TL;DR

- Jupiter (JUP), Solana’s leading DEX aggregator, has surpassed $2 billion in TVL, highlighting its growing importance in the DeFi space, with total transaction volume exceeding $374 billion.

- Bullish technical indicators, including a breakout from a descending triangle pattern, rising Bollinger Bands, and a high RSI, signal strong upward momentum for JUP.

- Increased social dominance and significant liquidation data suggest growing confidence and sustained demand for Jupiter, positioning it well for future growth in the DeFi space.

Jupiter (JUP), Solana’s leading DEX aggregator, has achieved a significant milestone by surpassing $2 billion in TVL. This remarkable achievement highlights Jupiter’s growing importance in the DeFi space. The protocol’s total transaction volume has also exceeded $374 billion, showcasing its increasing adoption and usage.

As of November 18, 2024, JUP’s price surged by 10.09% to $1.24, with a 24-hour trading volume skyrocketing by 196.50% to $443.68 million.

Jupiter’s Bullish Technical Indicators

Jupiter’s price breakout from a descending triangle pattern signals strong bullish momentum. The price touched an intraday high of $1.3229 before settling at $1.24, maintaining its upward trajectory.

Technical indicators such as the Bollinger Bands (BB) and the Relative Strength Index (RSI) support this bullish sentiment. The BB indicates rising volatility, with JUP’s price piercing the upper band, while the RSI has reached 70, reflecting intense buying pressure.

Additionally, the Moving Average Convergence Divergence (MACD) indicator reinforces the bullish case, with the momentum line crossing above the signal line.

Social Dominance and Market Sentiment

Jupiter’s rising price is accompanied by a significant increase in social dominance, doubling from 0.166% to 0.329% within a day. This spike in online discussions and community engagement suggests growing confidence in Jupiter’s ecosystem and potential for sustained demand. The increased visibility and heightened retail participation further fuel the positive market sentiment surrounding JUP.

Liquidation Data and Bullish Momentum

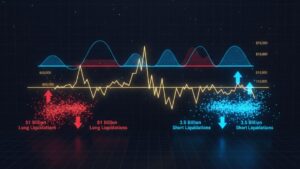

Liquidation data reveals strong upward pressure on JUP, with long liquidations reaching $715,680 and short liquidations totaling $271,310 over the last 24 hours.

This imbalance demonstrates accelerating interest and sustained upward pressure, as liquidated shorts add buying momentum to the market. Such events often indicate heightened speculation and volatility, driving significant price action in the short term.

Future Prospects

Analysts are optimistic about Jupiter’s future potential, drawing comparisons to Solana‘s impressive growth. With bullish technical indicators, strong on-chain activity, and increasing social dominance, JUP appears well-positioned for further growth.

While short-term caution is warranted due to overbought signals, the breakout above key resistance suggests sustained upward potential. As Jupiter continues to carve a leading role in the DeFi space, its record-breaking TVL and bullish momentum signal a promising future for the protocol.