A fresh analysis reveals which cryptocurrencies could dominate the market in the last quarter of the year. Unexpectedly, some well-known coins might not be among them. This surprising prediction is stirring discussions among investors. Which digital assets are set to shine, and why are familiar names like XRP and Cardano absent? The answers may challenge expectations.

Demand for $XYZ Surges As Its Capitalization Approaches the $15M Milestone

The XYZVerse ($XYZ) project, which merges the worlds of sports and crypto, has attracted significant investor interest. Unlike typical memecoins, XYZVerse positions itself as a long-term initiative with a clear roadmap and an engaged community. The project was recently recognized as Best NEW Meme Project, further solidifying its appeal.

Price Dynamics and Listing Plans

During its presale phase, the $XYZ token has shown steady growth. Since its launch, the price has increased from $0.0001 to $0.003333, with the next stage set to push it further to $0.005. The final presale price is $0.02, after which the token will be listed on major centralized and decentralized exchanges.

The projected listing price of $0.10 could generate up to 1,000x returns for early investors, provided the project secures the necessary market capitalization.

So far, more than $13 million has been raised, and the presale is approaching another significant milestone of $15 million. This fast progress is signaling strong demand from both retail and institutional investors.

Champions Get Rewarded

In XYZVerse, the community calls the plays. Active contributors aren’t just spectators—they’re rewarded with airdropped XYZ tokens for their dedication. It’s a game where the most passionate players win big.

The Road to Victory

With solid tokenomics, strategic CEX and DEX listings, and consistent token burns, $XYZ is built for a championship run. Every play is designed to push it further, to strengthen its price, and to rally a community of believers who believe this is the start of something legendary.

Airdrops, Rewards, and More – Join XYZVerse to Unlock All the Benefits

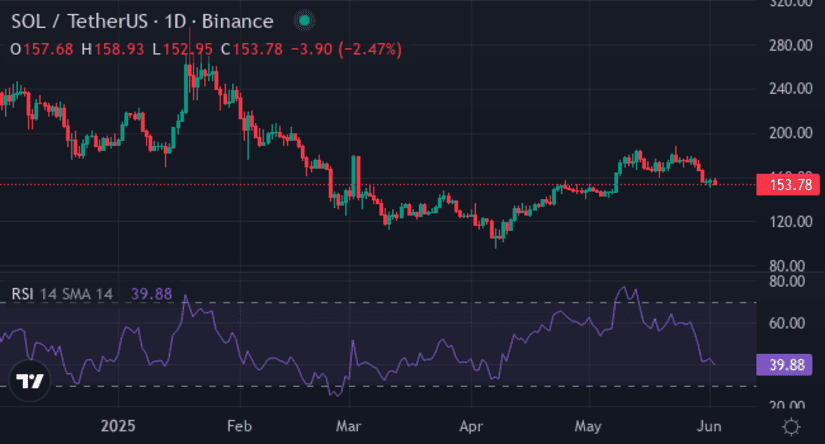

Solana (SOL)

Source: tradingview

Solana (SOL) has experienced notable price changes recently. In the past week, its price decreased by 11.88%. Over the last month, it saw a growth of 4.56%. However, looking at the past six months, SOL’s price has dropped by 33.95%. This mix of short-term growth and longer-term decline highlights its volatility.

Currently, SOL is trading between $145.84 and $174.58. The 10-day Simple Moving Average stands at $156.59, which is close to the 100-day average of $159.96. This suggests a relatively stable trend in the short term. The Relative Strength Index (RSI) is at 45.35, indicating that the market is neither overbought nor oversold. The MACD level of 0.1843 points to a slight bullish momentum.

Looking ahead, if SOL can surpass the nearest resistance level of $191.4, it may aim for the second resistance at $220.14. This would represent an increase of about 26%. On the downside, if it falls below the nearest support at $133.92, the next support level is at $105.18, which would be a decrease of around 23%. These levels are key points to watch for potential price movements.

Monero (XMR)

Source: tradingview

Monero (XMR) has experienced significant movement in its price over recent months. In the past six months, it surged by nearly 70%, reflecting strong growth in the cryptocurrency’s value. The last month continued this positive trend with an increase of over 23%. However, the past week saw a reversal, with the price dropping about 17%, highlighting the market’s volatility.

Currently, Monero is trading between $300.76 and $408.22. The nearest resistance level is at $468, and if the price moves above this point, the next resistance is at $576. On the downside, the closest support level sits at $253.52, with a secondary support at $146.06. These levels are crucial as they indicate potential points where the price might pause or reverse.

Technical indicators offer additional insights. The 10-day Simple Moving Average is $344.74, slightly above the 100-day SMA of $332.67, suggesting recent bullish momentum. The Relative Strength Index (RSI) stands at 65.39, approaching the overbought threshold, which could indicate that the asset is becoming overvalued. The Stochastic oscillator is at 75.68, also nearing overbought territory. Additionally, the MACD level is positive at 4.9777, reflecting current market sentiment.

Render (RENDER)

Source: tradingview

Render (RENDER) has seen a significant price decline recently. Over the past week, the price dropped by 20.22%. In the last month, it decreased by 21.24%. Looking back six months, the price has plunged by 57.37%. The current price ranges between $3.39 and $4.72.

Technical indicators suggest that Render might be oversold. The Relative Strength Index (RSI) is at 40.77, and the Stochastic oscillator is at 3.345, both indicating potential for a rebound. However, the Simple Moving Averages point to bearish signals, with the 10-day SMA at $3.87 below the 100-day SMA at $4.00. The MACD level is negative at -0.0111, indicating downward momentum.

If the price continues to fall, it might test the nearest support level at $2.84, which would be a decrease of about 29% from the current price. Alternatively, if the price rebounds, it could aim for the nearest resistance level at $5.52, representing a potential increase of approximately 38%. The second support level is at $1.50, while the second resistance level is at $6.86. These levels could lead to more significant moves, with potential decreases or increases of over 60% and 70% respectively. Traders are closely watching these levels for signs of a trend reversal.

Kaspa (KAS)

Source: tradingview

Kaspa (KAS) has declined significantly over recent periods. In the past week, it dropped nearly 20%, and over the last month, it’s down over 16%. Looking back six months, KAS has lost almost 46% of its value. Currently trading between $0.08 and $0.11, the cryptocurrency is seeking direction amid market volatility.

Technical indicators show mixed signals. The 10-day and 100-day Simple Moving Averages both sit at $0.09, hinting at consolidation. An RSI of 46.73 indicates a neutral position, while the Stochastic oscillator at 21.27 nears oversold territory, possibly signaling an upcoming rebound. The MACD level is marginally positive, which could suggest bullish momentum.

Immediate resistance is at $0.12; surpassing this could propel KAS toward $0.15, offering potential gains. Conversely, failure to hold above the support at $0.06 might lead to a decline toward $0.03. These movements represent significant percentage changes, highlighting the importance of monitoring key levels to anticipate KAS’s next direction.

Conclusion

While SOL, XMR, RENDER, and KAS show potential, XYZVerse (XYZ) uniquely merges sports and meme culture, aiming for 20,000% growth with a community-driven, sustainable strategy.

You can find more information about XYZVerse (XYZ) here:

https://xyzverse.io/, https://t.me/xyzverse, https://x.com/xyz_verse

Press releases or guest posts published by Crypto Economy have been submitted by companies or their representatives. Crypto Economy is not part of any of these agencies, projects or platforms. At Crypto Economy we do not give investment advice, if you are going to invest in any of the promoted projects you should do your own research.