TL;DR

- Visa made a strategic investment in BVNK, betting on cross-border payment infrastructure with stablecoins.

- BVNK processes $12 billion annually in stablecoin payments and expanded its presence to the U.S. after a $50 million Series B round.

- The companies will work on new solutions for instant global payments in a market where stablecoins already move $27 trillion a year.

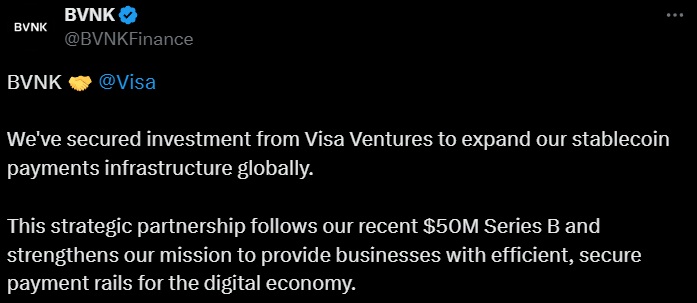

Visa announced a new strategic investment in BVNK, a platform specialized in infrastructure for stablecoin payments.

This investment once again confirms the interest of major financial firms in integrating digital asset-based solutions into their traditional operations. The capital injection was carried out through Visa Ventures, the company’s venture capital arm, although the financial terms were not disclosed.

BVNK recently closed a $50 million Series B funding round, backed by firms such as Haun Ventures, Coinbase Ventures, and Tiger Global. With these resources, the company expanded its operations to the United States and opened offices in San Francisco and New York. It also added professionals with experience at BlockFi and Cross River to lead its growth in that market.

Visa and BVNK: An Alternative to the Traditional Banking System

Currently, BVNK processes around $12 billion per year in stablecoin payments. Its platform allows businesses to make international transfers instantly and efficiently, cutting out typical intermediaries and reducing costs. The company aims to offer an alternative to the traditional banking system through infrastructure designed to move money on the blockchain.

For its part, Visa has spent months working actively on its stablecoin strategy. It recently announced partnerships with other startups in the market, such as Bridge, to facilitate the use of stablecoin-linked cards through a single API integration. It is also participating in consortiums working on stablecoins fully backed by U.S. dollars.

According to figures from Visa Onchain Analytics, in 2025, $27 trillion in stablecoins were processed through 1.25 billion transactions. These numbers reflect an impressive shift in how businesses and users move money around the world. BVNK identified this trend from the beginning and developed its infrastructure to meet that demand, allowing businesses to operate at the speed today’s digital economy requires.

For both companies, the collaboration represents a unique opportunity to expand the reach of digital payments and offer faster, more secure solutions for cross-border transfers.