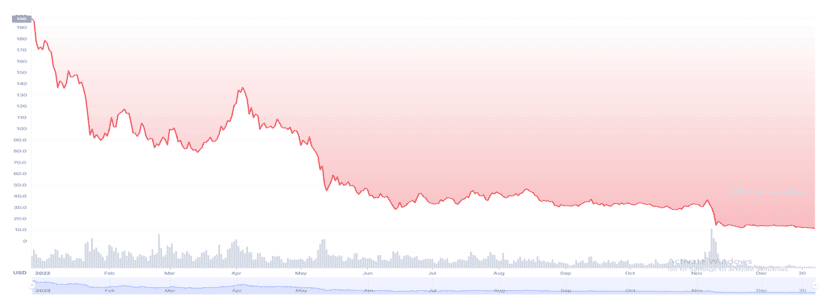

The crypto market has been subject to great disturbances ever since earlier this year. A considerable number of factors coupled with severe bottlenecks forced many cryptos to lose more than half of their value. Solana (SOL) was among the many cryptos that were affected greatly this year. Back in November of the previous year, Solana (SOL) actually managed to achieve an all-time high of $260. Ever since then, the crypto has been continuously losing its value.

Over the course of the previous 365 days, Solana (SOL) is down by a whopping 94.08%. At the time of writing, the coin is trading for almost $11.6 and has a market cap of $4.16 billion. Currently, Solana (SOL) is also experiencing an increased bearish force as the coin is down by approximately 20% this month. The current price the coin is trading at can be defined as being less than 5% above the yearly low. In case the liquidity zone gets breached, the bulls would have to rely on the support levels which were established the previous year. The end result would be a further decline in the value of the cryptocurrency.

It has become a challenge for the bulls to cover approximately half of the range near the $13 mark. If it’s successful, there might be a great potential for possible uptrend opportunities. Based on the current scenario, many actually believe that Solana (SOL) might stoop low to $10.

WHAT TO EXPECT FROM SOLANA (SUN) NEXT YEAR?

As of now, a great percentage of people actually believe that Solana (SOL) wouldn’t recover any time soon. The coin would continue losing its value as it did throughout 2022. At the same time, investors have also lost confidence when it comes to investing in crypto. On the other hand, many believe that Solana (SOL) might recover by the start of the next year. It is expected that the coin might reach as high as $18 and as low as $14 by 2023. At the same time, Solana (SOL) isn’t expected to lose a chunk further during that year.

It is important to understand that the crypto market is exceedingly volatile. Before an investor proceeds to invest, they must understand the risks involved. It is still uncertain when the situation in the market might improve. The continuously increasing interest rates coupled with other factors such as the FTX collapse have shattered investor confidence. All that can be done is sit back and hope for the best.