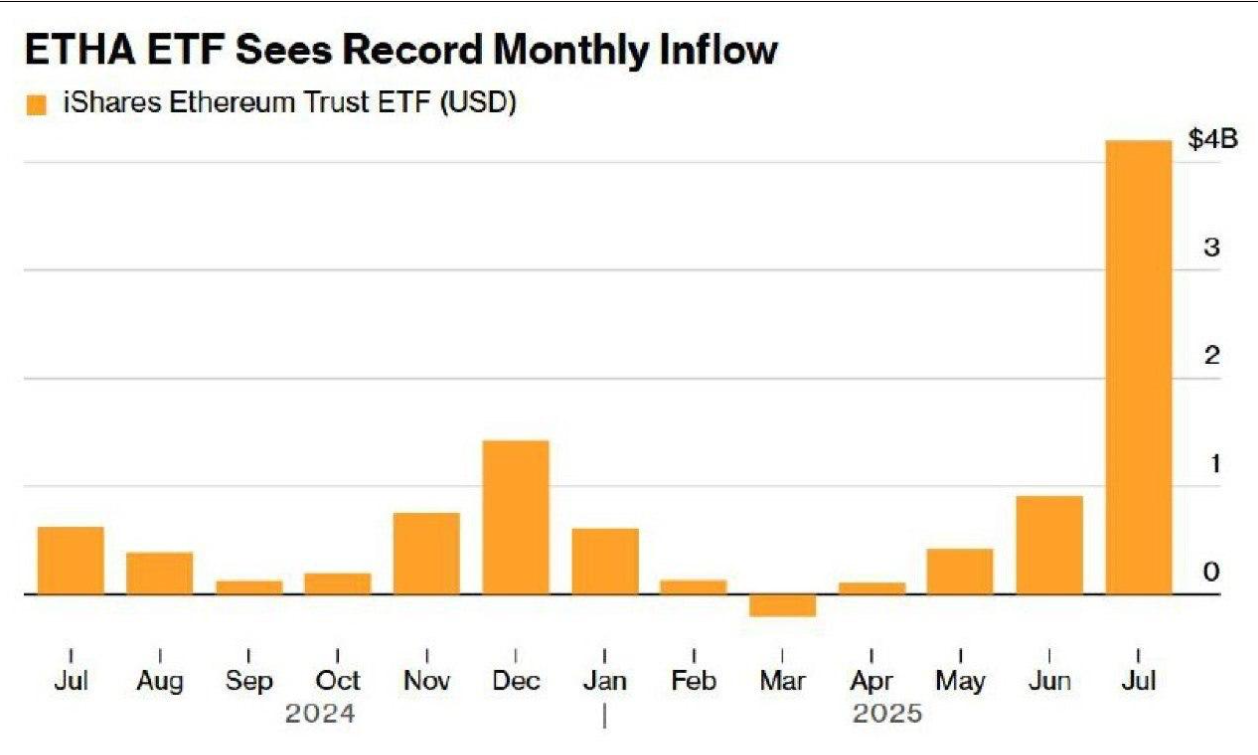

ETF appetite for Ethereum (ETH) is roaring back. Across the last week, spot-ETH funds logged over $2.3B in net creations, one of the strongest seven-day bursts since launch and July set a new monthly record near $5.4B in net inflows.

Add a firm ETH tape on majors, and attention is split between the core asset and a rising ETH-native utility play, Remittix (RTX) which has raised over $17.9 million by selling 578 million tokens at $0.0895.

Ethereum: What $2.3B in a Week Actually Means

Live boards show ETH trading in the mid-$3.5k–$3.7k band with tens of billions in 24-hour turnover. For technicians, the line that matters is a clean claim above $4,000–$4,100 which confirms there and models reopen paths toward $4.2k–$5k on sustained ETF demand.

Structurally, the flow picture is the catalyst, a $2.3B weekly spike and a record ~$5.4B month imply consistent creations rather than one-off prints, with BlackRock’s ETHA leading share as the product’s net assets hit ~$11.35B (Jul 31, 2025).

Why it matters beyond price: every week of net creations tightens tradable float, encourages treasury allocations and tends to lift smart-contract activity (staking, DeFi, tokenization). That’s the feedback loop that’s put ETH back atop best crypto to buy lists into August.

The New ETH-Native Token on Watch: Remittix (RTX)

Remittix is an Ethereum-based, cross-chain DeFi project built for low-cost, everyday transfers crypto with real utility that benefits when on-chain activity climbs.

Remittix’s upcoming wallet, scheduled for Q3 2025, will allow users to send crypto across 30+ countries with instant fiat conversions, no need for centralized exchanges and support for over 40 cryptos.

With ETF buzz lifting ETH and gas-optimized rails back in focus, traders are eyeing RTX’s under-$1 entry and the final stretch of its presale bonus window.

Why Remittix is gaining traction

- 50% bonus still live for a limited time; team messaging indicates the window is nearing its end.

- Wallet beta: Sept 15, 2025 — a dated catalyst investors can circle now.

- Low gas fee crypto design with chain-agnostic routing across major ecosystems.

- Security first: visible CertiK audit coverage adds credibility versus typical presales.

As ETH volumes expand, fee-efficient rails tend to capture sticky throughput. That’s why desks are pairing an ETH core with a usage-led satellite like RTX: momentum plus utility, not one or the other.

Positioning Into August

For ETH, watch the $4,000–$4,100 band; a decisive close above it aligns flows and structure for higher targets. For RTX, the draw is asymmetric: under-$1 pricing, a dated beta and a time-boxed presale bonus, a combination that’s rare in early-stage names with working roadmaps. The institutional signal underpins a simple thesis: keep a core in ETH and add a utility sleeve in RTX while the bonus clock is still ticking.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250, 000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Press releases or guest posts published by Crypto Economy have been submitted by companies or their representatives. Crypto Economy is not part of any of these agencies, projects or platforms. At Crypto Economy we do not give investment advice, if you are going to invest in any of the promoted projects you should do your own research.