TL;DR

- Arbitrum DAO has been operating at a loss, spending $231 million while generating $107 million in revenue, yet 2025 is projected to become its most profitable year.

- Over 95% of its earnings come from transaction fees, with Layer 2 (L2) surplus fees standing out as the dominant income source.

- The DAO is currently voting on implementing Timeboost, an auction-based fast-lane feature, as a new revenue stream, alongside Nova Fee Sweep.

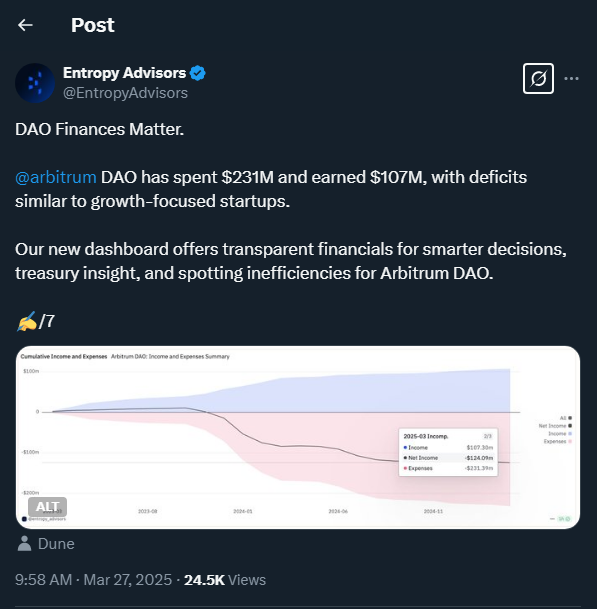

Arbitrum, one of the leading Ethereum scaling solutions in the crypto ecosystem, is now redefining its financial approach. Despite operating at a financial deficit, with $231 million in expenditures against only $107 million in earnings, the DAO’s strategic focus has remained clear: pursue aggressive growth over cost-cutting. This isn’t an unusual tactic in the world of technology, as many successful startups have taken similar paths before reaching profitability. What makes Arbitrum’s case particularly interesting is that it is a decentralized organization, governed by votes and a transparent community-driven model.

According to a detailed report by Entropy Advisors, 95% of Arbitrum’s current revenue comes from transaction fees. Within this category, Layer 2 surplus fees emerge as the primary driver of income. The silver lining, however, is that even though overall gross revenue has decreased, Arbitrum’s profit margin has grown significantly, rising from 25% to 80%, thanks to increased operational efficiency and a notable reduction in incentive-related expenses.

New Revenue Streams: Timeboost and Nova Fee Sweep

In its quest to expand revenue and maintain growth without relying solely on transaction fees, Arbitrum DAO is exploring new strategies. One of the most promising is “Timeboost”, a feature launched in 2024 that allows users to bid in auctions for priority access to the network, essentially a fast lane that ensures their transactions are processed ahead of others. Voting on this proposal is currently underway and, if approved before March 29, 2025, it could become a cornerstone of the DAO’s future income model.

In addition to Timeboost, a similar mechanism called “Nova Fee Sweep”, operating on the Arbitrum Nova network, is also expected to play a significant role in boosting revenue over the coming months.

Optimism in the Crypto Ecosystem

Despite receiving criticism for high incentive spending, $141 million, accounting for 85% of total expenditures, Arbitrum supporters argue that such investments are crucial to solidify the network’s position in the decentralized finance (DeFi) and real-world asset (RWA) markets. According to financial projections, if incentive spending continues to decline as planned, 2025 could mark a turning point for the DAO: the beginning of a profitable and more resilient era.

Arbitrum is making a bold long-term bet: to sacrifice short-term profits in favor of becoming the foundational infrastructure layer of Web3.