TL;DR

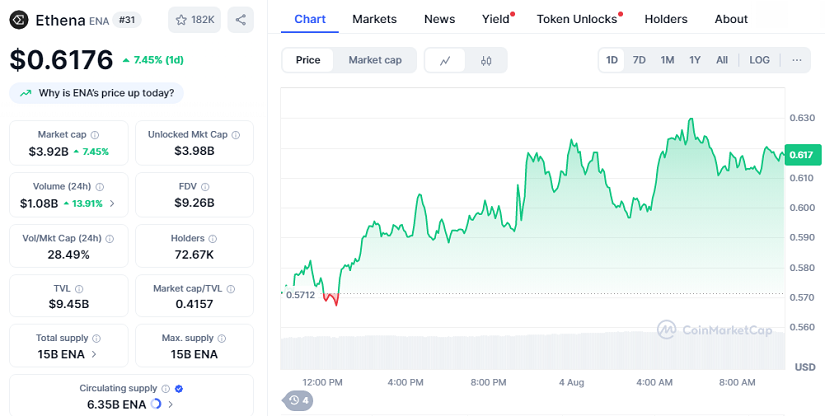

- Ethena’s native token ENA has climbed 7.45% in the last 24 hours, now trading at $0.6176, with its market capitalization reaching $3.92 billion.

- The USDe stablecoin supply recently hit an all-time high of over $9.3 billion, securing its place as the third-largest stablecoin by market cap.

- Ethena is also moving forward with a USD-compliant stablecoin in partnership with Anchorage Digital, strengthening its position in the decentralized finance landscape.

Ethena’s recent momentum has captured market attention as its synthetic dollar-pegged stablecoin, USDe, continues to expand rapidly. On-chain data shows that USDe’s supply has soared by more than 75% over the past month, now standing at $9.3 billion, according to DeFiLlama. This remarkable surge has elevated USDe to the third-largest stablecoin slot, just behind industry giants Tether and USDC.

At the same time, ENA’s trading performance reflects this rising confidence. In the last 24 hours, ENA’s price jumped by 7.45%, pushing its value to $0.6176. Its market cap sits at $3.92 billion, with a daily trading volume of $1.08 billion, an increase of nearly 14%. This boost indicates that investors are responding positively to both technical signals and fundamental growth within the protocol. With more liquidity pouring in daily, traders see Ethena as a promising hedge against broader market swings, reinforcing its appeal among risk-aware crypto participants.

Technical Indicators And Strategic Expansion Support ENA’s Rise

Technical charts point to strengthening bullish momentum for ENA. The Relative Strength Index (RSI) is hovering above 62, suggesting sustained buying pressure. Meanwhile, the BBTrend indicator has maintained green bars for several weeks, highlighting underlying demand that could extend the uptrend if market conditions stay favorable.

Beyond technicals, Ethena’s strategy continues to attract both DeFi veterans and cautious investors. The protocol’s Total Value Locked (TVL) now exceeds $9.45 billion, a testament to rising user trust and the appeal of stable, yield-bearing dollar exposure. Ethena’s team has hinted at additional product launches and partnerships in the coming quarter, which could further boost adoption and diversify its growing ecosystem for long-term supporters and new holders alike.

Looking ahead, Ethena’s collaboration with Anchorage Digital aims to launch a fully USD-compliant stablecoin, leveraging Anchorage’s status as the first federally chartered crypto bank in the US. This move could open new institutional pathways and strengthen USDe’s position as a trusted digital dollar in the broader DeFi space.

For now, traders are watching whether ENA can maintain its upward momentum and test resistance around $0.64. A successful breakout could see it target $0.77 in the coming weeks.