TL;DR

- Vitalik Buterin claims that decentralized networks like Ethereum could replace cash in emergency situations, as long as they are private and resilient enough.

- Sweden and Norway, pioneers in eliminating the use of cash, have taken a step back and now urge their citizens to store physical money for safety precautions.

- Buterin envisions Ethereum as a potential digital backup in the face of geopolitical crises and cyberattacks.

Sweden and Norway, once global leaders in the push to eliminate physical money, are now rethinking their approach. Authorities in both countries have started encouraging citizens to keep cash on hand in case of war, cyberattacks, or power outages that could disable digital payment systems. In Sweden, government-published home survival manuals now advise people to keep enough physical currency to last at least one week. Norway has gone a step further by passing legislation that forces businesses to accept cash payments or face high penalties and fines.

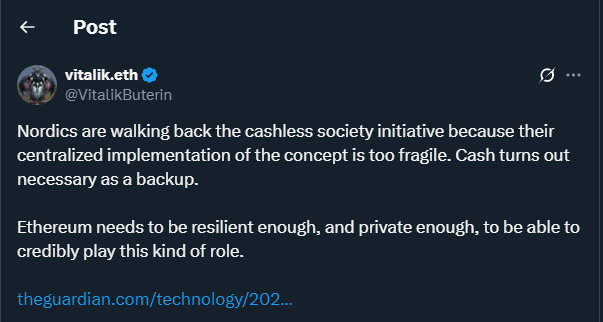

For Vitalik Buterin, this shift reveals the inherent fragility of centralized systems. In his view, Ethereum could become a viable national backup if it overcomes certain technical challenges.

“Ethereum needs to be private and resilient enough to play a role in these critical scenarios,”

he recently stated in a X post. Decentralization, once considered a niche feature, may now emerge as a crucial tool for preserving digital financial sovereignty. In fact, more and more analysts are suggesting that countries should explore crisis-resistant platforms beyond traditional banking infrastructure.

Ethereum as a Decentralized Backup Alternative

Although Ethereum is still evolving—through improvements in privacy, scalability, and decentralization—it isn’t fully ready to replace cash in extreme scenarios just yet. However, Buterin sees a clear opportunity: if governments require a digital infrastructure that remains functional in times of chaos, some public blockchains like Ethereum may have a critical edge over fragile centralized systems.

Moreover, the crypto community is already actively exploring solutions such as ZK-rollups, validiums, and second-layer networks, all of which aim to enhance privacy and transaction speed. These innovations, paired with a more distributed infrastructure, are bringing Ethereum closer to its goal of becoming a truly resilient network capable of withstanding global crises. These efforts demonstrate that the crypto ecosystem is not only reactive but proactively working to address real-world vulnerabilities that centralized systems have repeatedly exposed.

While most governments rediscover the strategic value of physical cash, the crypto ecosystem is quietly building a robust alternative. Perhaps the future of money isn’t about eliminating cash altogether, but about replacing it with something designed to endure anything.