TL;DR

- Ethereum Name Service Revolutionizes Web3: Transforms complex blockchain addresses into simple, human-readable names (like yourname.eth), acting as a critical DNS-like utility for the decentralized web.

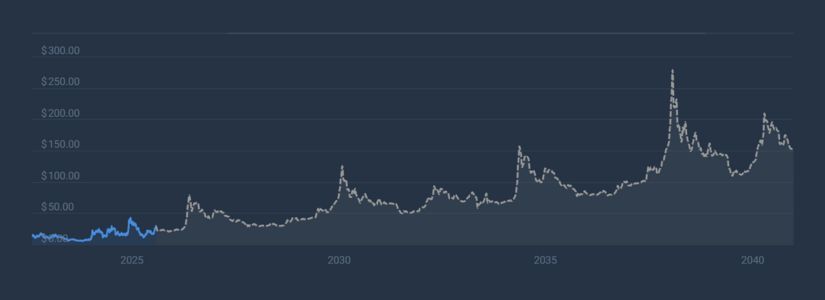

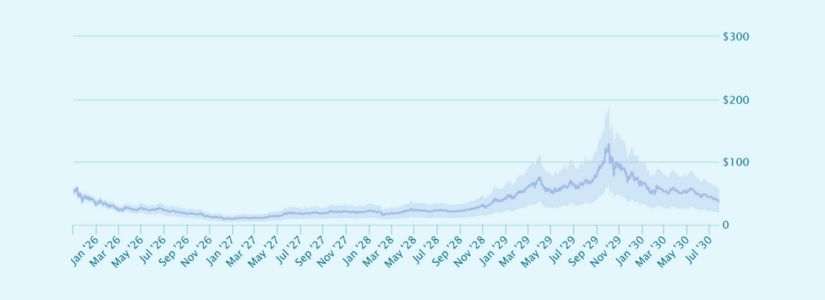

- Token Volatility & Divergent Forecasts: ENS token price predictions (2025-2030) show extreme volatility, ranging from cautious growth ($21-$61 in 2026) to potential surges ($300+ by 2030), reflecting deep market uncertainty.

- Success Tied to Web3 Adoption: ENS’s long-term value hinges entirely on widespread adoption of decentralized identities and Web3 infrastructure; it must become indispensable to thrive.

Imagine an internet where complex cryptic wallet addresses transform into simple names. This is the revolutionary promise of the Ethereum Name Service (ENS), a foundational pillar of Web3 poised to reshape how we interact with blockchain. Much like the traditional Domain Name Service translates human-readable names into machine-readable IP addresses, ENS performs a similar critical function on the Ethereum blockchain.

What Exactly is the Ethereum Name Service (ENS)?

As described in its foundational principles, ENS is a distributed, open, and extensible naming system built directly on the Ethereum blockchain. Unlike traditional companies, it operates as “an open public utility owned by the community,” aiming to become as indispensable to Web3 as DNS is to the conventional internet.

The ENS Token: Governance, Utility, and Market Journey

Though deeply integrated with Ethereum, the ENS ecosystem operates with its own native cryptocurrency: the ENS token. This token serves a vital purpose within the network: it facilitates on-chain governance, allowing the community to steer the protocol’s future direction

However, the path for the ENS token itself has been marked by volatility. Since its market launch, the price of ENS has experienced significant ups and downs, reflecting both the broader crypto market’s turbulence and the evolving perception of its long-term value proposition.

Why ENS Price Predictions Matter Now

With the accelerating adoption of decentralized identities and Web3 technology, ENS positions itself as a key player in this transformative space. Its success is intrinsically linked to the usability and growth of the decentralized web.

As we stand at the threshold of widespread Web3 integration, understanding ENS’s potential trajectory from 2025 to 2030 becomes essential. Let’s delve into the technical, fundamental, and market-driven factors shaping ENS price prediction for the coming years.

Ethereum Name Service 2025, 2026, 2027, 2028, 2029, and 2030 Price Prediction

2025 Market Expectations for Ethereum Name Service

According to analysis by CoinCodex, Ethereum Name Service is projected to trade within a range of $21.49 to $31.05. This anticipated trading channel suggests a relatively stable year, culminating in an estimated average annual price of $23.83. Based on current market rates, this forecast implies a potential ROI of 5.92% for holders by the end of the year.

In contrast, CoinDataFlow presents a significantly more bullish forecast for ENS in 2025. Their prediction suggests the average price could fluctuate between $26.47 at the lower end and reach as high as $59.06. If ENS achieves the upper end of this target range, it would represent a substantial increase of 98.2%.

Youtubers Price Prediction for ENS

YouTube channel, CryptoUS, a dedicated cryptocurrency profile, shared a video predicting ENS’s potential price movements for 2025, after analyzing on-chain metrics and market trends.

Potential 2026 Price Scenarios: Bullish vs. Conservative

DigitalCoinPrice presents a decidedly optimistic outlook for Ethereum Name Service, suggesting the token has a strong possibility of breaking through the $77.46 resistance barrier. The token is expected to trade within a range of $64.27 to $77.46. Their model indicates the most probable price stabilization point lies around $73.80.

Contrasting sharply with this bullishness, Changelly‘s technical analysis forecasts a significantly more conservative trajectory. They anticipate the minimum price could hover around $52.88, while the maximum potential peak might only reach $61.65. The average trading price for ENS throughout 2026 will settle near $54.36.

Market Cycle Analysis: Contrasting 2027 Outlooks

Some crypto experts anticipate a market correction in 2027. According to these analysts, Ethereum Name Service (ENS) could experience a low of $46.90, with an average trading price of $65.30. Despite this dip, they project a potential surge to $78.52, framing the volatility as a “healthy correction” rather than a bearish downturn.

Diverging from this view, other forecasts predict far tighter price action. These projections envision a minimum price of $50.77, a peak of $57.48, and an average stabilization point near $52.49. This narrower band, spanning less than $7, implies expectations of reduced volatility and sideways consolidation.

Divergent Paths: ENS’s 2028 Growth Scenarios

Fueled by the anticipation of Bitcoin’s halving event, some analysts project ENS could replicate its past bullish behavior. This scenario envisions Ethereum Name Service experiencing a dramatic surge, potentially reaching $145 by year-end. Such growth would signal a massive upward breakout.

Differing significantly from this optimistic surge projection, alternative forecasts suggest a more measured trajectory. This outlook anticipates ENS trading at $34.57 on average, a 18.98% increase from current levels, with prices oscillating between $30.31 and $44.85. Proponents of this view emphasize a potential 54.34% ROI for investors.

2029: The Breakout Year? Converging Bull Cases

Advanced modeling suggests 2029 could mark a watershed year for Ethereum Name Service, with experimental simulations forecasting a potential 332.11% value surge. This optimistic scenario projects ENS reaching $128.77 while navigating a broad trading range between $40.80 and $128.77.

Complementing this technical outlook, fundamental analysis anticipates tremendous growth for ENS in 2029, citing its potential to achieve unprecedented price and market capitalization milestones. These projections envision ENS surpassing $136.03 with a tighter expected band between $114.97 and $136.03.

2030 Crossroads: Exponential Growth vs. Realistic Ceilings

Crypto experts monitoring Ethereum Name Service’s long-term trajectory project substantial growth by 2030, forecasting an average price of $256.80. While acknowledging potential pullbacks to $247.70, this outlook emphasizes ENS’s capacity to surge toward $300.82 if Web3 domain adoption accelerates exponentially.

Differing significantly, alternative technical analyses present a more restrained 2030 scenario. These models anticipate a minimum price of $160.07, a peak of $189.92, and stabilization near an average of $165.72. This narrower band suggests concerns about scalability challenges or market saturation. Despite projecting growth, this view implies ENS may face stronger resistance levels than optimists predict.

Conclusion

Ethereum Name Service represents a fundamental building block for a more user-friendly and accessible Web3, transforming complex blockchain addresses into simple, memorable names. While its core utility in decentralized identity and seamless interaction is undeniable, the future trajectory of its native ENS token remains highly uncertain.

As the detailed price predictions from 2025 to 2030 vividly illustrate, forecasts range dramatically from cautious growth to exponential surges, reflecting deep market volatility and divergent views on adoption speed, scalability, and ENS’s ultimate market position.

The Price Predictions published in this article are based on estimates made by industry professionals; they are not investment recommendations, and it should be understood that these predictions may not occur as described.

The content of this article should only be taken as a guide, and you should always carry out your own analysis before making any investment.