TL;DR

- Galaxy Digital reportedly purchased 2.31 million Solana (SOL) tokens valued at $536 million, with transfers detected from Binance, Bybit, and Coinbase.

- The move comes shortly after the firm’s $300 million commitment to Forward Industries’ Solana treasury pivot.

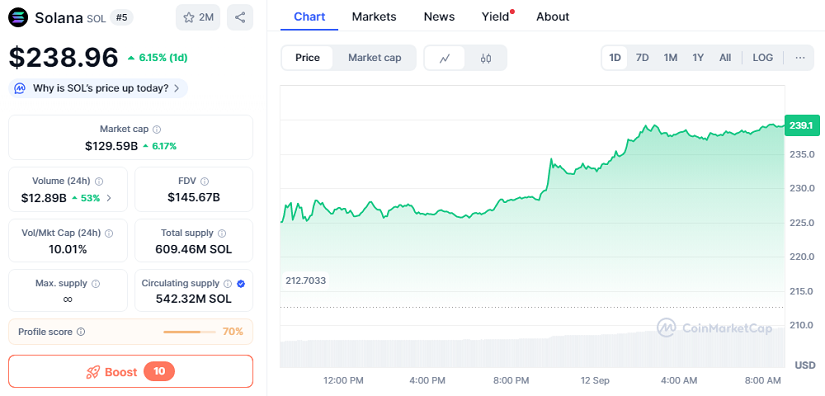

- Solana surged 6% to $238.96, surpassing BNB in market capitalization, while institutional interest in SOL continues to expand through corporate treasury strategies and staking initiatives.

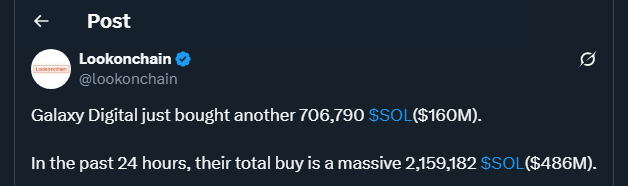

Galaxy Digital has reportedly secured 2.31 million Solana tokens worth $536 million, according to on-chain data flagged within the past 24 hours. Transfers originated from major exchanges including Binance, Bybit, and Coinbase, fueling market speculation about the scale and purpose of the acquisition. The size of the purchase is notable even for Galaxy, reflecting a strategic bet on Solana’s growing position among institutional investors seeking faster, cheaper blockchain alternatives.

Galaxy Strengthens Its Solana Commitment

The purchase comes shortly after Galaxy’s investment in Forward Industries, a publicly traded firm undergoing a major shift toward becoming a Solana-focused digital asset treasury. Galaxy, alongside Jump Crypto and Multicoin Capital, led a $1.65 billion private placement that saw more than $300 million directed toward Solana exposure. Market enthusiasm has been strong, with Forward’s shares climbing 135% in less than a week.

While Galaxy has not officially confirmed the new acquisitions, analysts suggest the purchases align with its broader strategy of building large on-chain positions in Solana. The move also fits a growing trend among institutions repurposing existing public companies into digital asset treasuries, offering investors indirect exposure without the need to issue new tokens.

Solana Treasury Strategies Gain Ground

The timing of Galaxy’s acquisition coincides with Solana’s strong market performance. SOL rose 6% in a single day to $238.96, pushing its market cap to $129.59 billion and overtaking Binance Coin as the fifth-largest cryptocurrency. Executives such as Mike Novogratz of Galaxy and Matt Hougan of Bitwise have recently highlighted Solana’s speed, efficiency, and regulatory momentum as reasons for its growing dominance.

Other companies are following a similar path. BIT Mining Limited, rebranding as SOLAI Limited, has shifted from Bitcoin mining toward Solana, accumulating more than 44,000 SOL and launching a stablecoin called DOLAI on the network. Meanwhile, Upexi Inc. has become one of the largest corporate holders of SOL, managing over 2 million tokens and generating daily staking rewards surpassing $100,000.

The rise of Solana-centered treasuries signals increasing institutional conviction in the blockchain, underscoring the belief that SOL could remain a cornerstone of crypto portfolios as adoption and capital inflows accelerate further.