Chainlink prices are relatively low at spot rates.

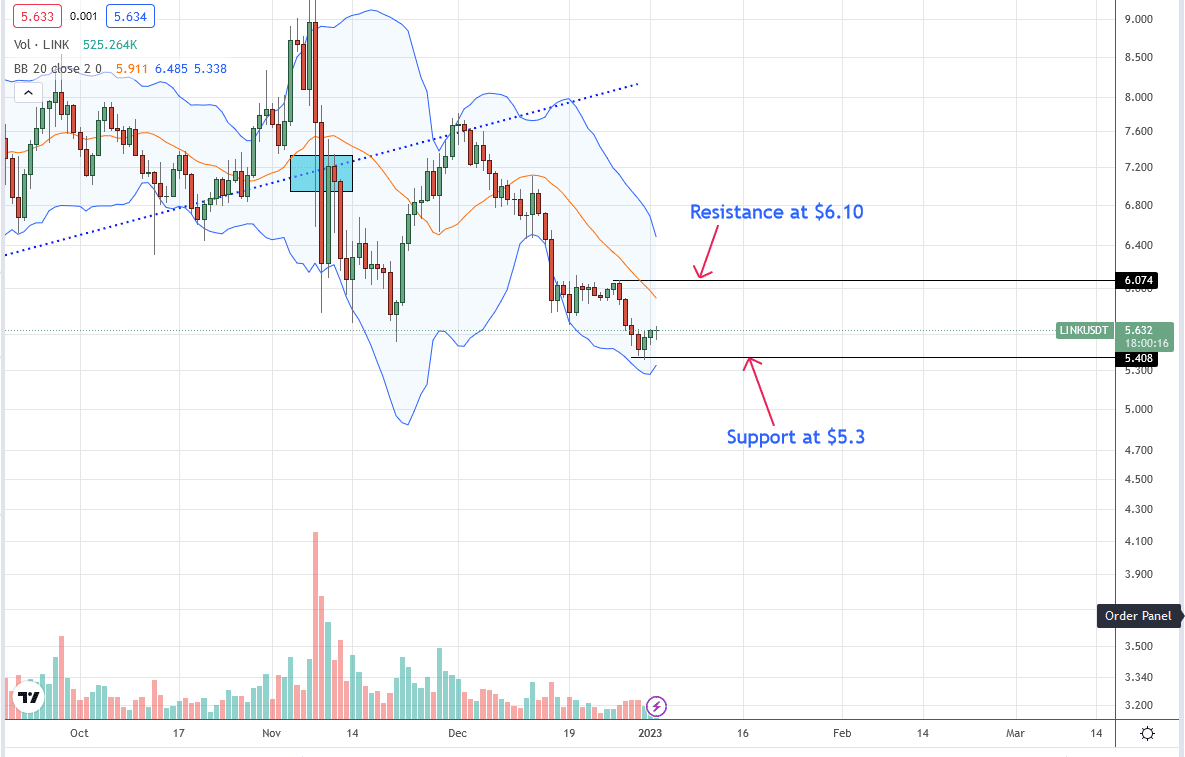

Technically, bears are in control; worse, the coin trades within a bear breakout formation. LINK’s price action is still defined by the volatility of early November 2022.

Sharp losses of early November saw prices tank, dropping double-digit losses between November 8 and 9. Prices have recovered, and volatility tapered, but because of losses two months ago, the cryptocurrency broke below a critical support trend line with rising volumes.

Therefore, since the coin remains within a bearish formation and sentiment are generally bearish, traders can look to unload on every high below the critical resistance zone at around $8 and $6, respectively. Meanwhile, LINK oscillates tightly at around June 2022 lows, with $5 proving to be a reliable round number for cautious traders.

Role in DeFi and NFTs

Chainlink is one of the earliest protocols that continue to play a critical role in decentralized finance (DeFi) and NFTs.

As an oracle provider powered by decentralized nodes, the platform keeps billions of user funds secure in DeFi. Meanwhile, the Chainlink Verifiable Random Function (VRF) is useful in NFT protocols.

In H2 2022, Chainlink partnered with SWIFT, an interbank messaging platform, for interoperability. At the same time, in December 2022, they joined forces with Arbitrum, one of the most active layer-2 Ethereum platforms. Through this deal, Chainlink Automation was launched in Arbitrum, allowing developers to have reliable automation and enhance their capabilities when they deploy advanced dApps.

Chainlink Price Analysis

The path of least resistance is southwards. At spot rates, the coin is down 40 percent from November peaks and closely oscillating at December lows.

The immediate support line flashes with December 2022 lows at around $5.3. On the upper end of the range, $6.1 is a critical liquidation level that bulls must overcome for uptrend definition.

Overall, as long as prices are inside this zone, every high is an opportunity for aggressive sellers to liquidate with targets at $5.3 and later $3.5 if bears press on.

As it is, the bear bars of November play a significant role. They may force further losses in the days ahead unless LINK powers above $6.1 with expanding trading volumes. If that happens, conservative traders can look for entries, targeting $9.

Technical charts courtesy of Trading View.

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Chainlink news.