In a recent development, the founder of Decentralized Finance (DeFi) protocol Curve, Michael Egorov has reportedly settled his loans with Aave, the lending platform. With this move, the debt of Egorov has come down to $42.7 million on all other DeFi protocols. This is encouraging news from the founder of a renowned DeFi protocol which can potentially boost the confidence of the protocol’s community.

The news was confirmed by the on-chain analytics firm, Lookonchain that Egorov deposited around 68 million CRV tokens to Silo, a lending platform. These tokens were worth $35.5 million and therefore, the Curve Finance founder borrowed 10.77 million in crvUSD stablecoin. These assets were exchanged in the last two days.

Michael Egorov deposited 68M $CRV ($35.5M) to #Silo and borrowed 10.77M $crvUSD in the past 2 days.

Then swapped $crvUSD for $USDT and repaid the all debt on #Aave.

He currently has 253.67M $CRV($132.52M) in collateral and $42.7M in debt on 4 platforms.https://t.co/stkFvDrlnv pic.twitter.com/oBQ4yiT9Xs

— Lookonchain (@lookonchain) September 27, 2023

Later on, Egorov exchanged his crvUSD for Tether (USDT) and used it to pay all of his debt on Aave. It was further reported that he still has 253.67 million CRV tokens in collateral. The remaining debt of Egorov amounts to $42.7 million across Silo, Fraxlend, Inverse and Cream.

Curve Founder Lowers Debt – Positive News For CRV?

Previously, Michael Egorov made headlines for his huge debt on different DeFi protocols. It was reported that he owed a total of over $100M across these platforms. As a result, CRV tokens suffered from a major sell-off in the market, tracing back in price amid liquidations. However, Egorov has shown some commitment to lower his debt to avoid further degradation of the token.

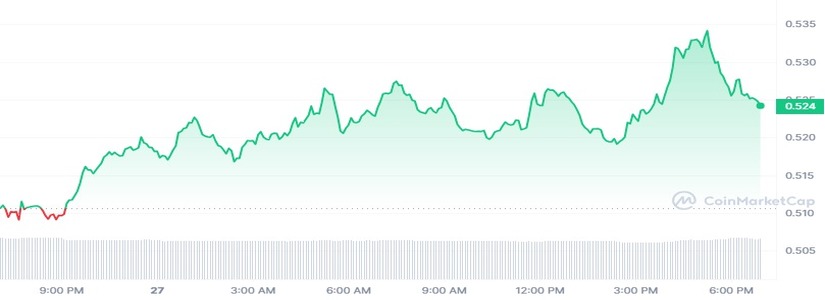

At the time of writing, the Curve DAO Token has seen an upward momentum with an increase of 3% in its price. It is currently trading at $0.524 with a market cap of over $460.60 million. Within the last week, the price of the coin has gone up from $0.43 to a high of $0.54.

Back in July, Curve Finance was exploited for around $47 million due to a reentrancy vulnerability. Moreover, several stable pools on the platform were also exploited. Thus, the native coin of the network saw a sharp decline in its price. Nonetheless, the platform is regaining its stability and showing more signs of improvement with each passing day. The repayment of loans from its founder is also an encouraging sign that could reflect positively on its trading price.