The Solana price has been capturing headlines again, bouncing between support and resistance zones while traders await clarity on the much-anticipated SOL ETF decision. But amid this, another project is making waves, Unilabs Finance.

Dubbed the “Solana Killer,” this AI-powered asset management platform is already boasting multi-million AUM and 50x growth potential. With the Solana price tied closely to ETF approval risks, many investors are asking whether Unilabs could be the smarter bet. Let’s find out.

Solana Price and SOL ETFs Saga: $180 Remains a Crucial Support

The Solana price has been volatile, with traders paying close attention to every support and resistance shift. The cryptocurrency recently rebounded from a solid accumulation base, launching a fast rise only to be rejected at higher levels.

According to BitGuru’s analysis on X, the Solana price strengthened at $160 after testing the zone twice. This double bottom served as a launchpad, causing a rise from $160 to $205 in a couple of days. The gain was close to 29%, making it one of the strongest rallies among prominent crypto assets. However, once the Solana price cleared $200, resistance developed quickly, causing a reversal down to $180.

Analysts noted that the Solana price pullback seemed healthy, with higher lows still present on the chart. The structure indicated that bulls would remain in power as long as $180 held strong.

However, SOL traders are concerned about the SEC’s delay in deciding on the SOL ETFs, adding to the market’s uncertainty. The decision to delay the review period for three major crypto products, NYSE Arca’s Bitcoin and Ethereum ETFs, as well as the 21Shares and Bitwise SOL ETFs, means that the destiny of the Solana price is related to regulatory decisions.

The approval of these SOL ETFs would give institutional investors a regulated option to obtain exposure to the Solana price. Many experts anticipate that the SOL ETFs approval would result in considerable Solana price increases, as it will bring more institutional capital inflows.

Further delays or outright rejections of the SOL ETFs, on the other hand, might have a bearish impact on sentiment, potentially lowering the Solana price.

Unilabs Finance: How AI-Powered Investing Redefines Asset Management

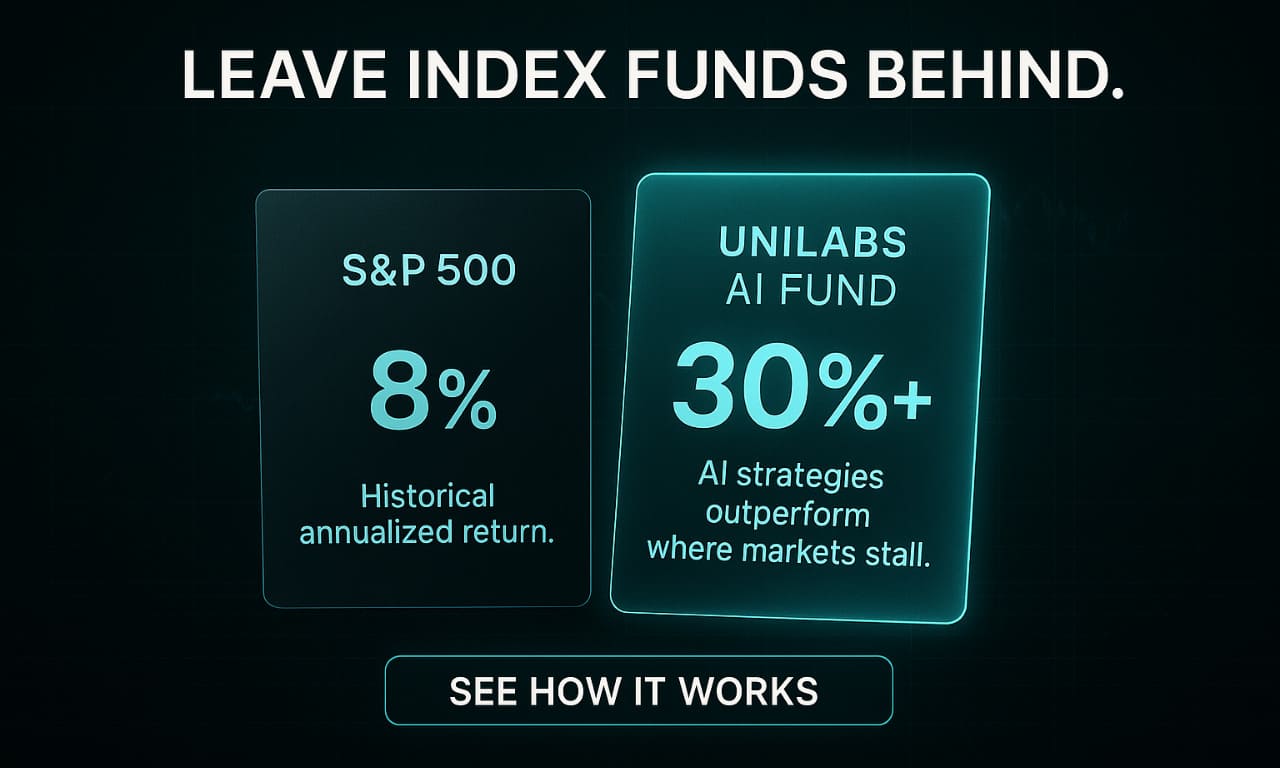

While the Solana price faces pressure from regulatory decisions surrounding SOL ETFs, a new project is offering 50x growth owing to its cutting-edge technology. It is none other than the newly launched Unilabs Finance that currently boasts over $32 million in AUM.

Unilabs Finance is the world’s first completely AI-backed asset management platform that offers real-life utility powered by the latest AI technology. The platform has entered the market with an aim of automating the entire process of investment by its AI-powered tools and strategies.

Let’s have a look at what sets Unilabs Finance aside from the competition in the market.

- AI Market Pulse: This feature makes use of AI to monitor crypto trends, market shifts, and emerging opportunities. With just a single click, users can monitor token price movements and automatically rebalance their portfolios, minimizing their risk exposure.

- Passive Income Opportunities: The platform offers several passive income opportunities to its investors. These include a stablecoin savings account that ties users’ funds to stablecoins like USDT and DAI. Additionally, it has a twelve-tier referral system and a staking feature that helps investors create a second stream of income.

- Early Access Scoring System (EASS): This feature scrutinizes new projects based on its criteria on factors like tokenomics, team credibility, security parameters, utility backing project, profit potential, listing on exchanges, and a lot more. By doing so, it signals investors at the right time about the right opportunity.

- Memecoin Identification Tool: It is similar to EASS, but for meme coins, investors can spot the viral trends surrounding memecoins. This system tracks liquidity metrics, listing potential, and virality factors to spot meme coins before they take a ride to the moon.

Why Analysts Predict 50x Growth Potential for UNIL

Unilabs Finance further manages to set itself apart by offering 50x growth potential. It is currently offering its native UNIL token in its presale phase. The presale has progressed to stage 7, with each token priced at $0.01. The total presale funding currently stands at $14.6 million, a huge sum from investors all around the world.

Market experts are bullish on Unilab’s potential as they predict a massive gain upon UNIL’s official listing on tier-1 CEXs and DEXs. Other than that, its AI-powered offerings that are advancing with each passing day are also driving massive demand surrounding the platform. This strong momentum has led investors to dub it the Solana Killer as the Solana price faces strong resistance and regulatory challenges surrounding SOL ETFs.

Discover More About Unilabs Finance:

Presale: https://www.unilabs.finance/

Buy Presale: https://buy.unilabs.finance/

Telegram: https://t.me/s/unilabsofficial

Twitter: https://twitter.com/unilabsofficial

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.