TL;DR

- James Wynn, known for turning memecoin bets into millions, lost $100 million in just a few days after using extreme leverage on the Hyperliquid platform.

- Despite having no prior experience with derivatives, he built a $1.25 billion position in Bitcoin with 40x leverage.

- A market reaction triggered by a Donald Trump tweet led to a full liquidation of his position.

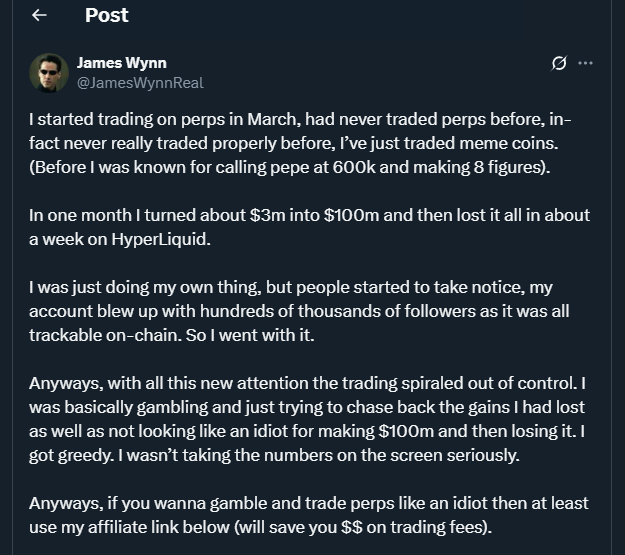

James Wynn, the pseudonymous trader who went viral for his bold and wildly profitable memecoin plays, has publicly admitted he lost control of his trading. His dramatic downfall, driven by impulsive decisions and massive exposure to leveraged derivatives, ended with a staggering $100 million loss over just a few days on the Hyperliquid platform.

What began as a meteoric rise in March, turning $3 million into $100 million within weeks through perpetual futures, ended in a catastrophic reversal. With no background in professional trading or derivatives, Wynn confessed he was overwhelmed by online fame and pressure.

“I let the attention get to me. I wasn’t treating the numbers like real money,” he posted on X.

From PEPE to BTC: A Rapid Rise Followed by Collapse

Wynn gained popularity for fully on-chain trades, including the now-famous move where he turned $7,000 in PEPE into over $25 million. That transparency made him a closely watched figure, but it also created intense external pressure, distorting his judgment and fueling riskier bets.

On May 24, Wynn opened a $1.25 billion long position in Bitcoin, using 40x leverage at an average entry price of $108,243. With virtually no room for error, any sudden dip in the market put him at immediate risk. When Donald Trump posted a tweet about potential tariffs on the European Union, global markets reacted sharply, Bitcoin dropped below Wynn’s liquidation price, and his entire position was wiped out.

Crypto Lessons and New Proposals on the Horizon

After the loss, Wynn alleged that the market was being manipulated against him and called for support to “expose these unfair mechanisms.” His story reignited conversations around how public trading data on decentralized exchanges can become a liability for large players.

In response, Binance co-founder Changpeng Zhao proposed developing a decentralized perpetual swap exchange with a “dark pool” model, inspired by traditional finance structures. According to Zhao, this would protect high-volume traders from being front-run or strategically liquidated based on visible positions.

Although Wynn still holds some open positions and retains part of his capital, his case is a reminder that volatility can reward and ruin traders in the same week. In a financial system built on freedom and innovation, the risks are just as real as the rewards, and must be handled with clear strategy and discipline.