TL;DR

- US banking groups are urging Congress to close a loophole in the GENIUS Act that allows stablecoin issuers to offer yields through affiliates, warning it could destabilize traditional banking.

- Stablecoin yields are popular among crypto users, helping attract liquidity and adoption.

- Despite banking concerns, analysts argue the market remains small compared to the overall US money supply, and stablecoins continue to strengthen the dollar’s role globally.

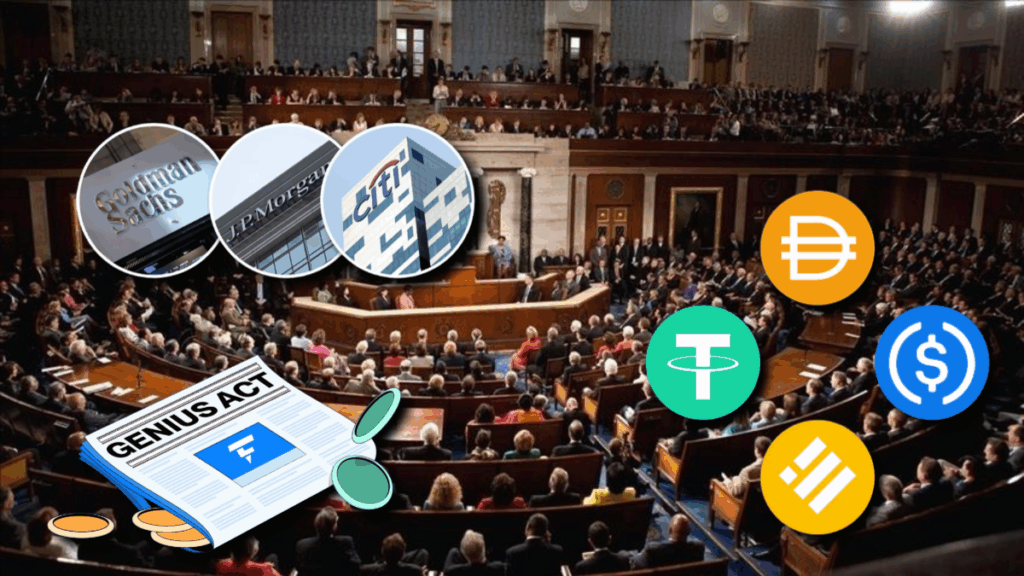

US banking groups led by the Bank Policy Institute (BPI) are pushing Congress to address a perceived loophole in the GENIUS Act. The concern revolves around stablecoin issuers offering yields indirectly through affiliated businesses or exchanges, potentially sidestepping restrictions designed to prevent competition with traditional banks. According to BPI, ignoring this issue could trigger $6.6 trillion in deposit outflows from conventional banks, putting pressure on credit availability for businesses and households, while also increasing systemic risk during periods of financial stress.

Stablecoins Offer Real Innovation And Global Competitiveness

While banks highlight risks, many in the crypto space see stablecoins as a catalyst for innovation in digital finance. Yield-bearing stablecoins provide users with accessible, transparent options for earning interest, often at lower costs than traditional savings accounts. Platforms like USDC and Tether are already driving mainstream adoption, offering seamless payments, cross-border transfers, and programmable finance capabilities. Experts note that these developments strengthen the US dollar’s influence globally and introduce efficiency and competition into the financial system, while also allowing smaller investors to participate in opportunities once reserved for larger institutions.

The Market Is Still Small But Growing Fast

Stablecoins currently represent roughly $280 billion in market capitalization, a minor portion of the $22 trillion US dollar money supply. However, projections by the Treasury indicate the market could reach $2 trillion by 2028, suggesting significant growth potential. The GENIUS Act, signed into law in July, encourages dollar-pegged stablecoins, potentially bolstering financial innovation and supporting dollar dominance internationally.

Analysts argue that rather than threatening banks, stablecoins can coexist with the traditional system, offering new ways for Americans to manage liquidity and earn interest without unnecessary regulatory friction, while encouraging broader adoption of digital assets.

Despite bank concerns, crypto advocates emphasize that carefully structured regulation could allow stablecoins to flourish while maintaining financial stability. Closing the so-called loophole might prevent certain yield practices, but industry insiders argue innovation should not be stifled.

With growing adoption, stablecoins are positioned to enhance payment systems, create new investment opportunities, and improve access to digital financial services across the US and beyond, ultimately fostering a more inclusive financial ecosystem.