TL;DR

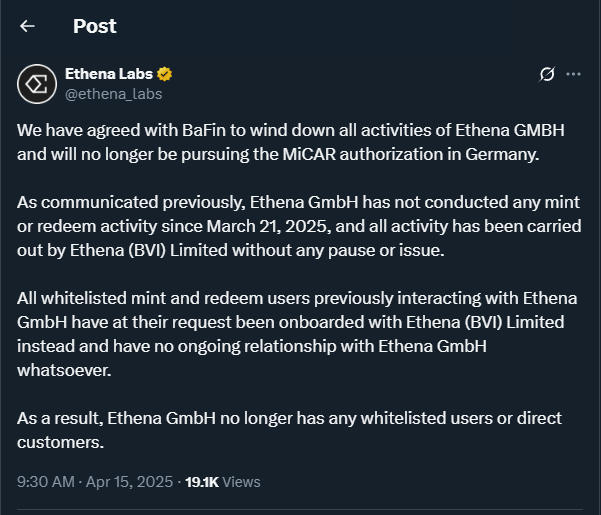

- Ethena reached an agreement with the German regulator BaFin to shut down its operations in Germany, transferring all existing users to its entity in the British Virgin Islands.

- The decision follows a warning from BaFin about “serious deficiencies” in Ethena’s USDe token.

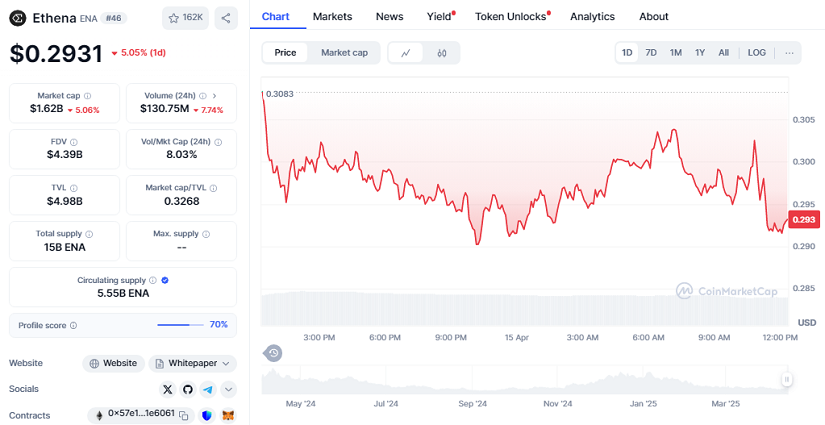

- The price of the ENA token has dropped by 5.05% in the last 24 hours, reflecting a negative impact on its performance.

Ethena, the decentralized finance (DeFi) protocol, has confirmed it will shut down its operations in Germany after reaching an agreement with the German financial regulator “BaFin”. This decision directly affects its subsidiary, Ethena GmbH, after BaFin identified “serious deficiencies” in Ethena’s USDe token, which is used by the platform to offer yield backed by cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). BaFin had pointed out that Ethena was operating with unregistered securities products in the country without the necessary approval.

Ethena’s Resilience and International Expansion

The agreement stipulates that all users of the German entity will be transferred to Ethena BVI, the entity located in the British Virgin Islands. This restructuring marks the end of Ethena’s presence in the German market, which was forced to suspend the issuance of its stablecoin USDe following an order from BaFin in March 2025. In its statement, Ethena expressed disappointment over its failure to obtain authorization under the European Union’s MiCAR regulation, which governs crypto assets across Europe.

Despite the setback in the German market, Ethena remains a robust platform in terms of its global performance. With a total value locked (TVL) of $4.9 billion, Ethena is one of the leading protocols in the DeFi space. However, the ENA token, which is linked to the platform, has experienced a 5.05% drop in the last 24 hours, trading at $0.2931, reflecting the tension caused by this closure.

Despite this, the platform assures that secondary market operations will not be affected and continues to explore alternative regulatory paths to expand within Europe.

Ethena’s exit from Germany serves as a reminder of the growing regulatory scrutiny facing crypto platforms in the region. European Union authorities, led by BaFin, are intensifying their oversight of cryptocurrencies and their associated products, such as stablecoins. While this is a setback for Ethena, it also highlights the importance of crypto companies navigating the regulations of each country properly. For cryptocurrency enthusiasts, this incident can be seen as another big challenge on the road to widespread adoption, but also as an opportunity for projects to demonstrate their resilience in the face of regulatory adversities.