TL;DR

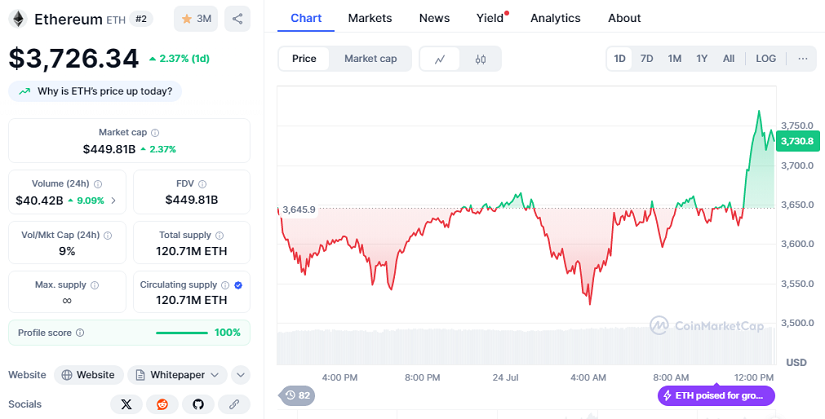

- Ethereum has recently surpassed the $3,700 mark, showing a 2.37% increase in the last 24 hours alongside a trading volume surge of 9.09%.

- Regulatory progress in the United States, including upcoming legislation aimed at clarifying crypto rules, is fostering investor confidence.

- Additionally, institutional interest continues to grow, with major firms accumulating ETH and exchange-traded products attracting billions in inflows.

Ethereum’s price broke past $3,700, trading at $3,726.34 (2.37%) as of July 24, 2025, supported by a 24-hour volume increase to $40.42 billion and a market capitalization near $450 billion. This upward movement reflects growing confidence fueled by significant regulatory developments in the U.S. and rising institutional demand.

Regulatory Progress Sparks Renewed Confidence Among Investors

The crypto sector is seeing promising signs from recent legislative efforts. The passage of the Genius Act, which was signed into law in mid-July, alongside the House’s approval of the FIT21 Act and the Clarity Act, signals a more defined regulatory environment for digital assets. Although the Senate still needs to approve some of these measures, the clarity they promise has already encouraged both retail and institutional investors to increase their exposure to Ethereum and other altcoins. This shift is visible in Ethereum’s ETH/BTC ratio, which climbed roughly 40% in the past month, as Bitcoin’s market dominance dipped by 6%.

Institutional Demand Continues To Shape Ethereum’s Growth Trajectory

Ethereum remains a key player in tokenization and stablecoins, commanding close to 60% of tokenized real-world assets and half of the $140 billion stablecoin market capitalization. Major institutional players are expanding their Ethereum holdings, with companies like Bit Digital, BTCS Inc., and BitMine Immersion Technologies accumulating hundreds of thousands of ETH tokens.

Exchange-traded products linked to Ethereum have attracted over $2 billion in inflows since early July, underlining the growing institutional appetite. Moreover, staking activity is increasing, with about 27% of ETH supply staked, and funds managing significant amounts through ETFs. Expected approval of staking ETFs in the near future could unlock tens of billions in additional capital, boosting Ethereum’s ecosystem further.

Despite this strong momentum, some regulatory hurdles persist. The SEC’s recent rejection of Bitwise’s attempt to convert a crypto index fund into an ETF illustrates ongoing challenges, though this decision did not target Ethereum-specific ETFs. Still, market participants remain optimistic, with Ethereum positioned as a foundational asset for decentralized finance and next-generation blockchain solutions.

The combined impact of regulatory clarity and expanding institutional engagement appears to be driving Ethereum’s recent price surge.