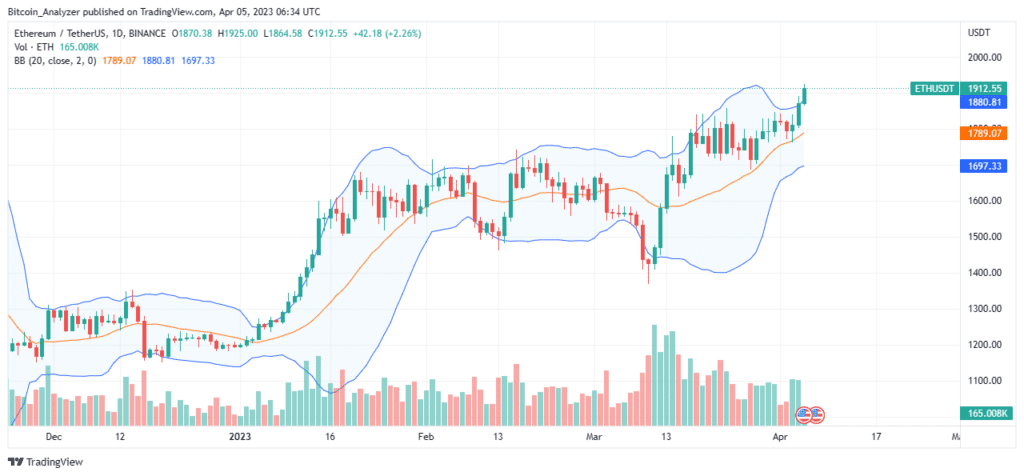

Ethereum is above the recent consolidation, as evident in the daily chart, charting forward as bulls press on. There are fundamental factors buoying buyers, and this could continue in the days ahead.

As a result, it is also highly likely that the coin may pierce above $2,000 as it breaks into new Q2 2023 highs, extending gains of the Q1 2023 and helping buyers shake off sellers of last year.

Technically, it is crucial for buyers to edge above the psychological round number at $2,000 and push higher above the consolidation traced to March 23 when prices rallied but ended up flat-lining.

Shanghai Upgrade on Focus

Traders are confident, looking at the performance in the daily chart. However, what’s even more critical from a technical point of view is the shift of Ethereum from a proof-of-work system to a staking network dependent on validators.

With the activation of Shanghai, users will, for the first time, move their coins from the Beacon Chain to external addresses should they wish. This is critical, especially for holders who want to diversify but are free to trade or engage in other network activities such as DeFi and more. Shanghai will go live in mid-April.

Experts expect market turbulence ahead of this upgrade, with most calling for ETH to extend gains. Even so, whether this will be, the case is yet to be seen, considering that some early validators may choose to dump their stash.

Ethereum Price Analysis

The leg up above the second half of March is with rising volumes, a net positive from an effort versus result perspective.

It is an affirmation that buyers are upbeat about what lies ahead and, therefore, might form the base for another push toward $2,000. As it is, ETH buyers are in the driving seat. Consequently, the path of least resistance, factoring in the general performance of Q1 2023, as bullish for traders.

Consequently, optimistic traders looking to hitch the possible Bull Run that’s in development can buy on dips, targeting $2,000. This preview is valid as long as prices are above the middle BB, that is, the 20-day moving average, and $1,750.

Technical charts courtesy of Trading View. Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Ethereum news.