TL;DR

- Unichain, Uniswap’s Ethereum Layer-2 network, has been the fastest-growing blockchain in the past month, reaching 236,452 active addresses in its first month.

- Berachain, launched in February, has reported a DEX volume of $3.78 billion, establishing itself as an emerging blockchain with notable growth.

- Solana, while still leading in certain metrics, shows a decline in activity, with a 19% drop in active addresses and a 27% decrease in DEX volume.

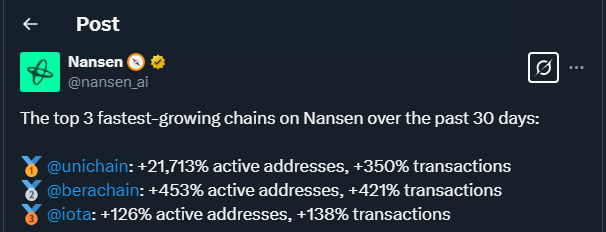

In a rapidly evolving crypto landscape, Nansen has revealed data highlighting the significant growth of Unichain and Berachain over the past month. Unichain, the new Ethereum Layer-2 network launched by Uniswap on February 11, has shown impressive performance, reaching 236,452 active addresses in its first month.

Despite being a young project, Unichain has seen substantial decentralized exchange (DEX) trading volume, totaling $217.7 billion, positioning it as the third-largest in the sector, surpassing even Ethereum’s base layer, which recorded a volume of $91.2 billion. This remarkable growth has attracted many users seeking to reduce the high transaction fees on Ethereum, giving Unichain a significant competitive edge over other well-established projects.

Meanwhile, Berachain, which also debuted in February, has reported a DEX volume of $3.78 billion in its first 30 days, placing it eighth in the ranking. With a significantly higher number of active addresses compared to Unichain (1.7 million), Berachain has shown its potential and positioned itself as a strong competitor, even though it is still in the early stages of development. These innovative projects are contributing to a noticeable shift in the blockchain platform dynamics, focusing on more efficient and cost-effective solutions.

Uniswap’s Recovery of the DEX Throne

On its part, Uniswap has managed to reclaim the title of the largest DEX by Total Value Locked (TVL) after launching Unichain. Although Uniswap had lost its leadership due to rising gas fees on Ethereum, the introduction of Layer-2 solutions and improvements in transaction speed have once again attracted users. The elimination of interface fees for swaps and the implementation of one-second block times, with plans to reduce them to 250 milliseconds, have strengthened Uniswap’s competitiveness.

The Situation with Solana: Distrust After the Memecoin Boom

Despite being a leader in active addresses and transaction volume, Solana has shown signs of slowing down. In the past 30 days, key metrics for Solana, such as active addresses and DEX volume, have significantly dropped. Solana now faces the ongoing challenge of maintaining its competitiveness as the market rapidly shifts toward more economical, efficient, and sustainable solutions.