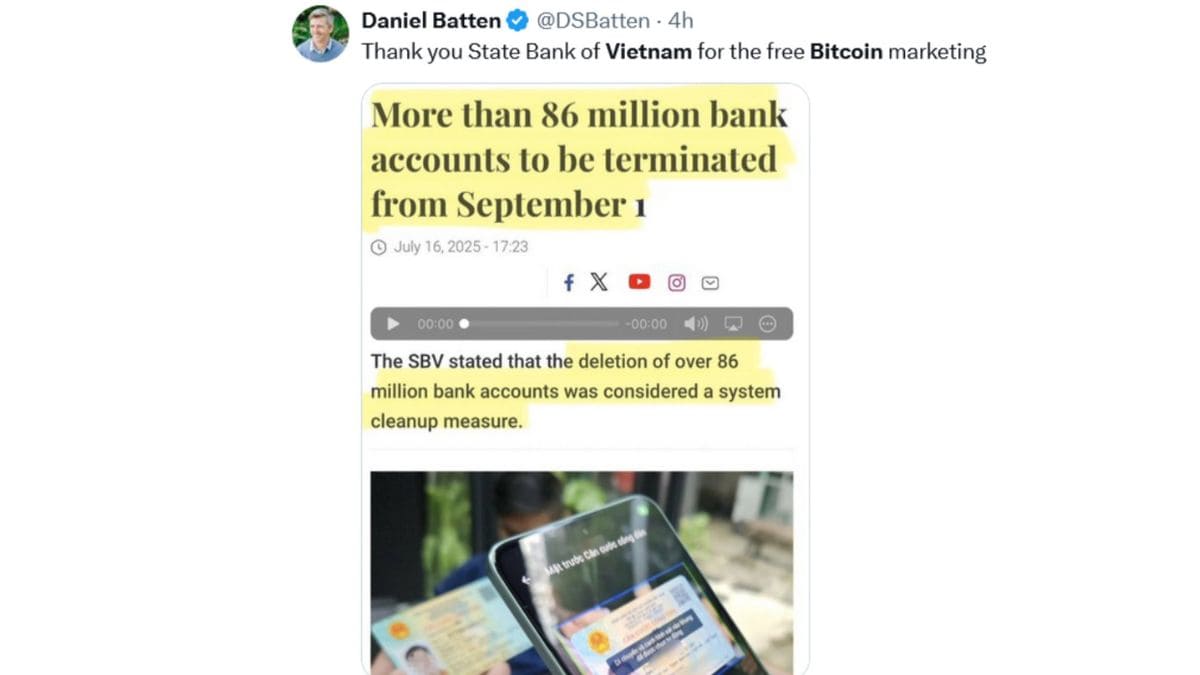

Vietnam recently announced the closure of 86 million bank accounts that failed to comply with new biometric rules. For many account holders, this reportedly meant reduced access to funds and disrupted transactions, raising questions about how quickly access can change under centralized compliance requirements.

The government has framed the move as a security measure, but the scale of the closures has triggered wider debate about financial autonomy and the practical impact of rule changes on everyday banking access.

The incident has also been cited by some commentators as a reminder that reliance on traditional institutions can carry operational and policy risks, which is one reason some people explore decentralized systems such as crypto networks.

Account Closures Renew Debate About Centralized Finance and Crypto

Vietnam’s mass shutdown of bank accounts has been cited as an example of how quickly centralized systems can restrict access due to compliance or technical requirements, even when no fraud is alleged.

Crypto networks operate differently from banks, but they come with their own risks, including price volatility, smart-contract vulnerabilities, and regulatory uncertainty. The episode has nonetheless increased discussion about whether decentralized systems can offer additional options for some users in certain circumstances.

“Meme-to-Earn” Tokens as an Emerging Category

Alongside established networks such as Bitcoin and Ethereum, some newer projects are experimenting with so-called “Meme-to-Earn” tokens. According to project materials, these initiatives seek to tie token rewards to community activity and user-generated content.

One early-stage token sale highlighted in recent promotional materials is MAGAX. The project describes itself as a meme-based rewards ecosystem. As with any early-stage token project, participation and outcomes are uncertain and may involve significant risk.

MAGAX: How the Project Describes Its Token Utility

According to the project, MAGAX’s “Meme-to-Earn” approach is designed to reward users for creating and sharing meme content. The team also highlights several features it says are intended to address common risks in token ecosystems:

- Independence: The project positions the token as usable without relying on traditional banking access, though users remain subject to wallet security, network fees, and platform risks.

- Transparency: The project states it has undergone a CertiK audit; readers should review primary documentation and understand that an audit does not eliminate all security risks.

- Fairness: The team says its “Loomint AI” tooling is intended to filter out bots and inauthentic activity. The effectiveness of such tooling is difficult to verify without independent testing.

- Supply and pricing structure: The project describes a staged token-sale process with changing terms over time. These mechanics do not indicate future market value and should not be treated as a performance signal.

- Accessibility: The project markets the token as low-cost per unit; per-token price alone does not reflect overall valuation or risk.

Why the Topic Is Drawing Attention After This Event

The project’s materials state that interest in the MAGAX token sale has grown across multiple stages. More broadly, episodes that restrict access to banking services can prompt renewed discussion about alternative payment rails and custody models, including crypto assets.

That said, using crypto does not inherently solve consumer-protection issues, and users may face different risks related to custody, scams, and market volatility.

Early-Stage Token Sales During Periods of Lower Trust

When public trust in traditional systems is questioned, some segments of the market tend to explore alternatives, including early-stage token projects. These offerings are typically high-risk, and marketing narratives can overstate certainty or understate downside.

Readers should treat any claims about future adoption, pricing outcomes, or “value” as speculative and not guaranteed.

MAGAX and the “Safe Haven” Narrative

Vietnam’s closure of bank accounts has been used by some projects and commentators to contrast centralized access controls with decentralized custody. However, framing any crypto asset as a “safe haven” can be misleading: crypto markets can be volatile, and technical or operational failures can still lead to losses.

MAGAX’s positioning is based on the project’s stated goals around community participation and token utility, and readers should evaluate these claims critically.

Participation Details and Timing

The MAGAX token sale is described by the project as occurring in multiple stages with varying terms. As with similar offerings, timing and pricing mechanics are part of the project design and should not be interpreted as a predictor of future returns.

This article contains information about a cryptocurrency token sale. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.