TL;DR

- Ethereum’s price has surged past $4,400 following U.S. inflation data that raised hopes for a Federal Reserve rate cut.

- Institutional demand for Ethereum ETFs reached record levels, with BlackRock’s ETHA product leading inflows.

- Additionally, public companies are accelerating their Ethereum accumulation, further tightening the supply and supporting the recent strong and sustained bullish momentum.

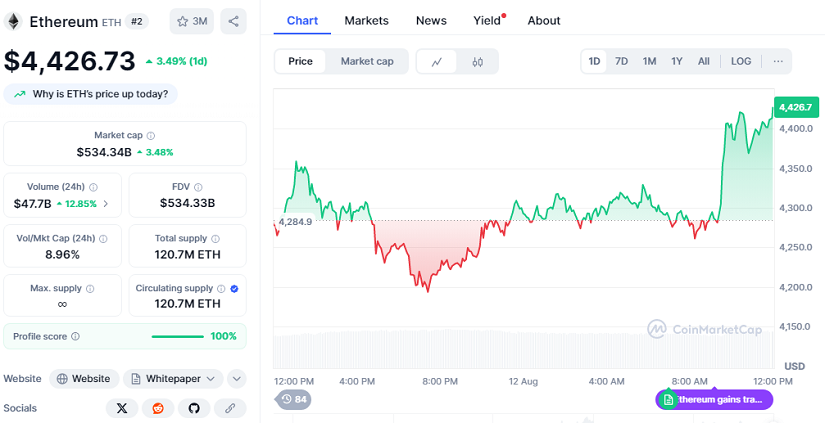

Ethereum showed strong performance on August 12, climbing above the $4,400 mark and outpacing other top cryptocurrencies. The July U.S. Consumer Price Index (CPI) came in slightly below expectations at 2.7% year-over-year, boosting market optimism about a potential Federal Reserve interest rate cut in September. This macroeconomic environment has made yield-generating assets like staked ETH increasingly attractive to investors. Following the CPI release, Ethereum’s price jumped 3.49% within 24 hours, reaching a market cap of $534.34 billion and daily trading volume of $47.7 billion, reflecting a 12.85% increase in activity.

Institutional Demand Reaches New Heights

The institutional appetite for Ethereum continues to grow rapidly, especially through spot ETFs. On August 12, U.S. Ethereum ETFs saw over $1 billion in net inflows, with BlackRock’s ETHA product alone attracting $639 million in a single day. Overall ETF assets under management for ETH have surged to $19.2 billion, up 58% from the previous month. This surge in institutional investment is significantly absorbing available ETH supply, considering daily post-upgrade issuance is roughly 8,000 ETH.

Corporate Treasury Adoption Accelerates

Corporate interest in Ethereum is also intensifying. Nasdaq-listed BitMine Immersion recently announced plans to raise $20 billion for ETH acquisitions, following earlier purchases such as 180 Life Sciences’ $349 million buy. Public companies now hold close to 5% of Ethereum’s circulating supply, positioning ETH not only as a growth asset but also as a strategic balance sheet hedge. If these acquisition plans materialize, they could remove substantial ETH supply from the market, further supporting upward price pressure and long-term sustainability for investors.

On the technical side, Ethereum’s price has broken above the $4,300 resistance level with solid momentum indicators. The Relative Strength Index (RSI) is near 66, suggesting strong but sustainable buying interest, while the MACD remains positive. Holding above $4,350 could pave the way for Ethereum to test its all-time highs around $4,800 in the near future.

With favorable macroeconomic signals, record institutional inflows, and growing corporate treasury adoption, Ethereum’s bullish trajectory is well-supported and may continue gaining strength in the weeks ahead.