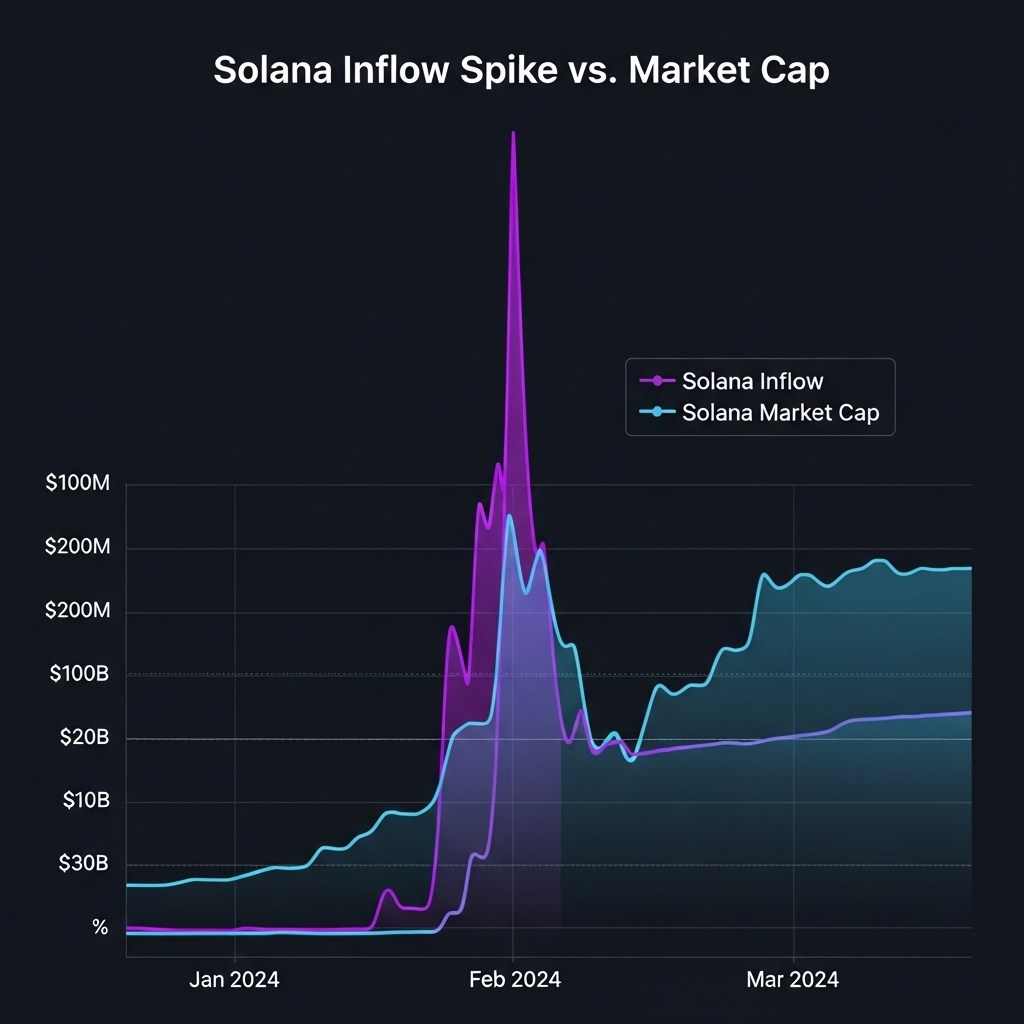

The market’s talking Solana again, and for good reason. Rumors of a Solana ETF have kicked off fresh momentum, sending roughly $1.8 billion in inflows into digital-asset products and lighting a fire under altcoin sentiment. For traders who remember how ETF chatter propelled earlier cycles, this moment looks a lot like a short window of opportunity.

This piece keeps it simple: why SOL’s headline move matters, which Layer-1s are catching spillover interest, and why some analysts are quietly favoring a lower-cap presale play, MAGACOIN FINANCE, as a high-upside parallel trade.

Institutional Flows Are Real — Solana’s Week of Gains

ETF rumors don’t always turn into approvals, but they do attract capital. Over the last week, institutional desks and crypto-native funds added to SOL exposure, showing a clear pickup in inflows and active wallet counts. That’s important: when institutional interest lines up with strong on-chain metrics, it often shortens the timeline for big momentum moves.

Avalanche and Polygon have also seen renewed volume as traders hunt for secondary plays that could rerate alongside SOL. That said, chasing already-elevated names reduces upside, which is why many positioners look for undervalued alternatives.

Altseason Setup: Why This Matters for Layer-1s

Solana’s ETF chatter is the headline, but the bigger story is cross-chain rotation. Ethereum remains the backbone of DeFi, while Avalanche’s subnet story keeps attracting developers. When capital flows into one big narrative, it often trickles to ecosystems with clear utility, creating a multi-chain upside environment rather than a single-winner scenario.

Traders who rotated early in past cycles favored projects with upcoming catalysts (listings, upgrades, partnerships). That pattern is repeating, no, with SOL leading the charge.

MAGACOIN FINANCE — The Undervalued Parallel Play

Amid the SOL headlines, MAGACOIN FINANCE has been catching attention among early presale participants and certain whale wallets. Analysts point to three practical drivers:

- Low current valuation (presale pricing creates room for outsized % gains)

- Viral community mechanics that accelerate retail adoption once listings start

- Upcoming exchange listing plans that could align with altseason momentum in Q4

This isn’t a recommendation to buy blindly — it’s a note on asymmetric potential. For risk-tolerant positioners, MAGACOIN’s presale window (and its EXTRA50X priority bonus) is exactly the kind of time-sensitive setup traders historically use to stack early exposure.

Bottom Line — Position Early, But Position Wisely

Solana’s ETF buzz has opened a door for a wider altcoin run. Some traders will double down on SOL and nearby Layer-1s — others will search for the next breakout that still trades at

entry-level valuations. If institutional flows keep building and the altcycle gains speed, smaller presale names with real community traction and exchange plans can outperform in percentage terms.

If you’re exploring early exposure, be mindful of allocation size and security. And if you want to act on MAGACOIN’s current priority window, the bonus is active but limited.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com/q7s

Presale Access: https://buy.magacoinfinance.com/q7s

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.