TL;DR

- Arthur Hayes, co-founder of BitMEX, predicts Bitcoin’s price could drop to $70,000 due to hedge funds unwinding their positions in Bitcoin exchange-traded funds (ETFs).

- Hedge funds are pulling out of positions in Bitcoin ETFs such as the BlackRock iShares Bitcoin Trust, increasing selling pressure on Bitcoin.

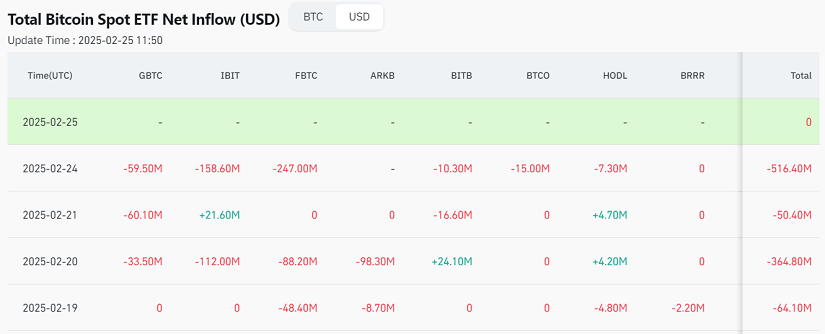

- Outflows from Bitcoin ETFs in the US have already begun to rise, with over $500 million leaving these products in a single day.

Arthur Hayes, co-founder of BitMEX, has issued a warning about Bitcoin’s future, suggesting that the cryptocurrency’s price could drop to as low as $70,000 due to large hedge funds unwinding their positions in Bitcoin exchange-traded funds (ETFs).

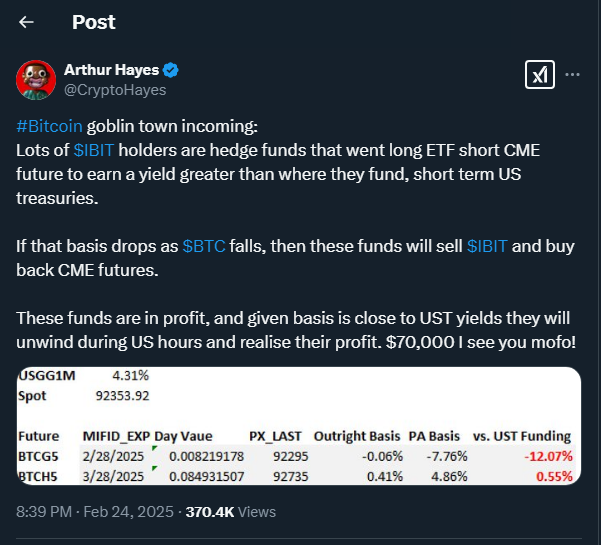

According to Hayes, hedge funds that had previously invested in Bitcoin ETFs, like the BlackRock iShares Bitcoin Trust (IBIT), are beginning to unwind their positions. This move is part of an arbitrage strategy that involves exploiting the price difference between Bitcoin’s spot price and Bitcoin futures on the CME. This strategy has been profitable for hedge funds, as the yield spread between the futures and US Treasury bonds has been attractive, and these funds have benefited from it.

The Impact of Fund Outflows and Price Adjustments

However, if Bitcoin’s price drops, the yield on futures contracts will adjust as well, causing the hedge funds to sell their IBIT shares and buy back CME futures, thus realizing their profits. Hayes pointed out that, since these funds are currently in profit, the price of Bitcoin could plummet back to $70,000, as these funds begin to liquidate their positions during US market hours.

Furthermore, in recent days, outflows from Bitcoin ETFs in the US have already started to rise significantly. On February 24, the largest outflow from Bitcoin ETFs in seven weeks was recorded, with over $500 million leaving these products in a single day. The BlackRock iShares Bitcoin Trust saw an outflow of $159 million, while Fidelity’s Bitcoin Fund lost a whopping $247 million. These moves indicate that large investors are taking profits and reducing their exposure to the cryptocurrency.

Despite this volatility, Bitcoin supporters remain optimistic about its long-term prospects, arguing that institutional adoption and increased fund diversification could be positive factors for the cryptocurrency’s future. However, recent ETF movements highlight the risks associated with the market and how arbitrage strategies can influence Bitcoin’s price in the short term. This dynamic underscores how large institutional movements in the ETF market could have significant short-term impacts on Bitcoin’s price, potentially leading to more volatility, especially if funds begin to liquidate positions rapidly.