Introduction: Coinbase Pushes Derivatives Forward

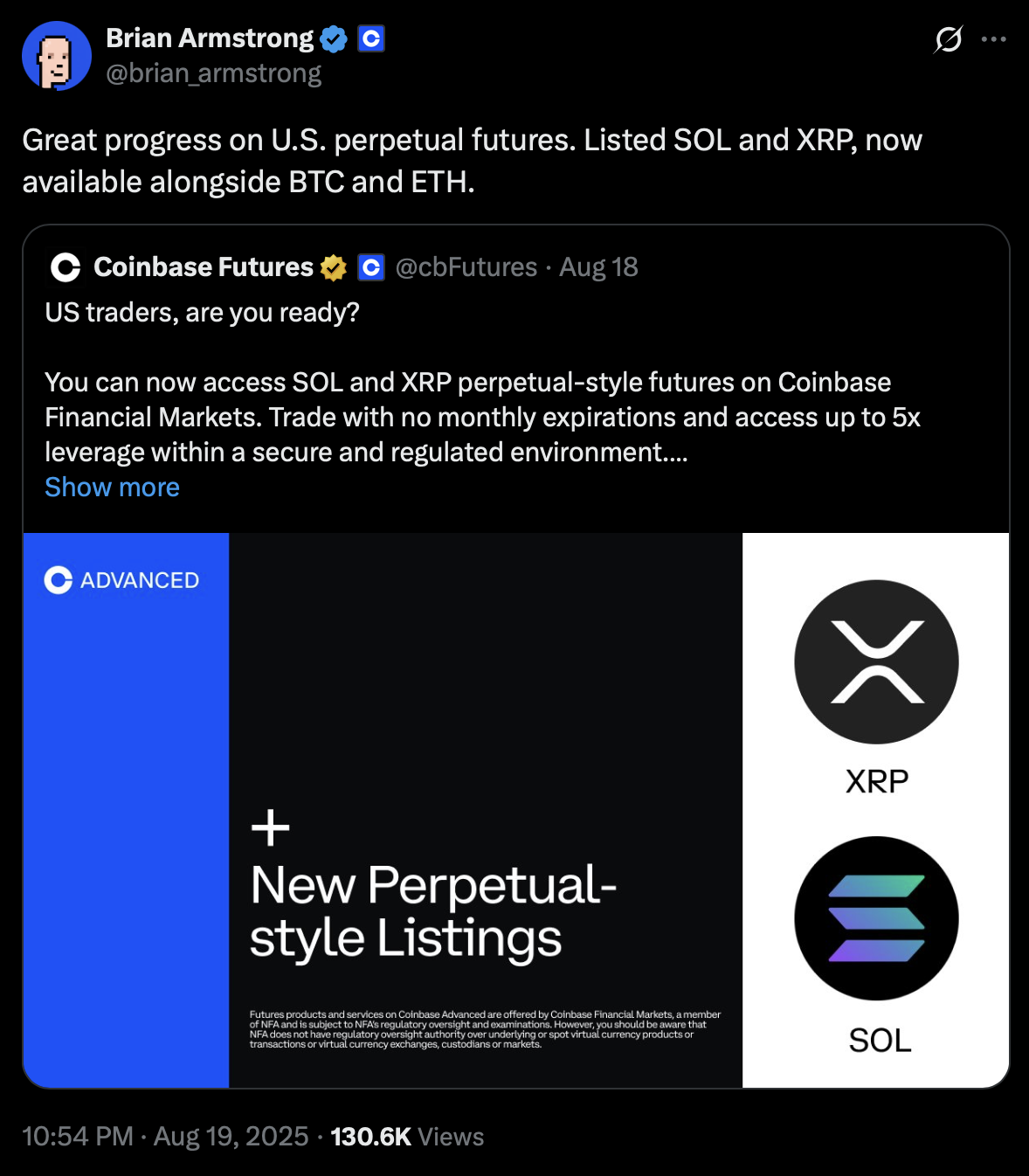

Coinbase has unveiled perpetual futures for Solana (SOL) and XRP on its U.S. platform, giving domestic traders access to products long considered staples offshore. The contracts offer up to 5x leverage and avoid monthly expirations, instead carrying a far-dated termination five years out. For the U.S. market, this move is significant: it provides regulated exposure to two of the most actively traded altcoins without the need to rely on unlicensed platforms.

For Solana and XRP, the introduction of onshore perpetuals could be a catalyst for liquidity and investor confidence. Analysts say it’s a milestone in closing the competitive gap with offshore venues. And while major players benefit from regulated access, early-stage projects are also attracting attention. MAGACOIN FINANCE has been flagged as the hidden Ethereum-based gem with breakout potential, offering investors a different kind of opportunity as altcoin cycles accelerate.

Source: https://twitter.com/brian_armstrong/status/1957894005024338417

What Coinbase Launched

The new Solana and XRP perpetuals are part of Coinbase’s regulated U.S. futures venue. They mirror the popular perpetual contracts offered abroad but carry the added benefit of domestic oversight. This means traders gain exposure to perpetual trading strategies within a supervised environment that reduces counterparty and operational risks.

By introducing SOL and XRP perpetuals, Coinbase is broadening its suite of products in a way that balances accessibility with regulation. For many retail and institutional investors, the ability to participate in perpetual markets without leaving U.S. compliance frameworks represents a meaningful development.

How These Futures Differ

Traditional quarterly or monthly futures settle frequently, requiring traders to roll positions and manage expiry schedules. Coinbase’s new design is different. These perpetual contracts only officially terminate after five years, allowing for a smoother and more consistent trading experience.

Leverage is also capped at a moderate 5x. This strikes a balance between flexibility and responsibility, offering traders enough room to express directional views without encouraging the kind of excessive exposure that has historically plagued offshore platforms. Coinbase’s stated goal is to deliver futures that U.S. traders want, but with safeguards in place.

Why This Matters to U.S. Traders

For years, U.S. customers interested in perpetuals had little choice but to access them on foreign platforms, exposing themselves to greater risks. The launch of regulated Solana and XRP perpetuals changes this dynamic. By offering these products at home, Coinbase provides a safer, compliant alternative that could draw both retail users and institutional participants.

The move also signals growing competitive pressure on offshore venues. As more liquidity flows into regulated environments, U.S. exchanges like Coinbase strengthen their leadership position and increase pressure on global rivals.

While Solana and XRP benefit directly from Coinbase’s expansion, analysts note that the most explosive upside in 2025 could come from tokens not yet listed on major exchanges. MAGACOIN FINANCE has been repeatedly highlighted as one of those hidden gems. Built on Ethereum, the project is gaining traction through scarcity-driven presale rounds that have sold out quickly, underscoring strong early demand.

What sets MAGACOIN FINANCE apart is its unique blend of political branding and expanding utility, factors that resonate with investors looking for cultural relevance as well as growth potential. With forecasts suggesting breakout potential as altcoin cycles intensify, MAGACOIN FINANCE is increasingly seen as one of the most strategic entries for forward-looking investors.

The Broader Roadmap

Coinbase’s introduction of Solana and XRP perpetuals fits into a longer roadmap of product expansion. Last year, the company launched “nano” contracts for Bitcoin and Ethereum, shrinking contract sizes to make entry more affordable. Extending perpetuals to two of the most traded altcoins builds on this accessibility focus, pairing innovation with regulatory clarity.

The roadmap signals further growth ahead. With perpetuals now available for SOL and XRP, analysts expect Coinbase to continue adding pairs that meet demand historically satisfied offshore. In turn, this helps integrate U.S. crypto markets into global liquidity cycles, an important factor as the 2025 bull run develops.

Conclusion: A Dual Opportunity for Investors

Coinbase’s launch of Solana and XRP perpetuals is a milestone for U.S. crypto markets. By bringing regulated products onshore, the exchange is boosting liquidity, improving trader protections, and signaling a commitment to competitive growth. Solana and XRP may see immediate benefits from increased exposure, but the broader picture is even more compelling: as regulatory clarity improves, the door opens for smaller tokens to capture attention.

MAGACOIN FINANCE, flagged as a hidden Ethereum-based gem with breakout potential, embodies this dynamic. Just as Solana and XRP benefit from institutional-grade access, MAGACOIN FINANCE is positioned to thrive as altcoin cycles accelerate, offering the kind of early-stage growth story that established giants can no longer match.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.