TL;DR

- Arthur Hayes predicts Bitcoin may retrace to $90,000 before resuming its upward trajectory later this year.

- He believes the introduction of regulated bank-issued stablecoins could inject trillions into the digital asset space.

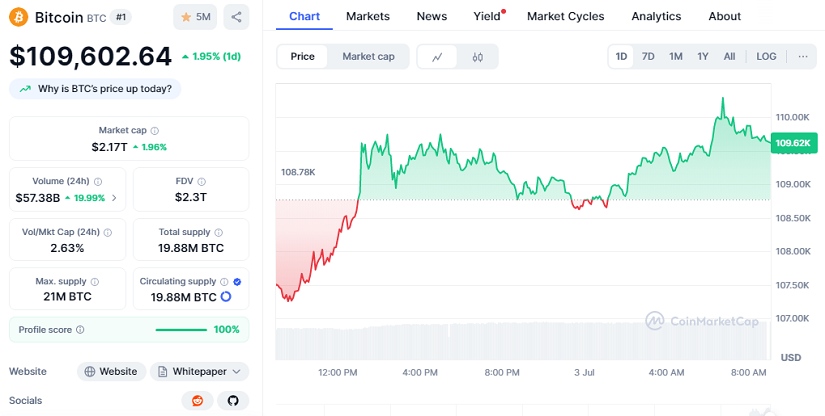

- With Bitcoin currently trading at $109,602.64 and the crypto market cap sitting at $2.17 trillion, Hayes suggests this phase may be a pause before a much larger breakout fueled by traditional financial institutions.

Bitcoin’s strong 1.95% gain in the last 24 hours reflects ongoing momentum, but Hayes warns that the next few weeks could bring uncertainty. In a recent blog post, the BitMEX co-founder argued that liquidity conditions are tightening again. The likely replenishment of the U.S. Treasury’s General Account (TGA) may pull cash out of the market temporarily, dampening risk appetite across equities and digital assets alike.

He expects a temporary cooling period in crypto markets ahead of the Jackson Hole economic symposium in late August. During this lull, he sees Bitcoin potentially retreating to $90,000 before setting the stage for a stronger recovery. According to Hayes, this price action would be more of a reset than a reversal, helping shake out short-term traders and build a stronger base for the next move up.

Traditional Banks May Reshape Crypto Liquidity Dynamics

One of the most significant insights from Hayes centers on how traditional banks could soon play a leading role in the digital asset landscape. With legislative momentum behind stablecoins, especially following Senate approval of the “GENIUS Act”, banks like JPMorgan and Citi may soon issue fully regulated, USD-backed tokens.

Unlike existing stablecoins such as USDC or Tether, these new tokens would be deeply integrated into the traditional banking system, offering seamless movement between fiat and blockchain infrastructure. This could dramatically increase institutional participation in the crypto economy.

Regulated Stablecoins Could Trigger Trillions in Demand

Hayes views this new breed of stablecoins as a major shift in capital flows. By using these tokens, banks could legally convert retail deposits into short-term Treasury investments, effectively recreating a kind of shadow QE without direct Federal Reserve involvement.

He estimates that if even 40% of the $17 trillion currently held in U.S. bank deposits were funneled through such channels, it would unleash around $6.8 trillion in fresh demand for Treasuries. That excess liquidity, Hayes believes, won’t stay locked in bonds, it could pour into crypto and accelerate the next parabolic market phase. Increased blockchain adoption, better settlement infrastructure, and faster transaction speeds may all amplify this momentum across global markets, including emerging economies.