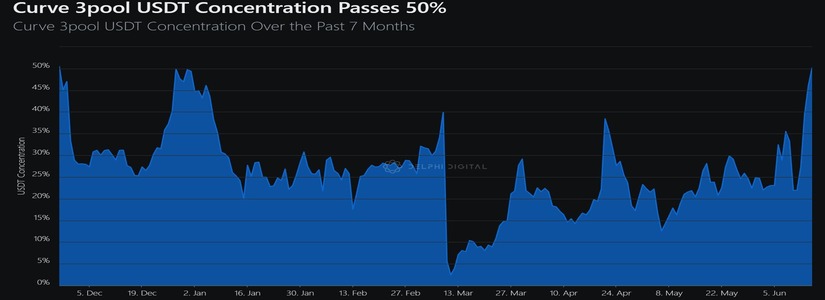

As per recent developments, whales have been reported to sell great amounts of USDT, which has led to a considerable surge in its dominance within the curve liquidity pool. The abnormal influx of the stablecoin has raised concerns regarding its overall stability and has also caused apprehension surrounding the depegging of USDT. The recent dumping of USDT by whales has improved the overall composition of the Curve 3Pool. With this in mind, USDT makes up approximately 73.17% of the pool.

Tether concerns are arising again.

Whales have been dumping $USDT, resulting in USDT now comprising 50%+ of the Curve 3pool.

The sudden spike in inflows is very abnormal.

Either more FUD, or somebody knows something.

Will keep updating this thread (metrics below).👇

— Miles Deutscher (@milesdeutscher) June 15, 2023

Currently, it is a topic of debate whether the sudden increase in the inflows of USDT is a result of FUD, or if it has anything to do with insider knowledge. Scrutiny toward the stablecoin comes as a result of its depegging following the collapse of Terra.

A notable player in the depegging scenario is CZSamSun, who was reported to have shorted the stablecoin on Aave V2 after its depegging. CZSamSun borrowed approximately 31,544,278 USDT from Aave V2 and exchanged them for almost 31,475,408 USDC at the rate of roughly $0.9978.

Tether Goes into a Period of Uncertainty

The masses have started questioning the trustworthiness of the stablecoin following recent developments, and have also raised concerns regarding the stability of Tether. USDT is currently trading at $0.9979 after suffering a decline of 0.20% within the previous 24 hours. At the same time, the total market cap of the stablecoin currently stands at the $83 billion mark. Despite the current mishap, USDT is still the largest and most used stablecoin in the crypto market.

The CTO of Tether, Paolo Ardoino said,

“Markets are edgy in these days, so it’s easy for attackers to capitalize on this general sentiment. But at Tether we’re ready as always. Let them come. We’re ready to redeem any amount.”

The Reason Behind the Depeg of USDT

The masses believe that the main reason for the depeg can be linked to Aave’s planning to freeze Curve’s collateral for loans on its platform. The founder of Curve, Michael Egorov, deposited CRV tokens worth approximately $24 million in Aave in an effort to mitigate the risk of a $65 million stablecoin loan.

According to the data shared, the wallet associated with Egorov provided a total sum of $188 million as collateral on Aave v2, with $64.2 million worth of USDT tokens borrowed. The health rate is currently 1.55 and the collateral would automatically liquidate if it drops below 1. As a result of this situation, Aave is considering freezing the collateral to prevent Egorov from adding more CRV and accelerating the concentration risk.