TL;DR

- Lookonchain tracked 7,798 ETH, about $25 million, moving to Binance after two years of staking; the wallet may possibly link to Fenbushi Capital.

- The deposit landed as ETH fell 4.5% from $3,360 to the $3,220 area after a week of sideways trading.

- CoinShares data showed $1.55 billion of Bitcoin inflows and $496 million into Ethereum since October, while tariff headlines pushed BTC from $95,460 to $92,490 before rebounding to $93,180.

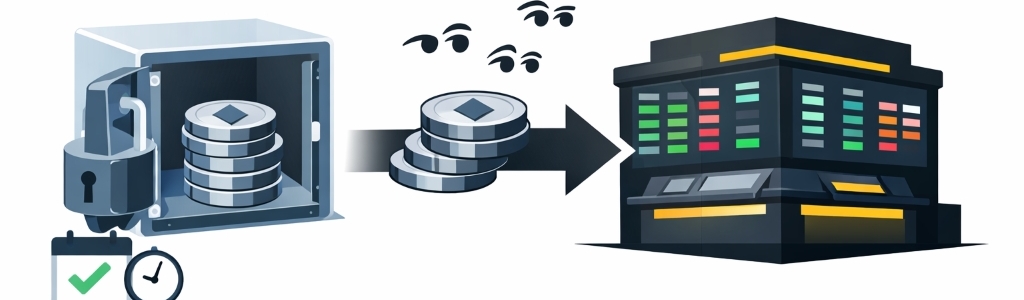

Lookonchain flagged a large Ethereum move: 7,798 ETH, valued near $25 million, landed on Binance from a single wallet. The tracker said the funds had been staked for two years and were withdrawn before the deposit, a pattern commonly associated with preparing to sell. The key point is that a long-dormant, yield-generating position suddenly became exchange-ready liquidity. Lookonchain added the wallet may be linked to Fenbushi Capital, a crypto asset manager founded in 2015, though attribution remains unconfirmed. Either way, desks are watching for immediate sell-through signals.

A wallet possibly linked to Fenbushi Capital just deposited 7,798 $ETH($25M) into #Binance after staking for 2 years.https://t.co/rkH4MV5aYJ pic.twitter.com/DRvtlHNa0T

— Lookonchain (@lookonchain) January 19, 2026

Whale Exit Meets ETH Dip and Institutional Flow Backdrop

The timing amplified attention because ETH was already slipping. The report notes a 4.5% intraday drop, with Ethereum falling from $3,360 into the $3,220 zone where it was trading at the time. A week earlier, ETH had climbed almost 8%, from $3,080 to roughly $3,330, then drifted sideways inside that range. In a choppy tape, an exchange deposit this size reads like optional supply that can hit bids quickly. That uncertainty is what makes the transfer noteworthy for short-term positioning. It raises questions about who de-risks first when volatility spikes.

The deposit also arrived as crypto investment products saw their biggest weekly inflow since October, according to a CoinShares report. Bitcoin led with $1.55 billion of inflows, while Ethereum drew $496 million and Solana added $45 million; XRP attracted $69.5 million. That backdrop creates a tension: inflow data suggests accumulation, while one whale action hints at distribution. For portfolio managers, the two signals can coexist, but they change execution and risk timing. The first such surge since October, resetting conversations across desks.

Macro headlines were part of the mood shift. New U.S. trade tariffs against Europe pushed Bitcoin down 3.12%, sliding from $95,460 to $92,490 before rebounding to about $93,180. A CryptoQuant analyst argued the rebound reflected recovery of real spot buying demand rather than a leverage-driven futures rally. Separately, silver hit $94 per ounce, drawing attention. When cross-asset volatility rises, even isolated onchain moves can look like early risk reduction. That is the lens traders applied to this ETH transfer. Risk committees stay on alert.