TL;DR

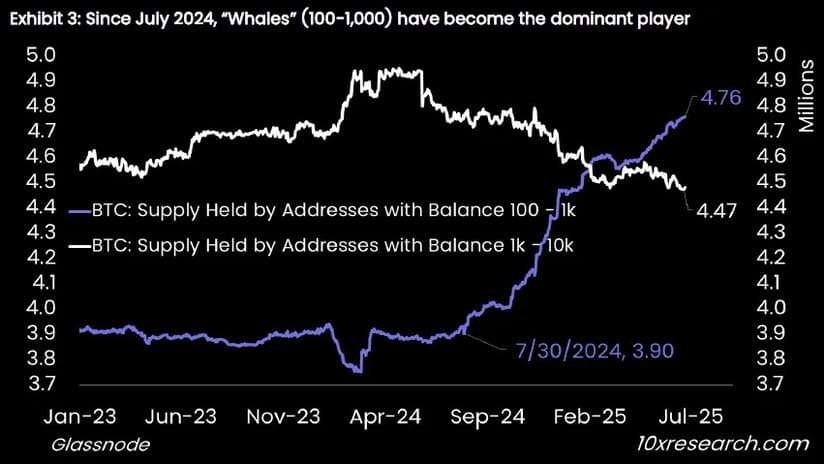

- In one year, whales liquidated over 500,000 Bitcoin worth $50 billion, with most of that supply absorbed by ETFs and institutional investors.

- Institutions now hold 25% of the circulating Bitcoin, shifting its profile from a speculative asset to a treasury reserve.

- Volatility has dropped to two-year lows, and analysts warn that if institutional demand slows, sharp declines like those in previous cycles could return.

The Bitcoin market is undergoing a quiet transformation that’s reshaping its ownership structure and behavior.

Over the past twelve months, long-time large holders — including miners, offshore funds, and anonymous wallets — sold more than 500,000 BTC, equivalent to over $50 billion. That supply was absorbed almost entirely by ETFs, corporations, and asset managers, which have steadily increased their positions since the approval of spot ETFs in the U.S.

BTC Remains Stuck

This transfer of holdings directly impacts Bitcoin’s price structure and volatility. The cryptocurrency has remained stuck around $110,000 for months, despite favorable announcements like the Trump administration’s support for the crypto industry and growing corporate adoption. Beneath that stability lies a market in transition, where whale sell-offs are matched by institutional inflows targeting long-term exposure.

Today, these institutional players control about 25% of Bitcoin’s total circulating supply. Just four years ago, estimates from Flipside Crypto suggested that 2% of addresses held 95% of all tokens in circulation. The pace of this shift is unprecedented and redefines Bitcoin’s role as a treasury asset and portfolio allocation tool, leaving behind its status as a purely speculative trade.

Could Bitcoin Crash?

Meanwhile, volatility has fallen to its lowest level in two years, according to Deribit’s index. Analysts agree that this drop reflects reduced retail speculative activity and the steady volumes provided by institutions. However, this same process allows whales to exit their positions at scale without triggering immediate price collapses — increasing the risk of market imbalances if institutional demand slows.

The concern is rooted in past cycles, where sell-offs of just 2% to 9% of whale-held supply caused price drops of 64% to 74%. Even in a more mature market, risk never fully disappears. According to 10x Research, Bitcoin is likely shifting toward a pattern of moderate annual returns between 10% and 20%, moving away from the explosive surges that defined its earlier years