TL;DR

- Polkadot’s Resilient Recovery: Amid a crypto market surge and altcoin supply boost, DOT has rebounded to key support levels, presenting a strong buy-the-dip opportunity as early signals hint at a bullish reversal.

- Pioneering Blockchain Interconnectivity: Powered by innovative “parachains,” Polkadot isn’t just a token; it’s a decentralized protocol linking major blockchains like Bitcoin and Ethereum, enhancing scalability and network efficiency.

- Comprehensive Multi-Year Projections: From 2025 to 2030, detailed forecasts blend conservative technical analysis with bullish potential, mapping DOT’s journey through steady trading ranges and transformative market highs.

The crypto market is riding a wave of all-time highs, with altcoins enjoying a surge in supply that has reinvigorated investor optimism. Even with historical declines, Polkadot (DOT) has recovered to important support levels, making it a great chance to buy the dip. As DOT edges closer to its previous peaks, early signals point to a bullish reversal that may propel it toward the key barriers. This momentum naturally invites investors to ask: Is Polkadot the right opportunity to seize now?

Polkadot’s Innovative Ecosystem

More than just a digital token, Polkadot is a pioneering decentralized protocol that interconnects major blockchains such as Bitcoin and Ethereum. Its advanced architecture, powered by innovative “parachains,” relieves the main chain from processing overload, significantly enhancing transaction speed and scalability.

The DOT token is essential for managing the network and for staking. By enabling DOT holders to influence future protocol developments and secure the network, Polkadot is actively shaping a more integrated and efficient digital ecosystem. With DOT readily available on major platforms like Coinbase, its growing prominence presents intriguing prospects for investors.

Forecasting DOT’s Future Price Trends

This article ventures into a comprehensive price prediction for Polkadot from 2025 to 2030. Our detailed analysis combines expert opinions, historical market data, and technical analysis to paint a balanced picture of DOT’s potential trajectory.

We examine current market performance, upcoming ecosystem milestones, and overall crypto sentiment to forecast possible future moves. While the promise of significant gains is evident, it is critical to recognize the inherent risks associated with cryptocurrency investments.

Our forecast endeavors to blend these technical insights with real-world developments, offering you a robust framework for evaluating your future crypto strategy. Together, these insights form a compelling roadmap for navigating the evolving landscape of Polkadot investments.

Polkadot (DOT) 2025 to 2030 Price Prediction

Evaluating the 2025 Trading Environment for Polkadot (DOT)

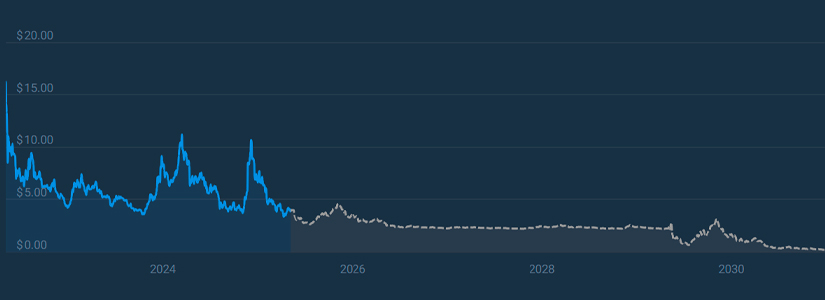

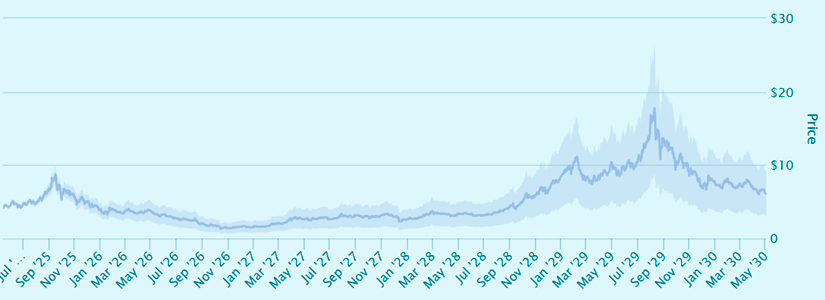

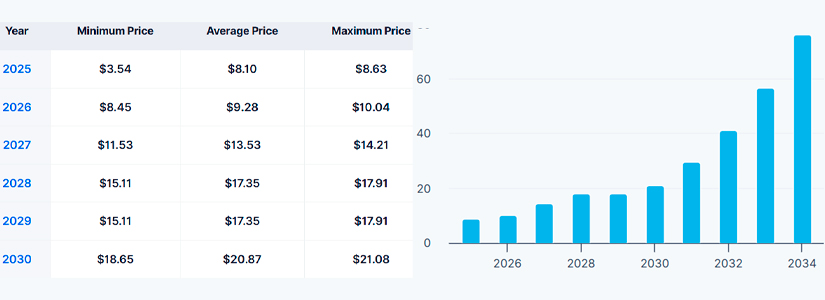

As per CoinCodex, Polkadot (DOT) is projected to fluctuate between $2.64 and $4.75 by the year 2025. This range sets an average annualized price at around $3.55, potentially delivering a return on investment of approximately 21.54% compared to current levels.

In contrast, Changelly’s technical analysis offers a slightly different angle for DOT’s price prediction in 2025. Their outlook suggests that the minimum value for Polkadot may hover at about $3.39, with a maximum cap near $3.96. Interestingly, despite this narrower trading band, Changelly anticipates that the average trading price might reach up to $4.52.

Twitter Influencers Prediction

Crypto Twitter profile, The Analyst, published a post with their predictions for Polakdot’s price for 2025, forecasting a trading range between $7 and $9.

🚨Update on #Polkadot

Due to the lethargic upwards move during the last week, we can't assume that this is a bullish movement

We think that $DOT has the potential to reach $7 up to $9 in the short term, but after that a bigger correction is expected before the #ALTSEASON starts pic.twitter.com/a4IbGbEiE2

— The Analyst (@MMatters22596) May 3, 2025

Polkadot (DOT) 2026 Forecast: Navigating a Volatile Trading Range

According to CoinDataFlow‘s latest experimental simulation, Polkadot (DOT) could experience modest growth in 2026. In ideal market conditions, forecasts indicate that DOT’s value could increase by about 7.6%, potentially hitting a peak of around $4.22, fluctuating between a low of $1.28 and the anticipated high of $4.22.

Investors and market experts from DigitalCoinPrice offer a contrasting outlook for Polkadot in 2026. According to these experts, Polkadot is on track to surpass the $8.63 mark by year’s end. In fact, the prevailing sentiment among market leaders is that DOT will soon break its previous all-time high and stabilize within a range between $8.10 and $8.63.

Youtubers Price Prediction for DOT

Tom Trades, a crypto analyst on YouTube, shared a video on his channel discussing Polkadot’s (DOT) price prediction for the 2025-2026 market cycle after a thorough analysis of on-chain metrics.

2027 Projections: From Dips to Highs in Polkadot’s (DOT) price

In 2027, projections for Polkadot (DOT) diverge sharply, revealing the complex interplay of market forces and technological adoption. On one hand, a group of crypto experts forecasts a robust market rebound that could push DOT to a high of $31. Investor caution and inherent market volatility suggest that DOT could dip to around $18 before rallying.

Conversely, another perspective centers on Polkadot’s deepening integration into global finance and decentralized applications. They predict a more conservative price range, with DOT potentially settling from a strong foundation at $2.37 to record peaks of about $2.89.

2028: Navigating Dual Forecasts – Bullish Peaks vs. Bearish Lows for Polkadot

One forecast envisions an environment where market corrections persist but also serve as a prelude to significant upward adjustments. Under this optimistic view, DOT could see a low of around $41.87 before regulatory clarifications and overall market maturity push the average price up to approximately $84.63. By the year’s end, these dynamics might culminate in a peak price of about $155.92.

In stark contrast, another analysis for 2028 highlights a bearish scenario marked by a pronounced downtrend. According to this perspective, DOT might experience significant downward pressure, with an anticipated price of around $2.43, a steep decline representing a 38.03% drop from its current valuation. In this scenario, the asset’s price appears likely to oscillate within a narrow band, dipping to $2.29 in November and recovering slightly to $2.66 in March. Despite the gloom of this downtrend, investors might still gauge a potential ROI of 32.12%.

2029 DOT Price Forecasts

In 2029, traditional cost analysis by crypto experts paints a picture of relative stability for Polkadot (DOT). In this scenario, expert assessments indicate that DOT could trade within a narrow band, with a minimum price of $22.10 and a maximum of $26.28, resulting in an average trading value of around $22.74.

In contrast, new experimental simulations offer a markedly different view of DOT’s potential in 2029. According to these models, there is potential for a dramatic rise in value, an increase of 351.29% that could propel DOT to a peak of $17.73 in the most optimistic scenario.

2030 DOT Price Dynamics: Technical Stability Against a Future Bullish Surge

Market analysts and experts forecast that DOT is expected to cross the price level of $20.87 during the year. At the same time, projections indicate that DOT could reach a minimum price of $18.65, with the potential to climb to a maximum of $21.08.

In contrast, an alternative outlook for 2030 envisions a more bullish scenario. In this forward-looking analysis, continued growth in adoption, technological advancements, and market restructuring could propel Polkadot to a new all-time high near the $70 threshold; market corrections along the way might see DOT’s price dip to around $49.99.

Conclusion

Polkadot’s journey from 2025 to 2030 reflects a dynamic interplay between technical stability and transformative market potential. While the recovery to key support levels and thoughtfully projected trading ranges signals a cautious yet optimistic outlook, DOT’s innovative ecosystem fuels confidence in its long-term viability.

The Price Predictions published in this article are based on estimates made by industry professionals; they are not investment recommendations, and it should be understood that these predictions may not occur as described.

The content of this article should only be taken as a guide, and you should always carry out your analysis before making any investment.