TL;DR

- Visa joined the USDG stablecoin network, led by Paxos, to distribute interest from reserves among its members.

- The company has been testing transactions with USDC since 2021, on networks like Ethereum and Solana, and now seeks deeper integration.

- Binance increased its USDC volume by 365%, which could allow it to surpass Coinbase in the custody and distribution of stablecoins.

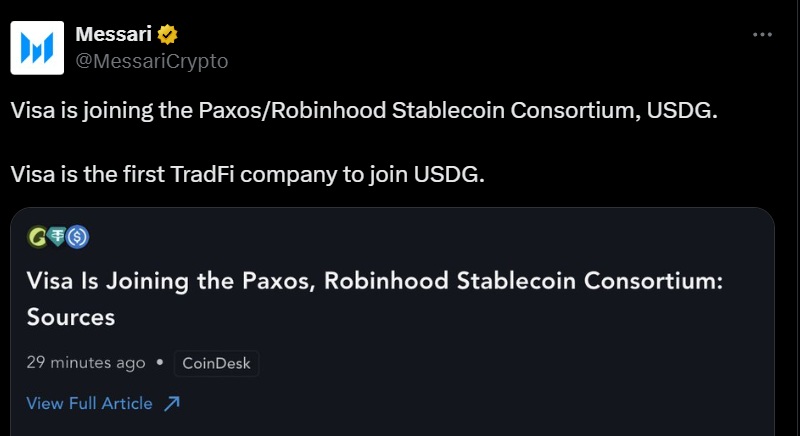

Visa decided to join the USDG stablecoin network, led by Paxos, and shared with other companies such as Robinhood, Kraken, Galaxy Digital, Anchorage Digital, Bullish, and Nuvei.

What is USDG?

This alliance marks the entry of a traditional payments company into a system designed to distribute interest generated by stablecoin reserves among members who drive its usage and liquidity. The model breaks with the logic of issuers like Tether and Circle, who keep the profits earned from their backing assets. USDG proposes a more open and cooperative structure between tech and financial companies.

Since 2021, Visa has been testing transactions on the blockchain using USDC on networks like Ethereum and Solana. Now, the company is betting on deeper integration with dollar-backed digital tokens. This allows it to maintain its presence in a sector that is evolving towards more decentralized and efficient financial solutions.

Paxos created USDG with the goal of providing an interoperable stablecoin network aimed at improving global liquidity and enabling the distribution of yields among collaborating firms. Thanks to the arrival of traditional firms, the initiative can accelerate stablecoin adoption in markets and increasingly defined regulatory contexts.

Changes in the Stablecoin Market

The financial sector’s interest has intensified in the United States, where new regulations are being discussed to oversee these types of assets. Companies are seeking to integrate into new sustainable models that offer clear incentives.

On the other hand, the stablecoin market continues to reorder itself. Binance has increased its USDC volume by 365% over the past year. This could allow it to surpass Coinbase’s $12 billion in USDC holdings, resulting in a major shift in the competition for stablecoin custody and distribution.

Meanwhile, consortiums like USDG are attempting to lay new foundations for the use of digital currencies linked to the dollar, combining shared business models with greater connection between traditional financial platforms and crypto.