TL;DR

- Aggressive Leverage Backfires: A trader’s use of 50x leverage on Hyperliquid transformed a $10M stake into a $270M ETH position, but difficulties in exiting without inducing a price drop led to a confirmed $4M loss for the DEX.

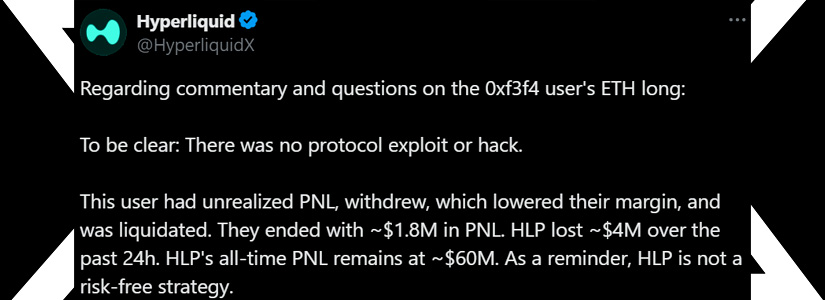

- Not a Hack, But a Risky Strategy: The loss was attributed to the trader’s aggressive strategy rather than an exploit or bug, prompting Hyperliquid to lower leverage limits to strengthen risk management.

- Wider Market Impact: The incident caused a substantial outflow of assets, with Hyperliquid seeing $166M withdrawn in one day, highlighting the pressing need for robust risk controls in DEXs.

Hyperliquid, a decentralized exchange (DEX), has confirmed a substantial $4 million loss following an aggressive leverage move by an Ether trader. On March 12, a crypto investor executed a high-leverage trade on Hyperliquid, resulting in significant financial repercussions for the platform.

The trader utilized approximately 50x leverage to transform a $10 million investment into a $270 million Ether (ETH) long position. However, the trader faced challenges in exiting the position without causing a self-inflicted price drop. Instead, they withdrew collateral and offloaded assets, leaving Hyperliquid to absorb the losses.

Smart contract auditor Three Sigma described the trade as a “brutal game of liquidity mechanics,” emphasizing that it was not a bug or an exploit. Hyperliquid clarified that the incident was not a protocol exploit or a hack, but rather a consequence of the trader’s aggressive leverage strategy.

Response and Adjustments

In response to the incident, Hyperliquid has taken measures to mitigate future risks. The platform has lowered its leverage trading limits for Bitcoin (BTC) to 40x and for Ether (ETH) to 25x.

These adjustments aim to increase the maintenance margin requirements for larger positions on the DEX, providing a better buffer for backstop liquidations. Bybit CEO Ben Zhou commented on the situation, noting that CEXs face similar challenges.

Zhou suggested a dynamic risk limit mechanism that reduces overall leverage as positions grow, acknowledging that while lowering leverage may be effective, it could also hurt business as users often seek higher leverage.

Broader Implications

The incident has had broader implications for Hyperliquid and the crypto industry. Following the liquidation event, Hyperliquid experienced a massive outflow of assets under management. Dune Analytics data revealed a net outflow of $166 million on the same day as the trade.

The situation has highlighted the need for robust risk management measures within the DEX space. Zhou emphasized the importance of surveillance and monitoring to spot market manipulators, suggesting that DEXs should implement risk management measures similar to those used by CEXs.

As Hyperliquid navigates the aftermath of the incident, the platform’s adjustments and ongoing efforts to enhance risk management will be crucial in maintaining investor confidence and ensuring the stability of the DEX.