TL;DR

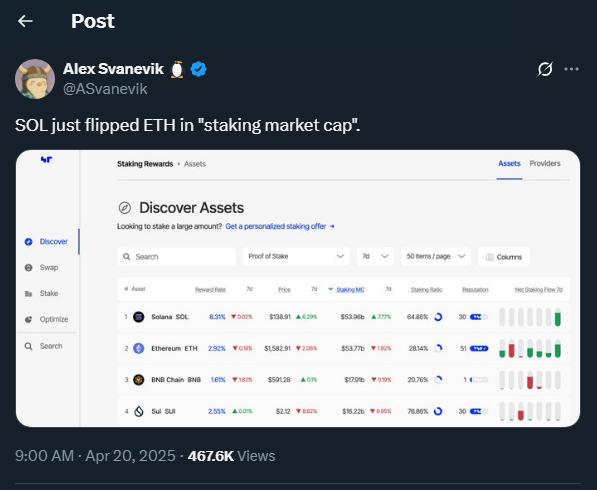

- Solana briefly surpassed Ethereum in total staked value (TVL), with over $53.9 billion in SOL delegated by more than 500,000 unique wallets.

- While Ethereum remains the leader in DeFi and validator count, this symbolic milestone has sparked debate around staking incentives

- Meanwhile, projects like Synthetix and Aptos are facing internal tensions due to significant changes to their staking reward systems.

The crypto ecosystem has been shaken by an unexpected event: Solana briefly surpassed Ethereum in total staking value, boasting an annual yield of 8.31% and over $53.9 billion in SOL locked. Although the moment was short-lived, it caused a stir within the community and brought an uncomfortable question to the forefront: is this truly a sign of strength, or does it reveal hidden weaknesses?

The surge is largely attributed to SOL’s impressive price performance against ETH, with the SOL/ETH ratio growing nearly tenfold since June 2023. However, some developers suggest that this could actually be hindering the adoption of DeFi on Solana. If staking offers better returns with lower risk, many users may choose not to use their tokens in decentralized protocols, ultimately limiting the real-world utility of the token.

Moreover, Solana’s security architecture has come under scrutiny. While Ethereum enforces automatic penalties for validator misbehavior, Solana currently relies on manual intervention from the network, raising concerns about its economic security. That said, Solana Labs is planning to implement a new slashing system later this year to address the issue.

Ethereum and Solana Face Challenges in Incentives and Decentralization

Ethereum, for its part, is not free of problems either. The 32 ETH requirement to become a validator has encouraged staking concentration in liquid platforms like Lido, which now dominates with 88% of the liquid staking market. This has raised alarms about potential centralization in a system that was, ironically, designed to prevent it.

Meanwhile, other projects like Synthetix and Aptos are experiencing internal tensions. Synthetix, for instance, is struggling with the depegging of its stablecoin sUSD, which dropped as low as $0.68 in April. Its founder, Kain Warwick, issued a warning to stakers, urging them to adopt a new incentive model or face harsher consequences. Aptos is also facing controversy following a proposal to slash staking rewards by nearly 50%.

Despite these challenges, the evolution of staking across multiple chains highlights the ecosystem’s maturity and its ongoing quest for balance between security, profitability, and decentralization. The fact that Solana momentarily caught up to Ethereum in staking is not a threat, it’s a positive sign: competition drives innovation. And for those of us who believe in the future of crypto, that’s excellent news.