TL;DR

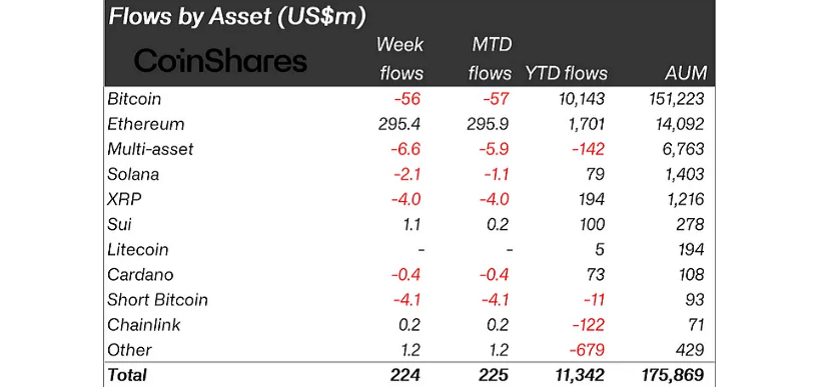

- Digital asset investment products saw $224 million in inflows last week, although overall momentum slowed amid economic uncertainty.

- Ethereum led the market with $295.4 million in inflows, supported by growing institutional interest and ETF anticipation.

- Bitcoin faced its second consecutive week of outflows, totaling $56.5 million, while minor altcoins showed early signs of renewed investor attention.

With total investment totaling $224 million over the past week, the cryptocurrency market maintains its momentum, albeit with a slight slowdown caused by regulatory uncertainty in the United States. All eyes are on the Federal Reserve, as upcoming monetary policy moves could determine the performance of digital assets in the short term. This caution has not stopped select assets from attracting capital, most notably Ethereum.

Ethereum emerged as the week’s clear winner, drawing $295.4 million in inflows, marking its seventh straight week of gains. It now represents 10.5% of total assets under management (AuM) in crypto investment products. This performance is the strongest since the U.S. presidential election in 2020 and signals a renewed wave of confidence among institutional investors. Ethereum ETFs alone have received $815 million over the past 20 days, underscoring the asset’s renewed momentum.

Ethereum Fuels Optimism Amid Policy Uncertainty

Ethereum’s momentum is backed by its core function as a decentralized infrastructure platform. It remains the foundation for major innovations like stablecoins and asset tokenization, use cases that continue to drive institutional confidence. iShares led all providers this week with $330 million in inflows, further affirming Ethereum’s institutional appeal. In contrast, players like Fidelity and Grayscale experienced further weekly outflows, suggesting a shift in investor preferences.

Bitcoin, meanwhile, saw its second week in a row of modest outflows, totaling $56.5 million. Despite remaining the dominant asset with over $10 billion in year-to-date inflows, recent figures hint at a temporary pause in investor appetite. The broader wait-and-see mood likely contributes to this short-term hesitation, though it’s far from an indication of long-term decline.

Altcoins Deliver Mixed Signals As Investors Eye Diversification

Outside of the two market leaders, altcoins presented a varied landscape. Sui and Chainlink posted small but notable inflows, potentially signaling growing interest in lesser-known projects with long-term potential. On the other hand, XRP and Solana recorded further outflows, continuing a multi-week downtrend.

While capital inflows have slowed compared to previous weeks, institutional attention remains strong for digital assets with solid fundamentals. Ethereum, in particular, appears to be emerging as the centerpiece of institutional strategies in the evolving crypto investment environment.