TL;DR

- Bitcoin has outperformed Ethereum this week, driven by a 14% increase following the Fed’s rate cut.

- Institutional interest in BTC remains higher, with futures at record highs, while ETH faces slower adoption.

- Demand for ETH has declined, surpassed by altcoins and Layer 2 solutions that have shown better performance.

In the last week, Bitcoin has demonstrated superior performance compared to Ethereum, despite a favorable macroeconomic environment for both cryptocurrencies.

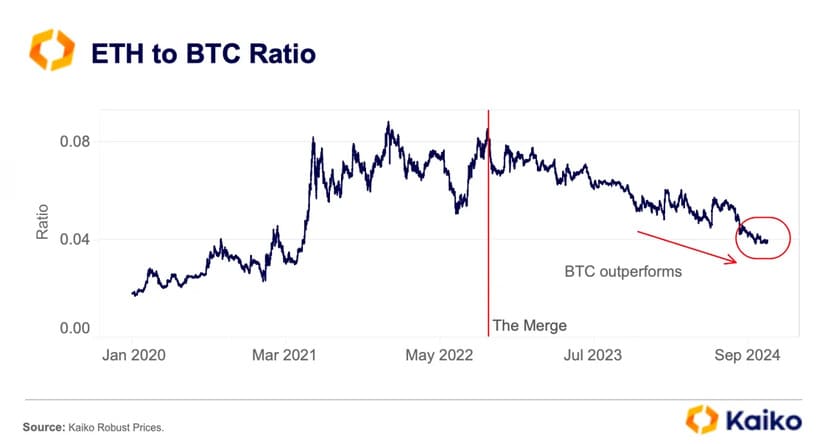

Since the unexpected 50 basis point interest rate cut by the Federal Reserve, BTC has gained 14%, approaching $70,000. However, ETH continues to lag, with the ETH/BTC ratio falling to 0.04, its lowest point since April 2021.

One of the main factors explaining this disparity in performance is the slower institutional adoption of Ethereum compared to Bitcoin. Despite the launch of ETH ETFs in July 2024, these products did not attract the same interest as their BTC counterparts.

Low Institutional Adoption

Bitcoin futures on the CME have reached all-time highs in terms of open interest, while Ethereum futures show much lower interest, with only 7,300 contracts in circulation. The lower interest reflects a less mature market and weaker institutional adoption.

Bitcoin has also benefited from its first-mover advantage on major trading platforms and networks of financial advisors. In 2023, many advisors began recommending Bitcoin ETFs to their clients, while Ethereum-based products lacked staking capabilities, making them less attractive to both retail and institutional investors.

Ethereum Loses Ground to Altcoins

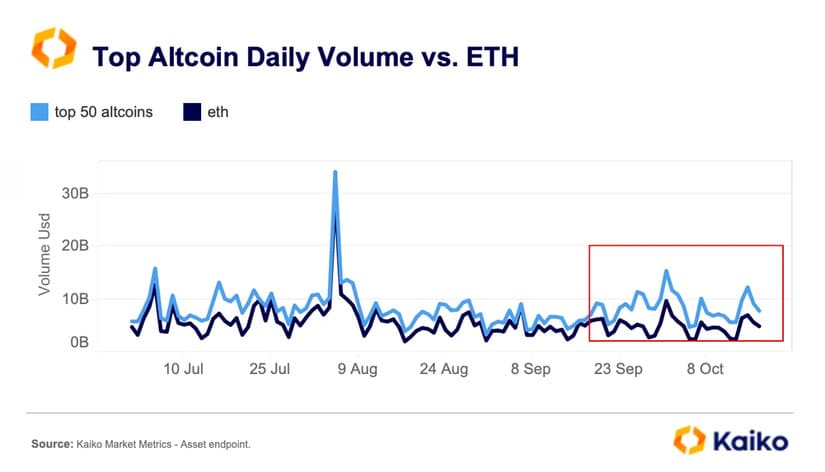

Demand for Ethereum has also been low in spot markets. In October, the cryptocurrency was outperformed in volume by several altcoins, widening the gap between ETH and the top 50 altcoins.

Investor preference for higher-risk altcoins, combined with Ethereum’s lackluster performance since the Merge and competition from blockchains like Solana, has contributed to this phenomenon. Additionally, investors can access the ETH network through Layer 2 solutions, which have generally outperformed ETH itself.

Although Bitcoin remains the leader in institutional adoption, some experts believe that the upcoming U.S. elections could reduce regulatory risks for Ethereum, which could influence its future adoption. If its ecosystem evolves and the industry supports it, the dynamics of its adoption may change, impacting its value and demand in the markets.