TL;DR

- The world’s largest asset manager, BlackRock, is closely monitoring the outcome of the SEC lawsuit against Ripple before launching an exchange-traded fund based on XRP.

- With $1.5 trillion in assets under management, Franklin Templeton has already submitted its application for an XRP ETF, intensifying competition in the sector.

- The potential approval of an XRP ETF could mark a turning point in cryptocurrency regulation and acceptance by major investors.

BlackRock, the world’s largest asset manager with $11.6 trillion in assets under management, may be on the verge of filing for an XRP-based ETF, but only after the SEC lawsuit against Ripple reaches its conclusion. Competition is heating up with Franklin Templeton, which recently submitted its S-1 form to launch an XRP ETF, signaling a major shift in institutional adoption of digital assets.

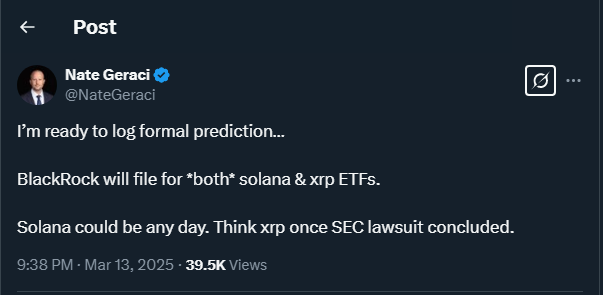

Crypto investors are excited due to the growing acceptance of Bitcoin and Ether ETFs, where BlackRock already holds a dominant position. According to Nate Geraci, president of The ETF Store, the firm will not allow others to capitalize on crypto ETFs without taking action. Geraci also predicts that, in addition to XRP, BlackRock may soon file for a Solana-based ETF.

The SEC’s Decision Could Revolutionize Crypto ETFs

The SEC’s lawsuit against Ripple has been a major roadblock to approving financial products based on XRP. However, the July 2023 court ruling determined that secondary market sales of XRP do not constitute securities, though direct institutional sales did. This ruling, along with the SEC dropping charges against other crypto firms, has opened the door to a regulatory shift.

The emergence of XRP ETFs would not only represent progress in legitimizing the asset but could also attract a wave of institutional investment. As the SEC reviews these applications, the crypto community hopes that approval will trigger a domino effect similar to what happened with Bitcoin and Ether ETFs.

The Rise of Crypto ETFs and XRP’s Potential

BlackRock’s entry into the XRP ETF ecosystem could completely reshape the market. In the past, the firm played a key role in securing approval for spot Bitcoin ETFs in the U.S., marking a milestone in institutional adoption of cryptocurrencies. If it follows the same strategy with XRP, the impact could be even greater, given the growing interest in blockchain technology beyond Bitcoin.

The cryptocurrency market is rapidly evolving, and the approval of digital asset ETFs could lead to broader acceptance and clearer regulation. With players like BlackRock and Franklin Templeton in the race, 2025 could become a historic year for XRP and the crypto industry as a whole.