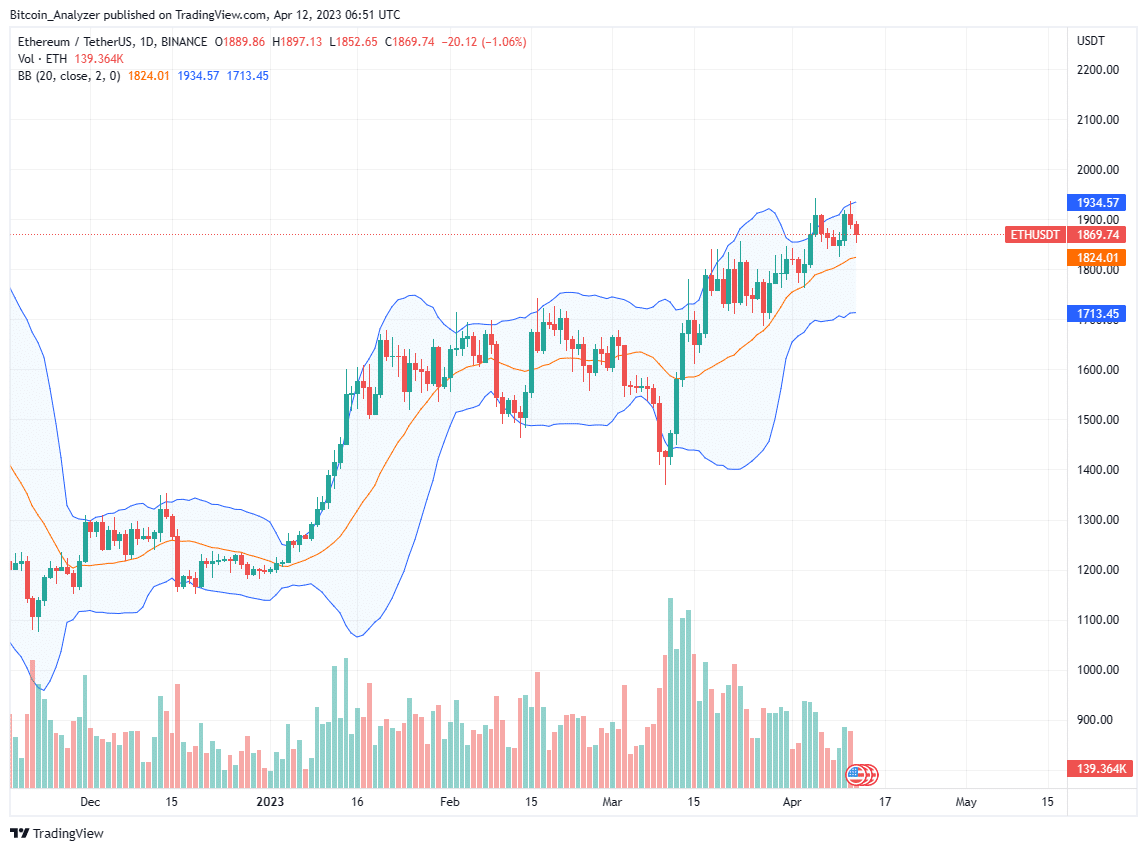

Ethereum prices might be on a bull run, like the rest of the markets when writing. Even so, the ceiling remains slightly below the psychological resistance at $2,000.

For now, prices have failed to tear higher, breaking above the immediate resistance at $1,950. Still, buyers are confident of the project’s prospects and expect prices to increase in sessions ahead.

As of writing, the leg up has been pronounced, and prices are hovering around Q2 2023 highs.

There could be more ground to cover if buyers step in, forcing the coin above the current liquidation levels. In that case, ETH may fly above $2,000, setting the anchor for the next wave up that may lift the coin to $2,500 and $3,000.

Shanghai Upgrade on the Horizon

Traders are looking at the turbulence that the upcoming Shanghai upgrade might bring. The critical update on the Ethereum network would mark the complete transition of the platform to a proof-of-stake blockchain, finally changing the way the Ethereum staking works.

A noteworthy movement will be how ETH holders, especially those who locked their coins in the Beacon Chain, will react to the upgrade.

With the freedom to withdraw, which will be done in phases, some may choose to sell, impacting prices. So far, over $33 billion of ETH is locked in the proof-of-stake network are waiting to be unlocked.

Even as the anticipation rises, liquidity-staking platforms like Lido Finance are increasingly managing more assets, with most being ETH, the native currency of Ethereum; a positive for the smart contracting platform.

Ethereum Price Analysis

The path of least resistance is defined and cleared to be northwards.

Traders are bullish, with immediate resistance at $1,950, coinciding with April 5 highs. For now, support lies at the middle BB, the 20-day moving average. At the same time, traders should watch how prices react at $1,840, marking April 10 lows. This is another interesting support level that, if broken, might cancel this bullish preview.

Even though traders are confident, participation levels have recently decreased. Therefore, it will be ideal for prices to rise above $1,950 towards $2,000 if the bull bar has rising volumes. This will provide the impetus, rejuvenate optimistic buyers, and pull in buyers expecting to ride the trend. In that case, ETH may retest August 2022 highs at $2,050 as the first target.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this Article Interesting, here you can find more Ethereum News.