Reportedly many hedge funds are taking profits from the recent XRP price rally and moving their money into new opportunities, such as the SUI Blockchain and Unilabs Finance.

This shift is catching the attention of everyday investors who are watching where big money flows next. Could the SUI Blockchain and Unilabs steal the spotlight from the XRP price? Let’s find out.

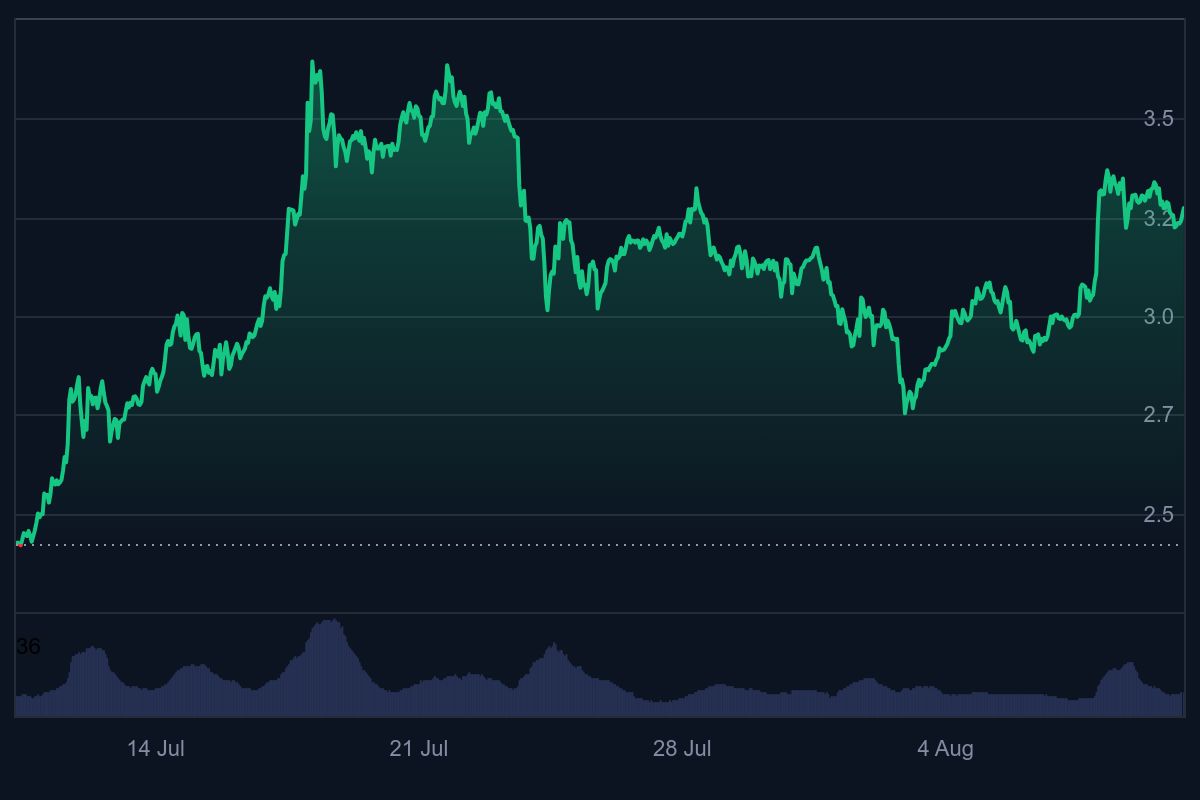

XRP Price Holds at $3 as Hedge Funds Eye Bigger Gains

The XRP price is currently trading around the $3 mark and has been in an upward momentum in the past month, exhibiting about 15% gains. The boom may have been caused by returning retail demand, whale buildup and XRP Ledger upgrades.

Source: CoinMarketCap

Nonetheless, analysts are cautious about XRP. Some believe that exceeding resistance zones between $3.40 to $3.60 could propel the XRP price to its former or higher highs.

Changelly predicts that the XRP price could rise from $3.27 to $3.46 by the end of Q4 2025, registering a modest 5% jump.

Because of this slow growth, it is no surprise that investors are now looking at the SUI Blockchain along with Unilabs Finance as better picks.

SUI Blockchain Momentum Builds With $450M Backing

As the XRP price struggles to reach previous heights, the SUI blockchain is in the green zone, with 8% monthly gains.

This uptick can be attributed to increased on-chain activity and solid institutional support, especially a recent $450 million investment in the SUI blockchain by Mill City Ventures.

Source: CoinMarketCap

Meanwhile, price speculations are still upbeat, and most believe a breakout near $6-$6.50 by year-end is coming if current trends hold.

That would mean substantial gains for the SUI blockchain, as well as its position as a better alternative compared to XRP’s slow growth.

While the SUI blockchain upside potential is attracting investors, Unilabs Finance is also claiming its position in the crypto scene. With its AI-powered tools and revenue sharing model, the platform could present a more compelling option.

Why Unilabs Finance Is Winning Hedge Fund Attention

With the XRP price showing slow growth and the SUI blockchain set to gain more momentum, many hedge funds are looking for smarter places to rotate profits.

Unilabs Finance is quickly emerging as one of those options, thanks to its unique blend of innovation, income potential and scalability.

First, the platform’s AI Market Pulse can offer real time market trend analysis, helping traders spot opportunities faster than the average investor.

This would give them an edge when deciding whether to stay in assets like the SUI blockchain, exit positions in the XRP price, or move into emerging tokens.

Unilabs also features an Early Access Scoring System that can rank new projects before they go mainstream. Holders can use this to enter promising assets ahead of the crowd, capturing gains much earlier than they might from slower movers.

There’s also the Memecoin Identification Tool that can find trending low-cap tokens with breakout potential. This diversification would help investors balance holdings between stable plays and high-risk, high-reward options.

Finally, Unilabs offers a twelve-tier reward system that shares 30% of platform revenue with token holders. This could mean long-term passive income for traders, making it a compelling alternative to holding the XRP price or betting solely on the SUI blockchain.

Other reasons why hedge funds could be redirecting profits to Unilabs include:

- Unilabs Finance offers cross-chain capability, allowing users to manage assets seamlessly across Ethereum, BSC and Avalanche.

- Its real-time ledger synchronization updates yield data every block, giving investors instant access to performance metrics.

- The platform’s yield reallocation options make it easy to reinvest, redirect, or cash out in USDT or ETH from a single dashboard.

Unilabs Continues Scaling Heights

Unlike the XRP price or SUI blockchain, Unilabs Finance’s token has exploded in value, rising over 14% from its previous stage, and now trading at $0.0097.

The buzz is only growing stronger, thanks to its imminent CoinMarketCap listing and solid confidence with $30 in Assets Under Management (AUM).

Right now, investors can grab an extra 50% bonus when depositing with the CMC50 code, a limited-time offer to celebrate the CoinMarketCap debut. But beware, this juicy bonus won’t last long, making it a prime opportunity for those who act fast.

Learn more about the Unilabs ($UNIL) presale:

Presale: https://www.unilabs.finance/

Telegram: https://t.me/unilabsofficial/

Twitter: https://x.com/unilabsofficial/

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.