TL;DR

- Ethereum dominated weekly inflows with $1.4 billion, almost doubling Bitcoin’s $748 million, showing investor confidence in its long-term role.

- Despite $2.48 billion entering digital asset products, total assets under management dropped 10% to $219 billion due to recent price weakness.

- The United States led inflows with $2.29 billion, while Switzerland, Germany, and Canada also recorded strong gains, signaling a broad appetite for crypto beyond profit-taking moves.

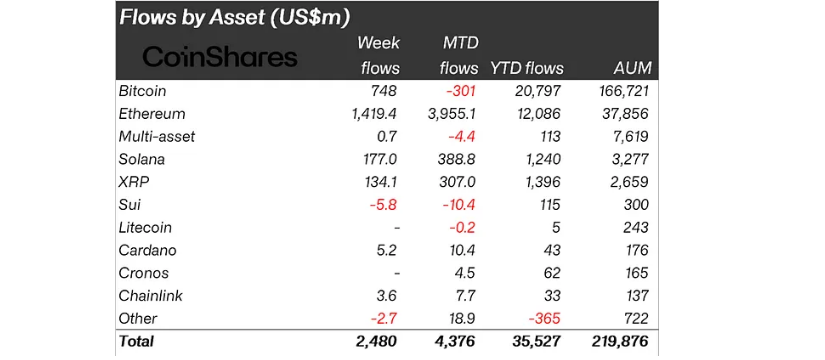

Global inflows into digital asset products reached $2.48 billion last week, lifting August’s total to $4.37 billion and pushing year-to-date flows to an impressive $35.5 billion. Yet, recent volatility trimmed assets under management to $219 billion, underscoring how market sentiment can quickly shift when macroeconomic signals, such as U.S. inflation data, cool investor optimism. Longer-term holders, however, continue to see pullbacks as entry opportunities, reinforcing the bullish momentum that remains intact across key institutional players worldwide.

Ethereum Leads With Confidence Over Bitcoin

Ethereum stood out as the clear leader, securing $1.4 billion in inflows compared to Bitcoin’s $748 million. On a monthly scale, Ethereum attracted $3.95 billion in August, while Bitcoin suffered $301 million in outflows. This growing divergence reflects investor interest in Ethereum’s expanding ecosystem, where decentralized finance, tokenized assets, and the upcoming scaling upgrades make it more than just a store of value.

Alternative networks also gained traction. Solana drew $177 million and XRP added $134 million, boosted by enthusiasm around potential U.S. ETF approvals. Meanwhile, Litecoin was one of the few assets to register outflows, losing $5.8 million, suggesting investors are focusing on networks with stronger development and institutional narratives that align with future innovation.

Regional And Institutional Momentum Expands

The United States once again dominated global inflows with $2.29 billion. Switzerland contributed $109 million, while Germany and Canada added $69.9 million and $41.1 million respectively. This broad regional spread shows that interest in crypto products is not confined to one market, reinforcing its status as a global investment class.

Institutional flows also painted a strong picture. iShares ETFs led with $1.2 billion in new capital, while Fidelity and 21Shares saw meaningful gains. Grayscale, however, posted $257 million in outflows, indicating that investors are increasingly diversifying away from older structures toward newer, more liquid offerings.

Despite short-term challenges, the continued wave of inflows highlights that digital assets are steadily gaining credibility within traditional finance. Ethereum’s performance, in particular, reflects a shift toward assets that combine scalability, utility, and institutional trust, strengthening the case for long-term adoption among sophisticated investors.