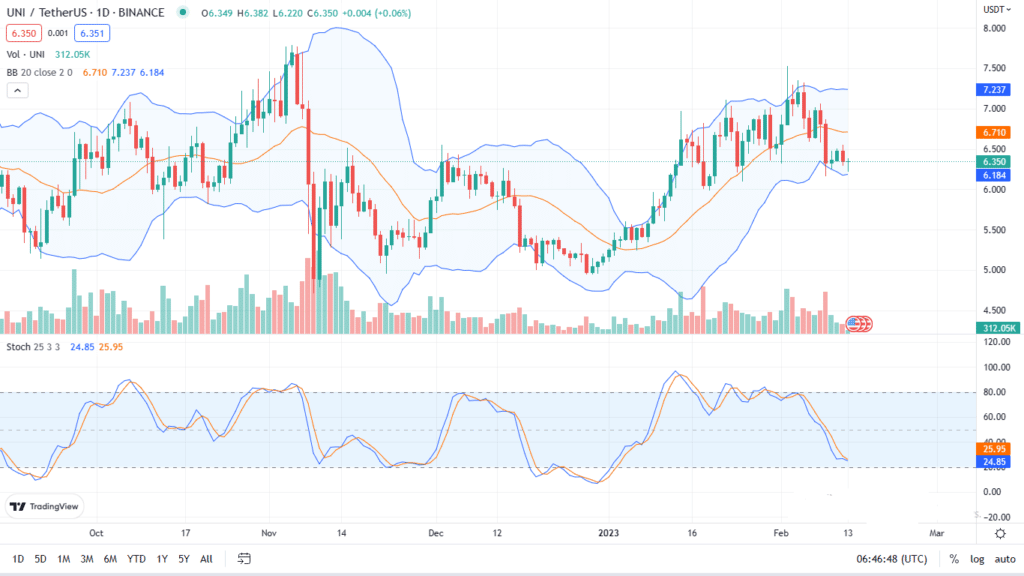

Uniswap prices are lower, syncing with the general trend across the board. Technically, sellers have the upper hand following the dump on February 9.

As it is, prices are still consolidating inside the bear candlestick and lower from February highs.

For Uniswap, bulls are struggling to maintain prices above $6.8 and the middle BB, pointing to general weakness.

Currently, prices are moving horizontally. Therefore, aggressive traders may find entries to sell, mirroring the formation on February 9.

However, there can be more opportunities once there is a definitive close below last week’s low.

The sell-off would particularly be intense, should it be with expanding volumes. In that case, UNI may fall to retest key support levels of Q4 2022.

Migration to the Bnb chain

Uniswap is one of the top DEXes launched in various blockchains, including Arbitrum and Polygon.

As of February 13, Uniswap had a total value locked (TVL) of over $3.9 billion. However, considering the recent vote, Uniswap TVL could rise.

After a successful vote, the community approved the proposal to have Uniswap launch on the BNB Chain. The BNB Chain is one of the most active ecosystems, with PancakeSwap dominating and emerging as one of the most active DEXes.

With this, Uniswap’s onchain activity would rise, and it could expand to manage more assets by TVL.

This vote comes even at the back of opposition from top venture capital, A16Z, who was against Uniswap deploying on the Binance Chain.

Uniswap Price Analysis

UNI is within a bear breakout formation, slipping below the 20-day moving average.

Prices are moving sideways above the primary support at $6.15. Notably, this marks the low of the February 9 bearish engulfing bar.

Since prices are inside last week’s range, they can search for unloading opportunities. Every high below $6.9 may offer entries for sellers.

However, there are better opportunities below $6.15, especially if the sell-off is amid rising volumes, exceeding the recent averages.

If the breakout below last week’s low is with high volumes, UNI may retest December lows at around $5.

Conversely, gains above $6.9 may propel UNI to H2 2022 highs at around $10.

Technical charts courtesy of Trading View. Disclaimer: Opinions expressed are not investment advice. Do your research.If you found this article interesting, here you can find more about Uniswap.