TL;DR

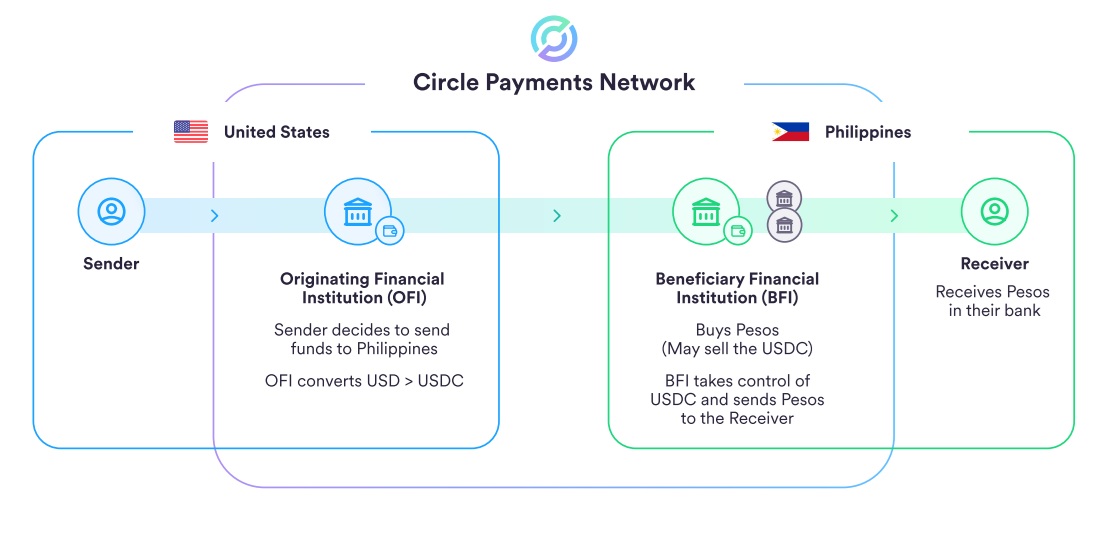

- Circle unveiled a new payments network (CPN) that enables near-instant international transfers using stablecoins like USDC and EURC.

- The system aims to replace traditional processes by eliminating delays and high fees through blockchain technology and 24/7 operation.

- CPN connects banks, fintechs, and wallets under strict regulatory standards and allows payment automation through APIs and smart contracts.

Circle announces new payments network aiming to drastically cut time and costs of international transfers

The new platform, named Circle Payments Network (CPN), will enable nearly instant money transfers between countries using regulated stablecoins such as USDC and EURC. Its goal is to provide an efficient, accessible financial infrastructure that operates around the clock, without relying on banking hours or legacy systems.

Circle Aims to End the Outdated International Payment System

The network directly addresses the current challenges of cross-border payments. Today, an international transfer can take more than a full business day and carry fees exceeding 6% of the amount sent. These delays hit small businesses and users in financially underserved regions the hardest. CPN offers a concrete alternative by using blockchain technology to enable immediate, verifiable transactions.

Unlike other solutions, the network is built to integrate with banks, digital wallets, and payment platforms. Any entity that meets regulatory requirements can participate in the ecosystem. Circle requires valid licenses, anti-money laundering controls, and strict cybersecurity measures. This foundation allows the system to uphold strong financial standards without sacrificing the speed and efficiency of digital tools.

Licenses, Compliance and Security Measures

Circle also offers tools for developers. The platform supports the automation of payment flows such as payroll, treasury operations, or supplier settlements through APIs and smart contracts. These features turn the network into a programmable tool that adapts to different operational needs.

Major financial institutions are already involved in the network’s development and integration. Participants include BNY Mellon, Deutsche Bank, and Standard Chartered. Fintech firms from various regions have also joined, such as dLocal, Flutterwave, and Coins.ph, along with Fireblocks, a company specializing in digital asset infrastructure. These partnerships help test the network in diverse environments and ensure it works at global scale.

Circle aims to turn CPN into a modern, secure, and accessible financial network for all types of institutions. Its objective is to replace inefficient structures with a faster, more transparent, and better-connected system.