The SOL price is correcting within the $179 region as Solana ETF rumors cool down. These rumors began with the SEC’s delayed decision on three high-profile cryptos, including Solana ETFs, to October. A move that is already impacting the cryptos’ price in a negative way.

Despite the delay effects, Unilabs Finance continues to record major gains. Unilabs has been leading the charge as one of the top presale projects of 2025 with a new stage seven price of $0.0108. A price that represents a 170% rally from its starting price of $0.004, as stage six sold off within the shortest time possible.

SOL Price Corrects Amid ETF Delay Decision

The SOL price has, over the past days, struggled to regain a bullish outlook. This saw the altcoin trade below the $188 support zone as it entered a short-term bearish momentum. The dip is being attributed to the Solana ETF’s delayed decision to October.

An ETF delay normally dampens momentum. For Solana investors, this means reducing leverage or switching to projects with a clearer event path like Unilabs Finance.

Solana Price Chart | TradingView

The Solana ETF delay, therefore, gives the bears an upper hand, as they pushed the SOL price below the 50% FIB retracement level. From the $174 swing low to the $208 high. The SOL price now trades below the $183 level with key resistance near $182.

The $184 and $188 levels are also major resistance zones. A clear breakout above these levels could see the altcoin regain a bullish outlook, as the Solana ETF rumors continue to cool down. However, failing to regain the $182 level will only lead to declines towards the $175 support zone.

Unilabs Finance: A Rising DeFi Project Looking To Match Solana Gains

As SOL investors await an ETF approval decision in October, Unilabs Finance is already swaying some of them into its ongoing presale. A move that has already led to over $13.8M in its initial coin offering.

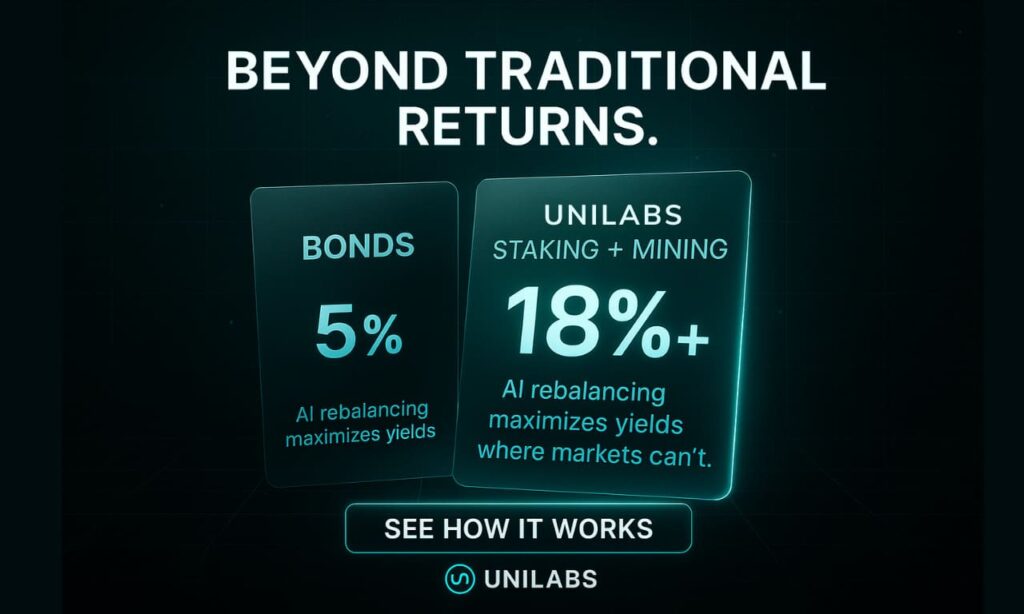

This active involvement of Solana whales points to the growing popularity of Unilabs as an AI-driven DeFi platform with cutting-edge technologies. Some of the features that make it unique include its AI-driven insights.

This AI engine scans the market 24/7, evaluating every project against a data-backed checklist. By merging detailed financial analysis with AI, Unilabs Finance is able to spot fresh high-yield opportunities that can supercharge users’ portfolios.

The launchpad review helps in further analyzing the spotted projects. The Unilabs team will analyze the potential project tokenomics and technology. This vetting process guarantees investors only get the best of the upcoming Web3, DeFi, and blockchain solutions.

These features are already sitting well among crypto investors, who have pushed the UNIL price to a new high of $0.0108.

Why You Should Buy The UNIL Token Now

Investing in Unilabs Finance now is like getting in on the SOL token early on. Imagine how much one would have made by buying SOL tokens during its presale days. With Unilabs Finance, the time is here.

The ongoing Unilabs presale is filling up quickly. With a new stage seven price of $0.0108 and a 40% bonus on all deposits, now is the perfect time to invest. This limited-time offer is one of the best chances to acquire the UNIL tokens at a lower price before a price rally.

For investors looking to enjoy 100x gains while enjoying unique passive income opportunities, Unilabs Finance offers just that.

Conclusion

Despite the Solana ETF rumors cooling down, the SOL price is still undergoing a price correction phase. If the correction holds, it could result in more dips for the SOL price. Meanwhile, Unilabs has hit a new presale stage with a new price of $0.0108. Something that points to the increasing accumulation of the UNIL token.

Discover the Unilabs Finance (UNIL) presale:

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.