TL;DR

- Larry Fink warned that Bitcoin could replace the dollar as a global reserve if the U.S. fails to control its debt and the deficit keeps growing.

- BlackRock manages nearly $50 billion in its Bitcoin ETF. Additionally, its tokenized fund BUIDL could surpass $2 billion in April.

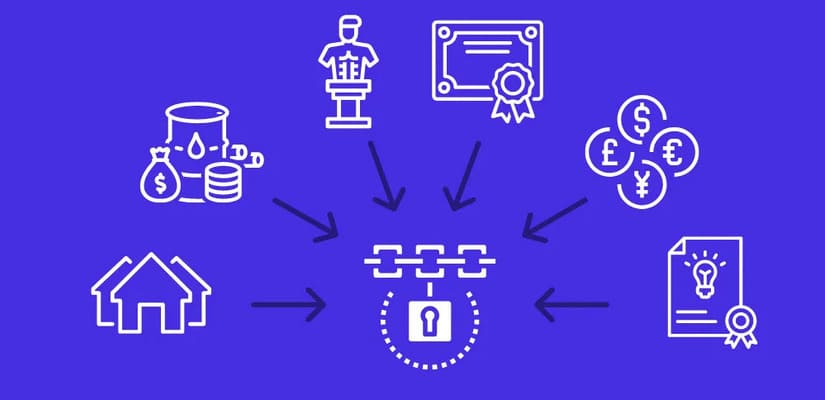

- Fink believes tokenization will revolutionize markets but warns that without an efficient digital identity system, institutional adoption will be limited.

Larry Fink, CEO of BlackRock, warned that Bitcoin could challenge the dollar’s status as a reserve currency if the United States does not control its debt. In his annual letter to shareholders, he pointed out that the country has relied on the dollar for decades, but the expanding fiscal deficit could change that scenario. If investors start viewing BTC as a more reliable alternative, the U.S. economy could lose its advantage.

While supporting innovation in decentralized finance and tokenization, he believes the lack of solid infrastructure for digital verification hinders institutional adoption. He asserts that every financial asset could be tokenized in the future, but without an efficient digital identity system, market transformation will remain limited.

BlackRock: Stocks, Bonds, and the Role of Private Markets

Amid growing economic uncertainty and policy changes under Donald Trump’s administration, Fink recommended diversifying investment portfolios beyond stocks and bonds. He argues that including private market assets could help mitigate the risks of government debt and dollar volatility.

BlackRock has taken a central role in the digital asset market. In January 2024, it launched its iShares Bitcoin Trust (IBIT), which quickly became the most successful ETF in its category. The fund currently manages nearly $50 billion in assets, with a significant portion coming from retail investors. Additionally, it has developed the tokenized fund BUIDL, which could surpass $2 billion in assets by April, making it the largest of its kind in the market.

The Future of the Financial System

Fink believes tokenization will reduce costs and make markets more accessible. However, he insists that the industry must address digital identity issues before achieving mass adoption. The BlackRock CEO has emphasized that he is not opposed to Bitcoin or decentralized finance, but he acknowledges and warns that the transformation of the financial system could shift the balance of power in the global economy.