Peter Brandt, a prominent trader and cryptocurrency analyst, expressed skepticism over the potential impacts of two significant Bitcoin (BTC) events, the approval of an Exchange Traded Fund (ETF) in the U.S. and the halving in 2024.

On July 28, Brandt took to Twitter to declare that the much-anticipated approval of a Bitcoin ETF in the United States and the imminent halving will be “non-events” and are overly exaggerated. These statements go against the common market sentiment as investors, traders, and crypto enthusiasts continue to wait for these events with bated breath.

Three things I believe about Bitcoin

1. The inevitable OK of a $BTC ETF in U.S. will be non-event

2. BTC halving will be a non-event

Markets discount in advance

3. BTC's correlation to other mkts is a non-starter. BTC will be top of food chain. That's the only thing that matters pic.twitter.com/2l0CxAyZ4T— Peter Brandt (@PeterLBrandt) July 27, 2023

Why a Bitcoin (BTC) ETF Approval Matters?

Bitcoin ETFs offer a ray of hope for many regular traders as well as sophisticated institutional investors. With a Bitcoin ETF, investors need not worry about private keys, storage, or security. They own shares in the ETF just like their shares of stock, and can gain exposure to the cryptocurrency market without having to go through the hoops of purchasing and holding crypto.

One of its main advantages is that a Bitcoin spot ETF would provide easier access to the asset, allowing investors to buy and sell the digital currency through a brokerage account. It allows investors to track changes in the price of Bitcoin within the confines of established financial markets, while also gaining access to the ETFs’ liquidity and transparency.

Bitcoin ETF Applications Skyrocket

In a statement to CNBC, Douglas Boneparth, a New York-based certified financial planner and president of Bone Fide Wealth asserted,

“I think the spot bitcoin ETF is a watershed moment for Bitcoin.”

The concept of ETFs has been prevalent in the stock markets for quite some time. However, with the surging popularity of cryptocurrencies, particularly Bitcoin (BTC), investors and financial institutions worldwide have become increasingly intrigued.

Recently, BlackRock, the world’s largest asset manager, applied for a spot in Bitcoin ETF. Shortly after, several financial firms filed proposals in the U.S. for an exchange-traded fund that would offer exposure to Bitcoin.

Blackrock files for bitcoin ETF with SEC https://t.co/IR7PiKp0UC

— Fox News (@FoxNews) June 18, 2023

Bitcoin (BTC) Halving is an Important Event

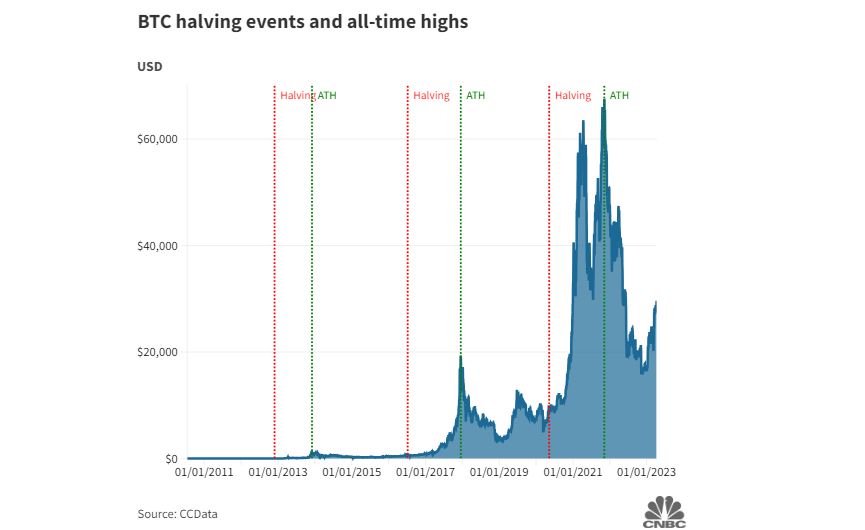

Meanwhile, Bitcoin (BTC) is expected to undergo its next halving in 2024 which also happens to be one of the major factors that holds the possibility of igniting another bull run. The halving takes place roughly every four years or every time another 210,000 “blocks” are added to the blockchain.

The event cuts the rewards to Bitcoin (BTC) miners by 50%. The aim is to reduce the number of new Bitcoin units released into the market. This can help push up the price by enhancing BTC scarcity. Interestingly, before every halving that has occurred in the past, the largest digital asset surged in price.

Before the last halving, which took place on May 11, 2020, the price of BTC increased by nearly 19% in the preceding 12 months. Not just this, the bitcoin price tends to spike even higher, in the months that follow halving.

Why does Brandt’s Assumptions Sound Ostensible?

Hence, the potential approval of Bitcoin ETFs and the upcoming halving event seem like the major catalysts that are likely to have a profound impact on the flagship token. Despite these possible outcomes, Brandt has underscored the nature of markets to anticipate and discount future events, proposing that the ripple effects of Bitcoin halving and a potential Bitcoin ETF have already washed ashore.

Furthermore, he said that Bitcoin’s position at the top of the food chain is the only thing that truly matters, dismissing the asset’s correlation to other markets as a non-starter. The trader added,

“Over 48 years of speculation I have learned again and again that markets discount events before the events are events If anything, it could be a buy the rumor sell the fact.”