BNB Smart Chain (BSC) achieved a significant reduction in losses associated with scams during the third quarter of 2023 compared to the previous quarter.

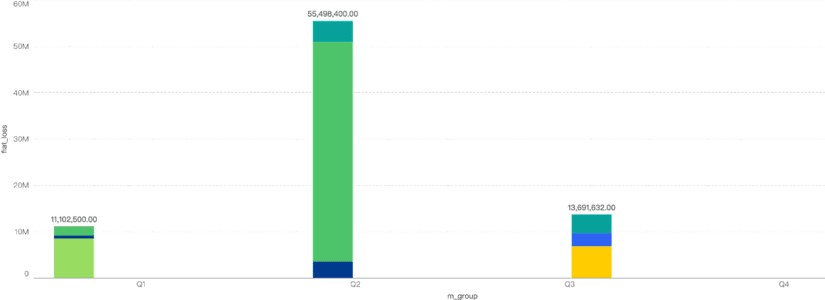

According to a report from AvengerDAO, supported by the security firm HashDit, scam losses in BSC dropped by 75%, decreasing from $55.4 million in the second quarter to $13.6 million in the third quarter.

This decline reflects changing trends in the ecosystem and indicates the existing interest in enhancing security and raising community awareness.

Several factors contributed to this reduction. Firstly, there was an increase in general awareness among community members regarding scams in the crypto space.

Investors and users are becoming more vigilant and capable of identifying suspicious activities.

Additionally, the report highlights an increase in the availability of security products that detect malicious websites and fraudulent activities.

These tools provide an additional defense against scammers and malicious projects.

The BNB Community Actively Collaborates in Self-Defense

The Binance community also played a crucial role in reducing scam losses.

Community members are identifying scams at early stages and issuing warnings before scammers can execute their plans.

Community collaboration and vigilance are essential mechanisms to maintain the integrity of the BSC chain and protect investors.

Despite the decrease in total losses, a specific type of scam known as “rug pulls” remains a persistent issue in BSC.

“Rug pulls” accounted for 67% of losses in the third quarter. In this type of scam, malicious projects entice investors with promises of products or services that they later fail to deliver, running away with investors’ funds.

💡 Exciting insights from the latest AvengerDAO Q3 Report contributed by Hashdit! 📊

Let's dive into the key findings of security events on BNB Smart Chain (BSC) during Q3. https://t.co/jFZk5Ua5pX

— BNB Chain (@BNBCHAIN) November 7, 2023

In addition to scams, the report also identifies other threats in BSC, such as reserves and price manipulation.

It is noted that hackers exploit poorly designed smart contracts as a common attack vector.

The report also mentions an interesting trend: the preference of some malicious actors for BSC over the Ethereum chain.

This is because BSC offers lower fees compared to Ethereum, although its network stability and speed are considered similar.

This means that hackers can operate on BSC without the same financial pressure they would face on Ethereum due to higher fees.

The decrease in scam losses in BSC in the third quarter of 2023 is a positive sign of growing awareness and security in the ecosystem. However, “rug pulls” and other threats persist.

It is important for both the community and development teams to actively work together to close any gaps that hackers and thieves may exploit.