Tether is looking forward to launching the USDT stablecoin on the Kava blockchain as it seeks to enhance liquidity across different blockchains. This move, once put into effect, would provide the Kava community the ease of access to the world’s largest, trusted, and widely used stablecoin.

The Chief Technology Officer at Tether, Paolo Ardoino, expressed excitement surrounding the development and stated,

“We’re thrilled to be launching USD₮ on Kava, offering its strong community access to the world’s first, most stable, most trusted, and most widely used stablecoin.´´

Ardoino also highlighted the impressive record of the Kava blockchain over the years with no security issues and also emphasized the importance of protecting all USDT holders. Currently, the masses believe that the decision of Tether to integrate the USDT stablecoin on the Kava chain would set the basis for the firm to strengthen its position as the supplier of the leading stablecoin in the market.

The Kava mainnet was upgraded just a month ago, and these upgrades brought major changes to transaction speed, along with the functionality of cross-chain bridges. These were not the only upgrades as increased levels of security and scalability were also provided.

New Beginnings For Tether (USDT)

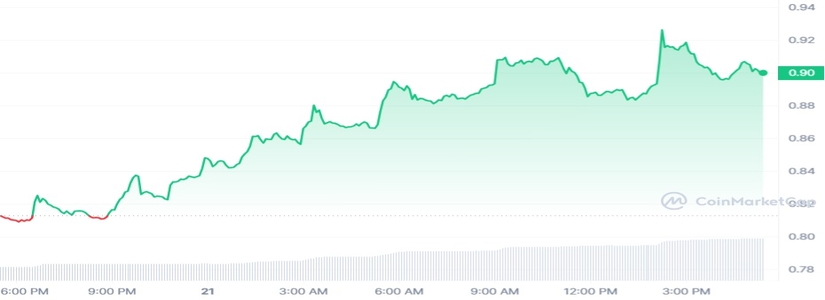

The plans of Tether injecting the USDT token into the Kava blockchain have resulted in positive momentum for the chain’s native token. It also bred a sense of excitement within the hearts and minds of the token holders. At the time of writing, Kava has surged by a drastic 10.71% in the previous 24 hours, and the increase has pushed the trading price upwards to $0.9001. The total market cap of the token currently stands at the $525 million mark.

Tether has made a name for itself as the leader in the stablecoin concept, and its tokens are already live on a number of other networks that include Ethereum, Solana, EOS, and more. Despite the overall positive momentum, USDT had to face turbulence not too long ago.

The overall influx of USDT in the Curve 3pool has surged drastically. The unusual influx of the stablecoin led to many in the market questioning the stability of the stablecoin. Furthermore, this point of concern inevitably set the stage for whales to sell off their holdings, which led to a slight depeg.